- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Price Commentary

- CCA Weekly Commentary: CCA’s price strengthen slightly as the market mechanism hedges the Cap-and-trade market against inflation

CCA Weekly Commentary: CCA’s price strengthen slightly as the market mechanism hedges the Cap-and-trade market against inflationWCI CaTMonday, 19th September 2022

Shubhangi Sharma

Summary:

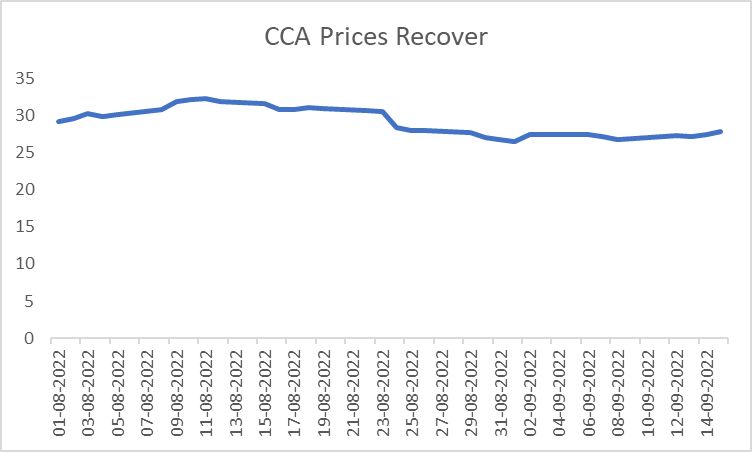

- CCA front on Friday closed at 27.82, gaining $0.98 over the week.

- ICE weekly volume was reported as 14.06 M tons (+90.5% WoW), 4-week moving avg. 27.27 M tons.

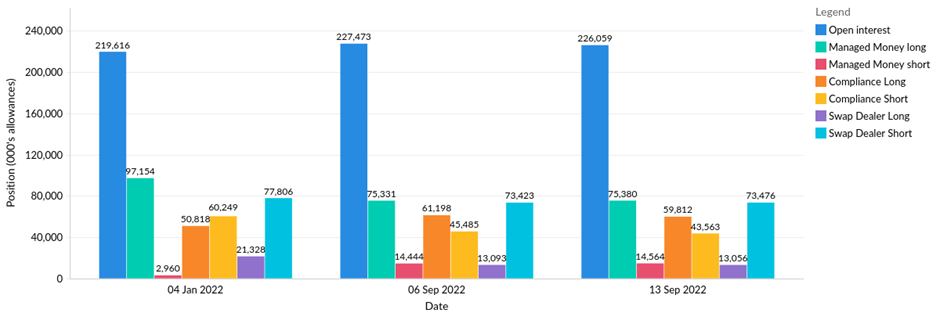

- CFTC: Total OI decreased by 1.41 M tons (+18.5% WoW).

CCA prices witnessed a steady increase, after a stagnant week. The compliance entities decreased short positions by 0.19 M tons and managed money increased short positions by 0.12 M tons. The California Cap-and-trade markets adjust the floor price, APCR prices, and ceiling prices every year to adjust for inflation. Hence, higher inflation will push the minimum bid price higher. Currently, the auction reserve price is 19.7, which will increase next year to $21+. At the current prices CCA is trading, the risk of inflation remains low.

Market sentiment remains clouded with uncertainty as US central bank gears up for its policy decision this week, with some investors starting to brace for a big surprise. The US FED is expected to announce 50-75 bps rate hike in September as inflation continues to persist.

Senators Dianne Feinstein and Alex Padilla introduced the Save Our Sequoias Act last week. This bill will protect California’s giant sequoias – the largest trees in the world – from the threat of wildfire and expedite future wildfire-resiliency projects.

Technicals:

Trading activity on the ICE exchange increased 90% WoW to 14.06 M tons.

Trader Positions:

CFTC V22: Positions across all traders (13th September)

In the CFTC data last reported on 13th September 2022, total OI decreased by 1.41 M tons. The compliance entities decreased short positions by 0.19 M tons and managed money increased short positions by 0.12 M tons.

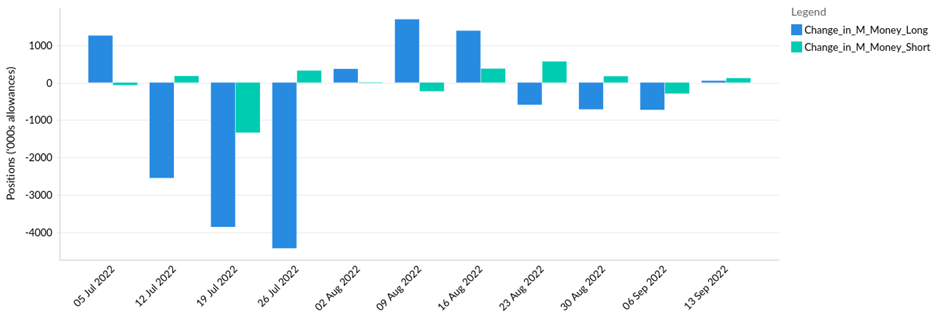

CFTC V22: Fund Manager change in positions (13th September)

Managed money increased long positions by 0.04 M tons, along with an increase in short positions by 0.12 M tons.

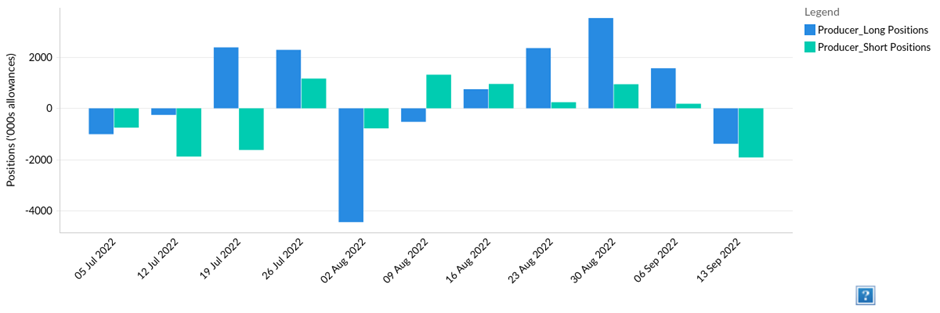

CFTC V22: Covered entity change in positions (13th September)

Compliance entities decreased long positions by 1.38 M tons and decreased short positions by 0.19 M tons.

Market Fundamentals:

- Read our latest Analyst Note and forecast on Emissions, Supply, Demand, and Price.

- The US FOMC raised federal rates by 25 bps in March’22, followed by a 50bps in May’22 and a 75bps hike in the June’22 and July’22 meeting. It is expected that the committee will deliver another 50-75bps hike later this month.

- Oil prices rose on Friday as a spill at Iraq’s Basra terminal appeared likely to constrain crude supply but remained on track for a weekly decline on fears that hefty interest rate increases will curb global economic growth and demand for fuel.

- Brent crude futures were up by 70 cents at $91.54 a barrel this week.

- U.S. natural gas futures took a second straight hit on Friday amid worries over record domestic supply and easing global gas prices. U.S. prices fell despite forecasts calling for warm weather to persist until the end of September.

Analyst:

- Craig Rocha (cmrocha@ckinetics.com)

- Megha Jha (mjha@ckinetics.com)

You might also likeArticle

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade