- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Price Commentary

- CCA Weekly Commentary: ICE CCA front recovers to $31.23 as more Dec22 long positions enter

CCA Weekly Commentary: ICE CCA front recovers to $31.23 as more Dec22 long positions enterWCI CaTTuesday, 18th January 2022

Craig Rocha

Summary:

- ICE CCA weekly volumes rise by 15%, to 23.1M tons

- CCA front last traded at $31.23 ( -$0.92 WoW)

- OI WoW net increase of 4.37M tons

- IEMAC Committee released draft report

Last week at the InterContinental Exchange (ICE), a total of 23.1M tons of California Carbon Allowances (CCAs) changed hands. Trading volumes increased by 15% as more traders purchased Jan22 and Mar22 contracts. The week saw net Open Interest (OI) grow by 4.37M tons. CCA prices were again volatile, losing $1.7 in the first two trading days but gaining back $0.80 by Friday. The CCA front last traded at $31.23 (-$0.92 WoW).

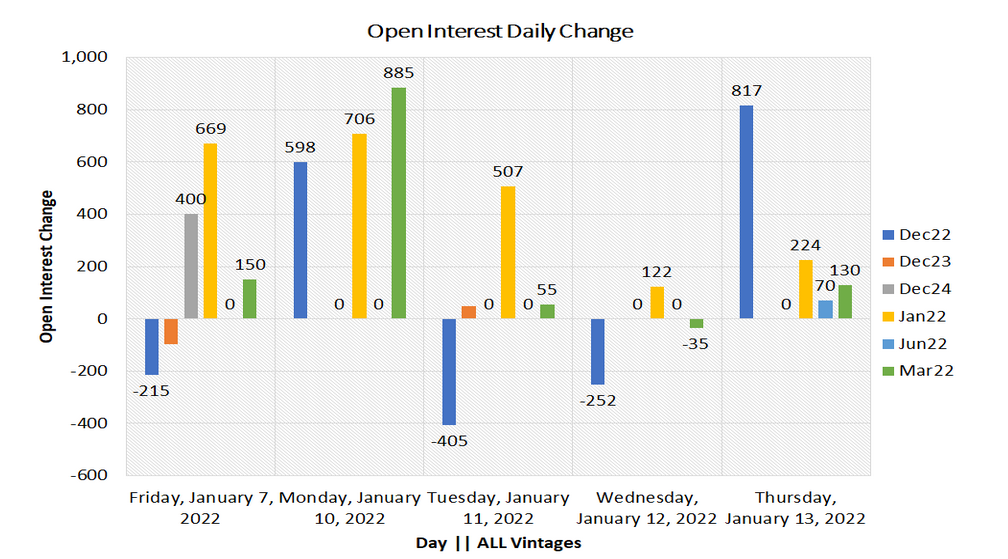

Participants opened fresh positions on Monday with the Jan22, Mar22 and Dec22 contracts (below) possibly after observing CCA prices continuing to weaken from their high point of $33.3 in the week before. CCA prices were on a decline since 5th January. However, on Monday, fresh buying returned (2.1M tons) on the day the market closed at $31.14.

The market then recovered by Thursday as more Dec22 positions (0.8 tons) were introduced. On Friday, the secondary market front closed at $31.23 albeit lower WoW by $0.92.

Total net OI grew by 4.37M tons WoW*. The secondary market front gained 2.2M tons while the Mar22 post-auction OI grew by 1.1M tons. Dec22 OI increased by 0.5M tons.

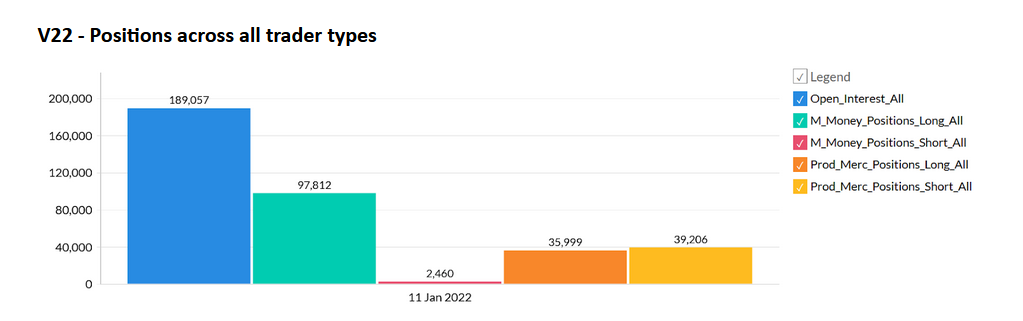

CFTC data last reported on 11th January suggests that fund managers still hold a substantial lead in long positions. Also, their short positions are extremely low in comparison. Their overall bullish outlook has led the CCA price recoveries in January. Compliance entity long and short positions have netted off.

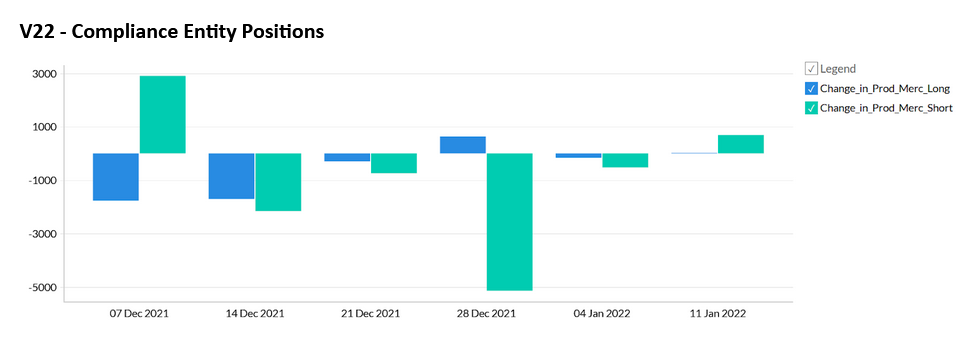

Compliance Entity positions show low change for the two reporting points in January. Compliance interest has not returned in its entirety ever since their Dec21 positions expired. ICE CCA futures prices are now much higher than the last auction settlement of $28.26. Even with a 5% step up ($29.67) the secondary market is trading above the primary market. Which makes it less appealing to enter into fresh positions at this price point.

Also last week, the IEMAC committee introduced it’s draft program review for the legislature. Firstly, they find that private market participants in the WCI Cap and Trade program (both jurisdictions) have banked a total of 321 million allowances from the first three compliance periods and into compliance period 4. They presented that this significantly exceeds the projections made by the CARB in their 2018 rule making for program extension. In 2018, CARB in their scenario projected an allowance bank of 150 million (179 million when adjusted for QC). (IEMAC, 2022)

Secondly, the committee stated that offset credit usage has directly contributed to the growth of the allowance bank. Whereas the emissions abatement from out-of-state projects does not count towards the state’s emission reduction goals. (IEMAC, 2022)

Thirdly, the WCI jurisdictions together must deliver on approximately 275 million tonnes of cumulative emissions reductions by a 2030 target which is lower than the existing allowance bank (321 million). (IEMAC, 2022)

So the draft suggested measures for controlling the state’s 2030 emissions targets by optimizing the allowance banks and offset usage.

In our upcoming webinar tomorrow, we deep dive into the IEMAC recommendations for Market Design, Leakage Risk, Allowance Banking and Scoping Plan Timelines.

*WoW OI Change reported between 13th Jan & 6th January.

*CFTC Data last updated 11th January

Analyst Contact:

Anant Jain (anant.jain@californiacarbon.info)

You might also likeArticle

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade