- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Price Commentary

- CCA Weekly Commentary: ICE CCA prices weaken after poor OI creation on Dec22

CCA Weekly Commentary: ICE CCA prices weaken after poor OI creation on Dec22WCI CaTMonday, 20th December 2021

Anant Jain

Summary:

- Weekly Volume = 63.2M tons, four week moving average of 39.4M tons

- ICE CCA front lost $1.57 WoW, last traded $29.01

- ICE Dec21 futures positions shrunk to 68M tons, down by 11.6M tons

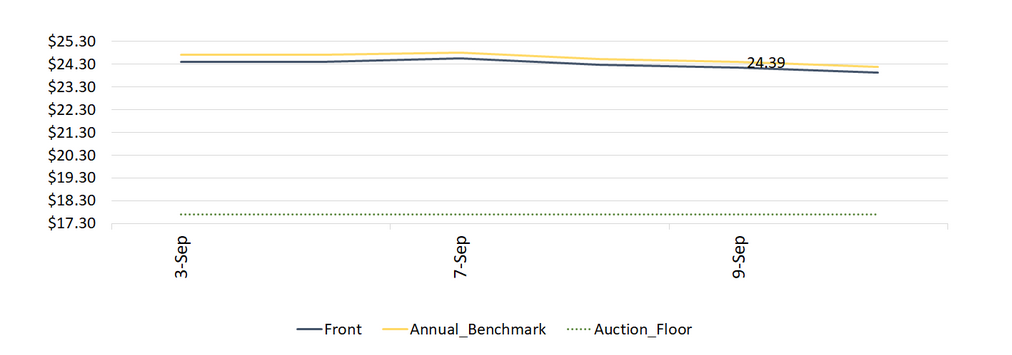

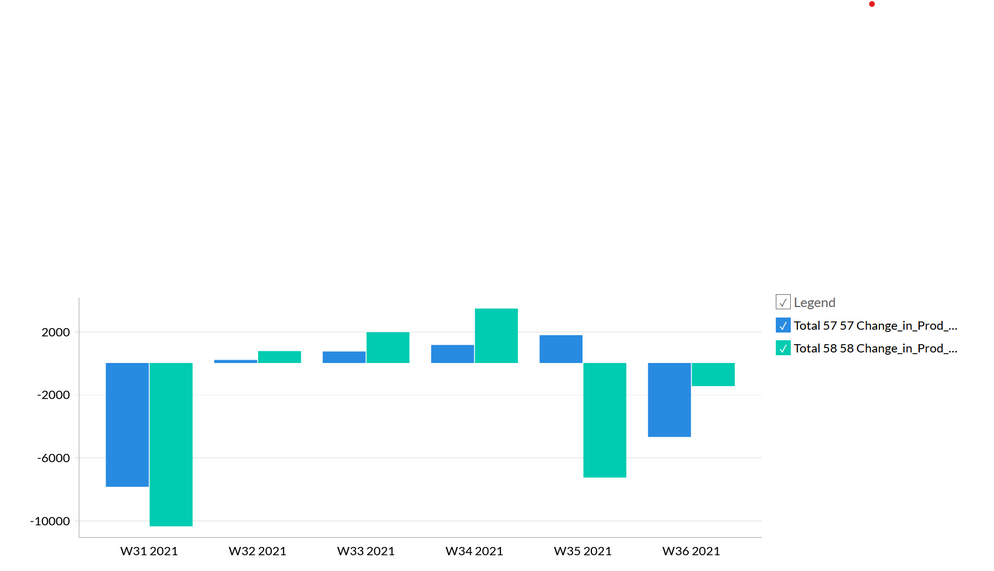

Last week at the InterContinental Exchange (ICE), California Carbon Allowance (CCA) prices for the Dec21 contract lost $1.57, last traded at $29.01. The secondary market saw a larger decrease of Dec21 positions than an increase of Dec22 positions, which then aggravated the price decline. The WoW* change in Open Interest was net negative by 4.6M tons; 11.6M tons of Dec21 contracts closed and only 4M tons of fresh Dec22 positions opened.

In the previous few weeks, OI increase of Dec22 outmatched increasing Dec21 positions as more financial entities rolled over to Dec22 positions. Fresh Dec22 positions developed when ICE CCA prices were closest to the $28 auction settlement price that then led to a temporary price recovery up to the $31 price band. Last week, the increase in Dec22 OI was quite low even when prices were near $29 which suggests that most financial participants may have completed movements to Dec22.

At present, there are 68.8M tons of Dec21 positions that are heading towards expiry and 161.5M tons of V22 Dec22. The ICE CCA front is likely to stay nearer to the $28 band in the absence of fresh OI on V22 Dec22. We expect that ICE CCA price movement could flatten out near the $29 level till the expiry of the Dec21 contract and then step up to $31.5 after the roll over.

From the CFTC data reported on 14th December, compliance entities reduced both long and short positions WoW by about 1M tons, most likely Dec21 contracts. Financial entities increased net short positions by 0.8M tons.

For the first time this year, Fund Manager long positions 27.2M (Green) have fallen below short positions from compliance entities 28.6M (Yellow). This changes the driving force for the V21 Dec21 contract, which was earlier financial participants, but will now lean towards compliance participants. In the current state of positions, long and short positions almost net off, suggesting that CCA prices could reach equilibrium at $28-29. But this would only last till the expiry of the Dec21 contract.

V22 positions remain predominantly with Financial participants. Their V22 short positions are extremely low suggesting that CCA prices could step up after the expiry of the Dec21 contract.

*WoW OI Change reported between 9th December & 16th December.

*CFTC Data last updated 14th December

Analyst Contact:

Anant Jain (anant.jain@californiacarbon.info)

You might also likeArticle

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade