- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Articles

- Demystifying the German Pseudo ETS: No Market pricing, Banking or Offset Integration until 2026

Demystifying the German Pseudo ETS: No Market pricing, Banking or Offset Integration until 2026EU ETSOther CaT NewsWednesday, 31st May 2023

Craig Rocha

Key takeaways

- The German National ETS (nEHS) increases coverage of carbon price in Germany from 50.20% to 87.80%. The program covers fuels in the transportation and building sectors.

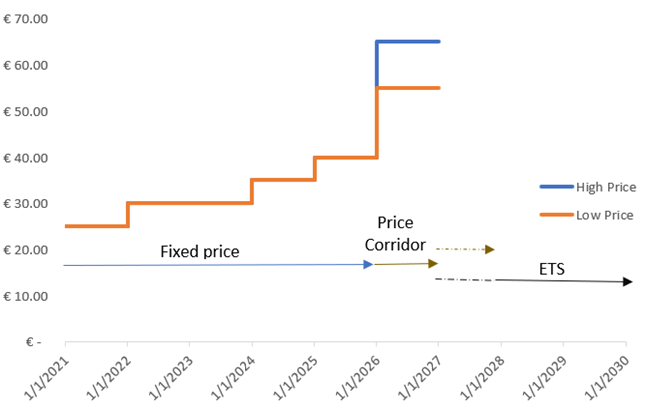

- The ETS will have fixed prices till 2025, 2026 will see trading start in a price corridor, followed by a market driven ETS from 2027 or 2028. The price started in 2021 was EUR 25, rising EUR 5 annually, an exception was given in 2023 – due to high energy prices.

- The current national German ETS – will eventually likely link or price-couple with the Europe “ETS-2” in 2027 or 2028, creating a separate European market for fuels.

Fixed price till 2025, then transition to a market driven ETS

The prices initially began in 2021 at EUR 25, rose to EUR 30 in 2022 and were expected to EUR 35 in 2023. However, the energy crisis in 2022 with sky high energy prices – resulted in the government delaying the 2023 rise of 5 EUR by a year. Currently in 2023, the ETS price stands at EUR 30, same as last year. The delay will not have an impact on the price corridor price in 2026 – EUR55 TO EUR65, or the transition to the beginning of an ETS in 2027 or later.

Figure 1. Price trajectory of German ETS price (Data: cCarbon.info)

The German ETS is born to complement the EU ETS, expanding carbon pricing to most sectors

The EU ETS is the largest single Emission Trading System (ETS) in the world. It is a cornerstone of the European Union’s (EU) policy to combat climate change and is its key tool for reducing greenhouse gas emissions in a cost-effective manner. The EU ETS currently has 27 EU member states along with Iceland, Liechtenstein, and Norway, covering electricity and heat generation, energy-intensive industry sectors, aviation within the European Economic Area and maritime transport. The EU ETS in its current form does not cover fuels and agricultural sector and results in an economy emission coverage of only 50.20% for Germany. Hence, the limited coverage of the EU ETS required Germany to build a program to cover the fuels used both in transportation and buildings. In order to meet its target of 65% below 1990s emissions by 2030. The German National Emission Trading System (nEHS) was born to serve this specific purpose. The nEHS covers emissions fuels – transportation and heating, expanding the coverage by 37.6% bringing 87.8% of the economy under a carbon-based pricing system.Expanding the Scope of ETS

Germany’s national ETS will include coal-derived fuels from January 1, 2023, and waste-derived fuels from January 1, 2024. This expansion covers small coal power plants and waste incineration plants that are currently not under the EU ETS. Initially limited to specific fuels in 2021, the national ETS will encompass all fuels by 2024.No banking or offsets in Fixed Price phase

Until 2026, no banking or offset flexibility is provided. Once the auctioning phase begins, banking of allowances will begin. Regarding offsets it’s yet to be seen whether they would be introduced in the auctioning phase of the program.The German ETS will phase into the EU ETS 2 by 2027/2028

In July 2021, the EU proposed the “Fit for 55” package. It includes a proposal to extend emissions trading to new sectors – fuel used for buildings, road transport and certain industrial sectors not covered by the existing EU ETS. The agreement will see the ETS 2 launch in 2027 or 2028. It will put an absolute cap on emissions, which will decrease in line with a linear reduction factor. Allowances will be distributed exclusively via auction; auction volumes will be frontloaded in the first year to ensure a smooth start of the system. In addition, a market stability reserve will adjust the supply of allowances in support of market balance (I-CAP). The German ETS is built to initiate carbon pricing of fuel prior to the “Fit for 55 package” and the “ETS- 2” agreement. Now, with the European Union all set to launch the ETS-2 in 2027 or 2028, the isolated existence of the German ETS becomes less meaningful. The purpose of the German ETS is to gradually raise the price on fuel emissions and subsequently integrate or price-couple with the EU-ETS 2 in 2027 or 2028, aligning with the broader objectives of the European Union.Conclusion

The German ETS represents a significant milestone as it expands emissions coverage under carbon pricing mechanisms in Germany to 90%, thereby solidifying the country’s position as a global leader in the Climate Arena. This initiative has been specifically designed to broaden the sectoral scope of the existing EU-ETS in Germany by gradually transitioning towards market driven carbon pricing of fuels emissions. While the program may currently lack appeal for investors or offset developers, the German ETS holds immense potential for future integration with an expanded EU-ETS. Anticipated developments in 2027/2028, including the introduction of the EU ETS-2, will further enhance the scope of the EU-ETS and generate substantial interest among investors. Source: 1. https://icapcarbonaction.com/en/ets/german-national-emissions-trading-system 2. https://www.oecd.org/tax/tax-policy/carbon-pricing-germany.pdf Analyst Contact: Craig Rocha (cmrocha@ckinetics.com)Table of Content

- Key takeaways

- Fixed price till 2025, then transition to a market driven ETS

- The German ETS is born to complement the EU ETS, expanding carbon pricing to most sectors

- Expanding the Scope of ETS

- No banking or offsets in Fixed Price phase

- The German ETS will phase into the EU ETS 2 by 2027/2028

- Conclusion

You might also likeArticles

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade