- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Price Commentary

- RGGI Price Commentary: RGGI prices revive after early week decline; Virginia’s Governor signs executive order for states exit

RGGI Price Commentary: RGGI prices revive after early week decline; Virginia’s Governor signs executive order for states exitWCI CaTTuesday, 18th January 2022

Anant Jain

Summary:

- Total Weekly Volume of 3.103M tons, -35.20% WoW change.

- RGGI ICE weekly weighted average settlement price was $14.18, +0.33% WoW.

- Governor Glenn Youngkin signs Executive order to re-evaluate Virginia’s participation in the RGGI and begin regulatory processes to end it.

RGGI prices drifted -$0.2 (1.4%) down in the first four trading sessions. The market saw a resurgence of trade volumes on Friday with 2.17M tons of allowance traded, and prices increased by +$0.11 (0.77%). The market is set up for a volatile February, with important updates on the RGGI membership of Pennsylvania and Virginia due, along with the interim compliance surrender deadline at the end of February.

- Virginia Executive Action

On the 15th of January, Virginia’s Governor signed Executive Order Nine, which aims to remove Virginia from the RGGI, either through executive order or regulatory action. The action though imposing does not dwell on a pathway to the state’s exit from the RGGI. Virginia’s Attorney General Herring has expressed his official advisory position on the issue of Virginia’s exit stating that the Governor may not repeal or eliminate through an executive order or other action the enacted status and regulations pertaining to Virginia’s participation in the RGGI. The remaining pathways through the legislature look difficult, with the Democratic party holding a majority in the state Senate. ( Attorney General of Virginia Office, Governor of Virginia)

2. Pennsylvania Finalisation

Governor Tom Wolf vetoed the anti-RGGI resolution on January 10. The legislature can now override the veto but would require a 2/3 majority. The Republican Party currently holds 28 seats in the 50 seat Senate, falling short of that 2/3rd majority. The Senate has another three weeks or ten legislative days to vote on the override of the veto. In the likely event that the override fails, Pennsylvania would successfully join the RGGI through executive action.

3. Compliance Entity Surrender Deadline

Compliance entities will have to surrender 50% of their total emission obligations for 2021 by March 1, 2022. The entities purchased 18.36 million allowances (67% of allowances) in the December 2021 auction, including 4 million excess CCR allowances. The estimated surrender in the upcoming compliance surrender is expected to be 53.75 million allowances.

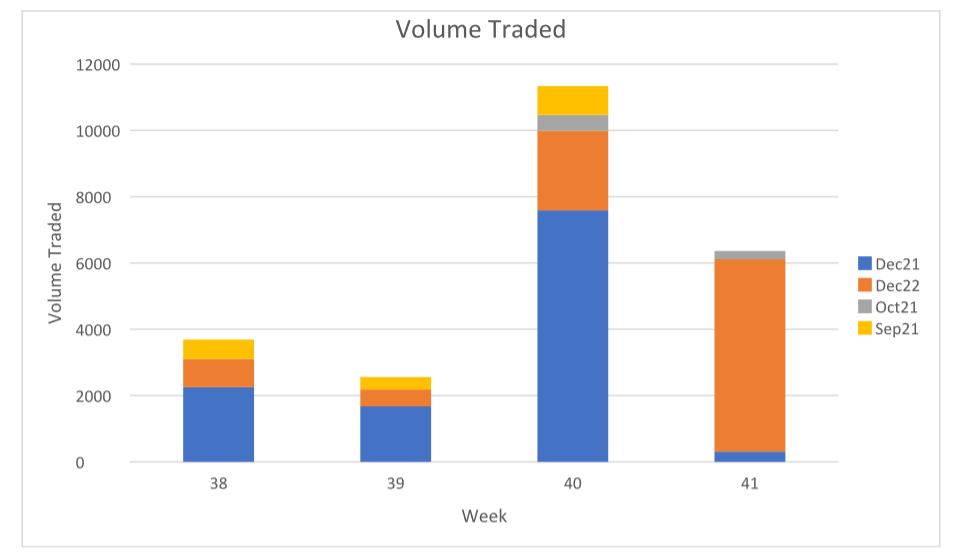

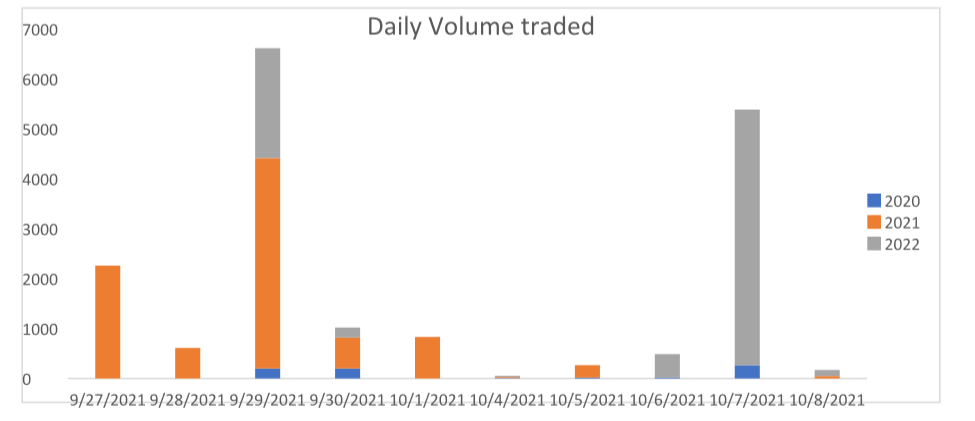

Volumes

The ICE futures market saw 3.103M tons of allowances traded. Market volumes remain low, as buyers remain hesitant and sellers are bullish.

CFTC Traders position Data

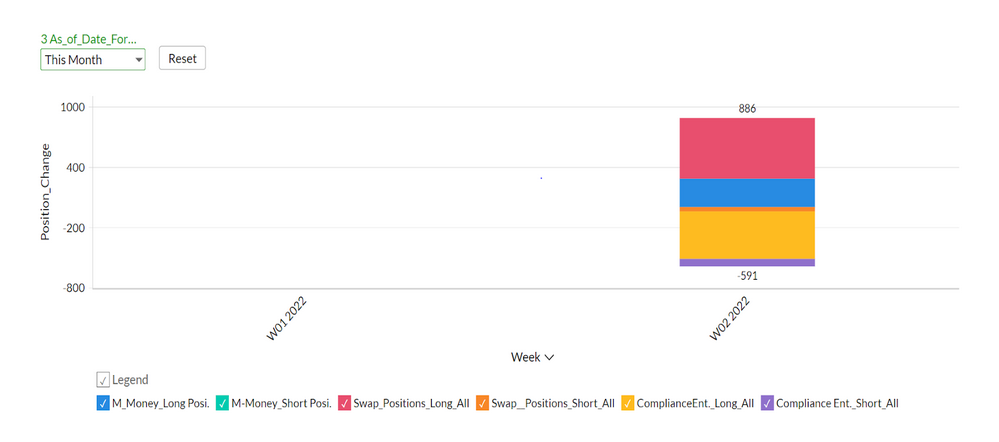

Market players opened 0.886M Tons of new positions and closed 0.59M tons of positions during last week (W02 2022). Compliance entities closed 0.55M Tons positions, with 0.47M tons of long positions and 0.075M tons of short positions. Managed Money increased their long positions with 0.28M tons of new long positions. Even at the high price of allowances, managed money has remained bullish on RGGI allowances across the board.

Analyst Contact:

Craig Rocha (cmrocha@californiacarbon.info)

You might also likeArticle

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade