- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Price Commentary

- RGGI prices continue to climb; Dec22 contracts surpass $12

RGGI prices continue to climb; Dec22 contracts surpass $12WCI CaTTuesday, 19th October 2021

Craig Rocha

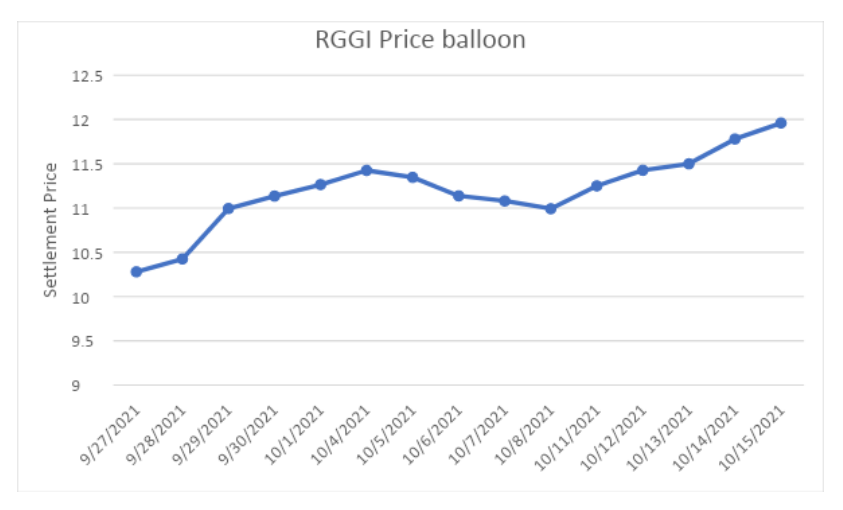

Weekly Commentary: ICE RGGI prices rise to $11.96 with Dec22 contracts trading above $12, weekly volume decreases.

Summary:

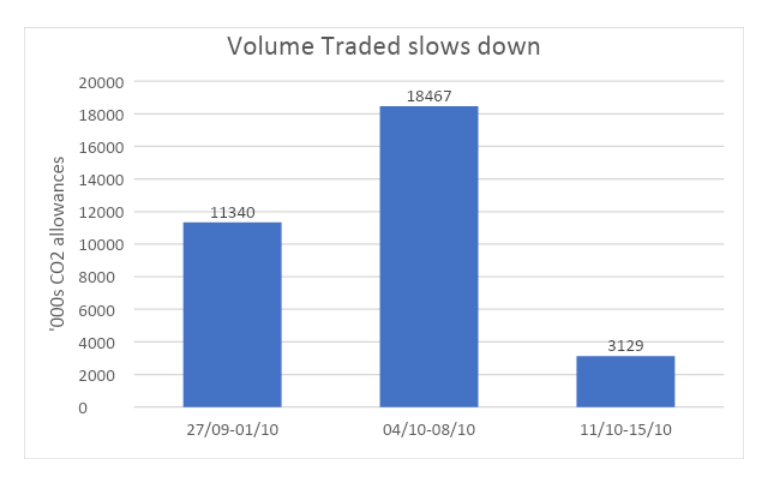

- Total Weekly Volume of 3.13M tons, -83% WoW Change.

- ICE RGGI price rise to new peak of $11.96

RGGI allowances continued to climb higher, ending the week at $11.96. A rise of 28.6% since the 53rd auction a month and a half back. The reasons for the rise :

- 97 out of 218 facilities have reported emission data, a slight increase of 0.5% from the limited data. This increase would maintain the 13% rise of Quarter 3 2021 emissions over 2019. We project that Q3 2021 emissions will be around 27.5 million tons, 4.5 million tons emissions more than the Q3 auctioned allowances.

- The upcoming 54th auction will be the last this year for compliance entities to secure allowances for 50% of their 2021 emissions, due before March 2022. The increased power plant emissions have increased demand for allowances, while managed money remain reluctant to sell. Increasing emissions add price pressure on participants with an emission obligation.

- The final approval for Pennsylvania to join the program is sitting with the attorney general, due later this year.

- Managed money and investor are looking for long term gains and further creating a crunch for compliance entities.

- Biden’s clean electricity plan is uncertain as he lacks the necessary support to pass the bill. This has revived a proposal of a pan-USA carbon tax of around $15-18 dollars, fueling speculation around allowance prices.

Volume Traded

Volume traded this week slowed down after a prior period of aggressive trading. The fall in volumes by 83% WoW would imply that compliance demand is mostly sated. We expect lower participation of compliance entities until the upcoming auction on Dec 1, while managed money continues to measure the potential for long term gains.

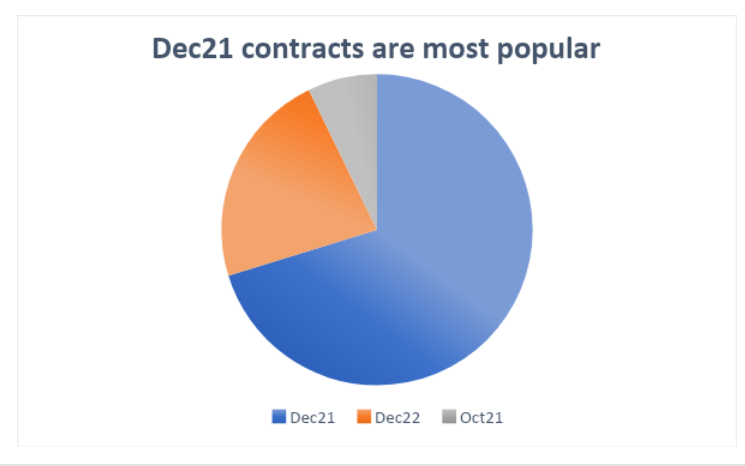

Last week, the most traded contract was the Dec21 delivery contract at 70% of traded volume. This is, in essence, compliance entities securing supply before the end of the first interim compliance period in December 2021.

V2022 Dec 22 forwards continue to trade at a slight $0.2 premium over Dec21 and Oct 21.

CFTC Derivatives Market:

Market’s Open Interest

Even as traded volume cooled down, the derivative market saw a rise in new call and put options opened. RGGI Vintage 2022 saw the greatest number of new contracts opened.

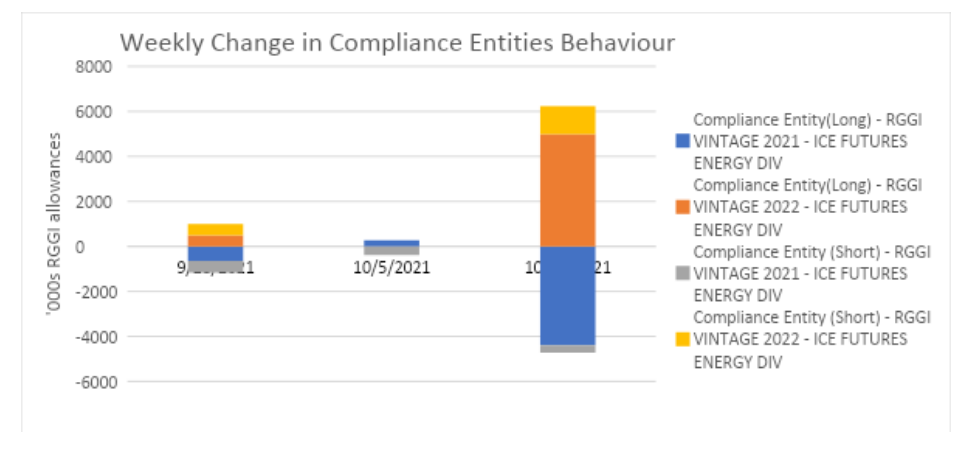

Compliance entities Behavior

Compliance entities’ participation saw a significant increase in the previous week, with compliance entities closing V2021 long and short positions and opening V22 long and short positions. This is common as entities roll over their options to the following year, closing V2021 and opening V2022.

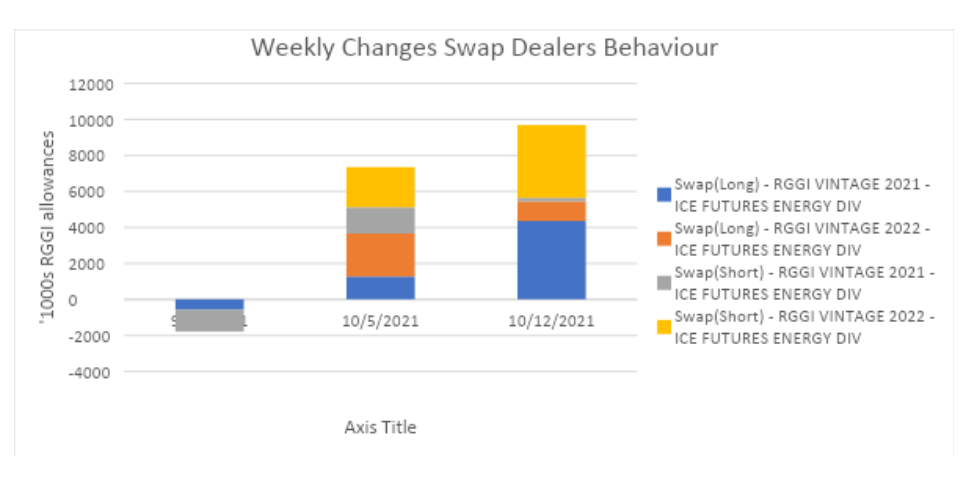

Swap Dealers Behavior

Swap Dealers have also increased their participation. Swap Dealers opened V2021 long position and V2022 short position, it seems swap dealers are optimistic about a price rise before December 2021 and a settling or drop in prices in 2022.

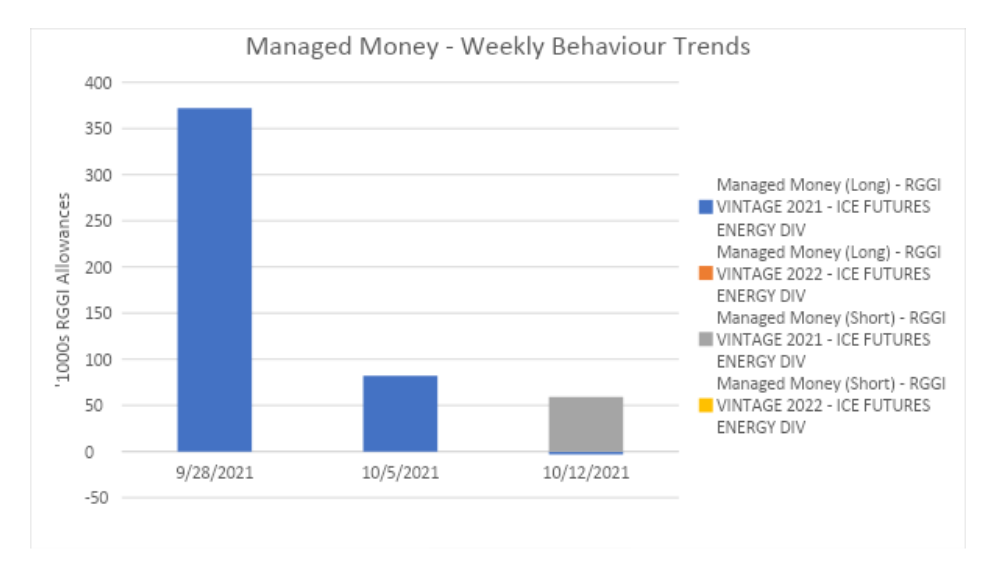

Managed Money Behavior

Managed money saw a slight increase in the options market. Mainly buying V21 short contracts, it is rare to see managed money buying short positions. The 28% rise in allowance price in under two months may have some investors viewing the market as overpriced and due for a fall in price.

Table of Content

You might also likeArticle

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade