- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Price Commentary

- RGGI prices see volatility as Supreme court rules against EPA’s power to control emissions

RGGI prices see volatility as Supreme court rules against EPA’s power to control emissionsRGGITuesday, 5th July 2022

Megha Jha

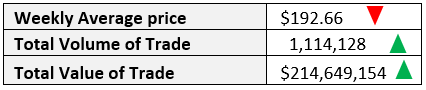

- Total Weekly Volume of 6.41 M tons, +81.07% WoW change

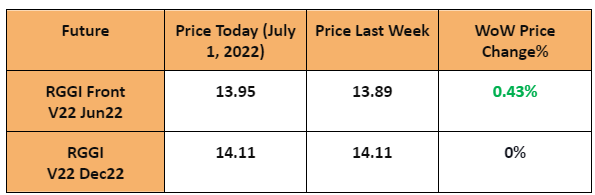

- RGGI ICE weekly average settlement price: $14.03, +0.22% WoW.

- Managed Money increased net-short positions by 0.55 M tons, compliance entities increased net-long by 4.9 M tons.

Quick Summary:

In its ruling, the US Supreme court said, ‘a cap on power plants’ carbon dioxide emissions that forces a transition to other fuels may be a “sensible” solution to the climate crisis but, Congress did not give the Environmental Protection Agency the broad authority to make such requirements’ (Texas Tribune). Going forward, all federal carbon programs that regulate emissions would need to be passed through Congress. The states may continue to regulate emissions through legislation. it will not have any impact on the WCI and RGGI carbon markets.

Before the ruling, compliance entities and managed money, reduced positions as there was fear that the ruling would have a negative impact on the cap-and-trade programs. The market rebounded quickly after the ruling, as deeper analysis of the verdict showed no fundamental impact on the RGGI.

RGGI Future Price RGGI price strengthen with front price trading above the 2022 CCR price

Weekly RGGI Volumes increase (+81.07% WoW)

Market Fundamentals

Trader Positions:

Compliance entities increase net long positions and Managed Money increase net-short positions

An analysis of traders’ positions from CFTC data gives us an indication of market sentiments. Open interest increased by 7 M tons, compliance entities net long increased by 4.9 M tons and managed money net-short increased by 5.59 M tons.

WoW Change in Positions

Compliance Entities (Net Long: 4.9 M tons ):

Increased long positions by 0.015 M tons

Decreased short positions by 4.9 M tons.

Managed Money (Net Short:0.55 M tons ):

Decreased long positions by 0.86 M tons

Decreased short positions by 0.31 M tons.

The RGGI rebounded quickly post the Supreme Court ruling on Thursday, with the RGGI front allowances now trading on the ICE exchange at prices above the CCR trigger price. The allowances have little room to move higher, having already surpassed the Cost Containment trigger price. Compliance entities reduced their short positions by 4.9 tons, and managed money reduced their long positions by 0.55 M tons. This reduction in open position was before the verdict, with the expectation that traders would initiate new positions soon after.

Analyst: Craig Rocha (cmrocha@californiacarbon.info)

You might also likeArticle

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade