- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Price Commentary

- Weekly Commentary: ICE CCA front sees first price drop in June in approach to front rollover

Weekly Commentary: ICE CCA front sees first price drop in June in approach to front rolloverWCI CaTMonday, 28th June 2021

Anant Jain

Summary:

- Market volume increased by 62%, to 47.4M tons

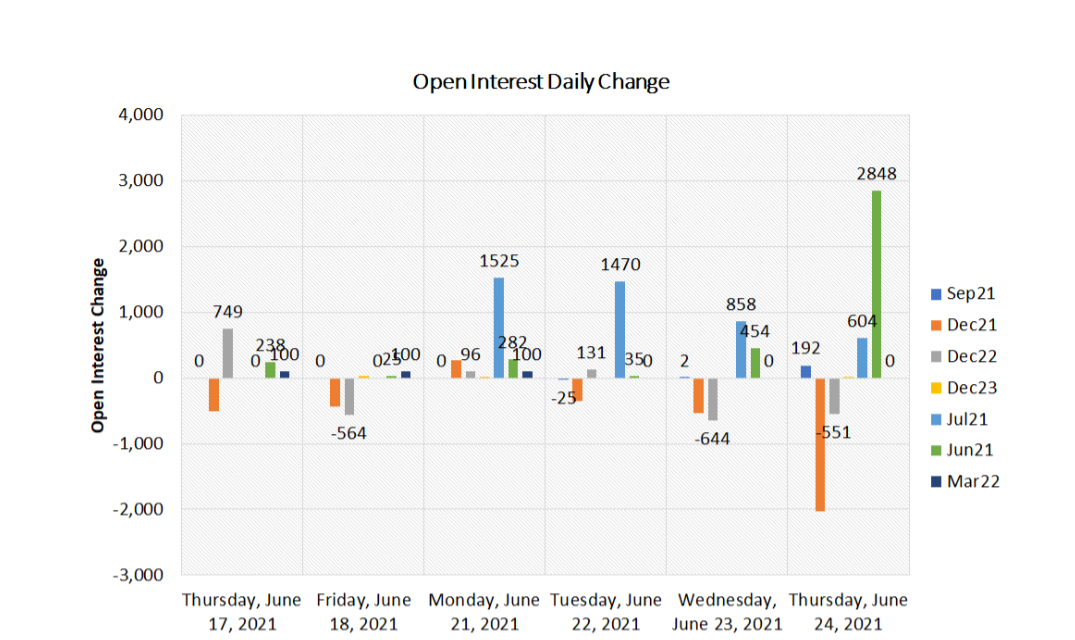

- Benchmark V21 Dec21 OI reduced by 2M tons

- Front V21 Jun21 OI increased by 3.9M tons days before expiry

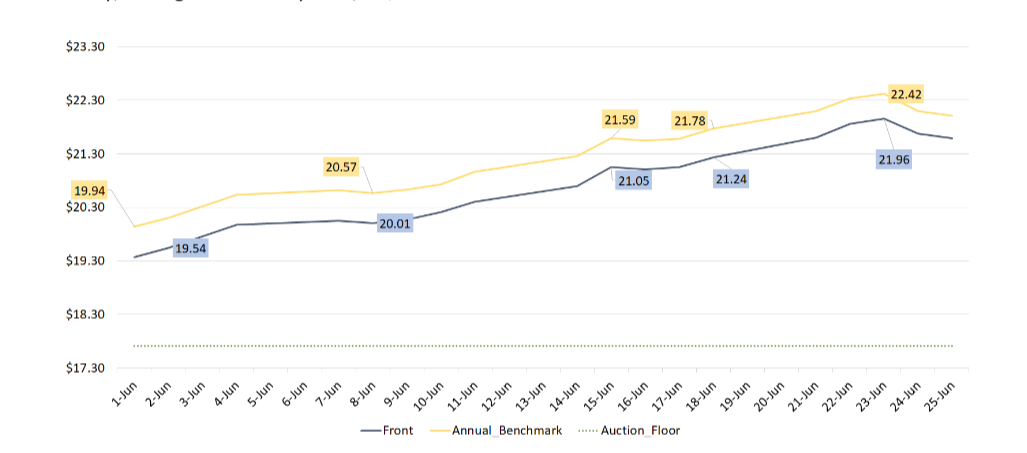

Last week at the InterContinental Exchange (ICE), CCA weekly volumes surged to 47.4M tons increasing by 62%. Positions on the Jun21 and Jul21 deliveries, expected to roll over this week, increased by a substantial 8.4M tons. Anticipating a sell off pre-rollover, CCA prices closed in the red on Thursday and Friday, closing near Monday level, at $21.59.

Market volumes increased after news of another positive underlying signal for prices. On 15th June, California released the updated CPI rates. California CPI rate increased by 2.3% in April and that led the ICE market into a rally. An added rate of 2.3% translates to a $0.20- $0.30 increment in the price floor for 2022. Although, current market prices have moved past a reasonable trajectory as the ICE market becomes more semi-strong form efficient. Some of the positivity from that week spilled over as market participants took to betting on the CCA front rollover from June21 to July21. Positions on the Jun21 and Jul21 deliveries, in anticipation of an upward price rollover, increased by a substantial 8.4M tons.

Participants increased V21 Jul21 positions on Monday and Tuesday by about 1.5M tons each day. An increase in positions carried last week’s momentum and CCA contracts gained $0.62 over the two sessions. However, Jun21 positions increased on Thursday by 2.8M tons, days before the front rollover. Additionally, V21 Dec21 positions also shrank by 2M tons. The V22 Dec22 contract too saw closures of 1.3M tons. Buying on the expiring front and selling on the benchmark created a downward price movement. CCA prices fell by $0.37 in the last two trading sessions. The secondary market front closed at $21.59.

A net total of 3.9M tons of fresh contracts entered the ICE secondary market.

The ICE CCA market has experienced a steady upward movement in the past. The secondary market front has gained $2.22 in June alone. Last week we saw the first price correction this month. At present, the Jun21 contract has 17.9M tons of positions while the Jul21 contract has 9.3M tons OI which is about half. In the coming week, the secondary market may feel a new resistance level after the rollover of the front.

*WoW Change reported between 17th June and 24th June.

Analyst Contact:

Anant Jain (anant.jain@californiacarbon.info)

You might also likeArticle

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade