- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Price Commentary

- Weekly Commentary: ICE CCA prices weaken by over a dollar as fund managers increase short positions on the front

Weekly Commentary: ICE CCA prices weaken by over a dollar as fund managers increase short positions on the frontWCI CaTMonday, 23rd August 2021

Anant Jain

Last week at the InterContinental Exchange (ICE), a total of 31.5M tons of CCAs changed hands. The secondary market front dropped steadily after short positions increased consistently in the market. This comes in the auction week where the presence of financial entities is now more than ever.

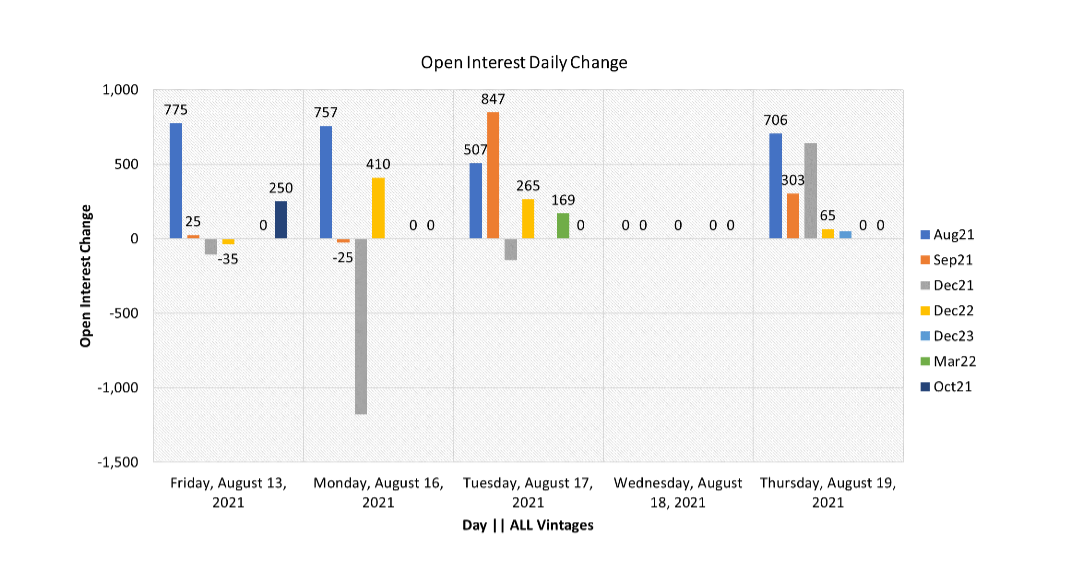

A total of 4.6M tons of OI increased WoW*. The V21 Aug21 front received 2.2M tons of fresh OI. V21 Sep21 positions increased by 1.4M tons.

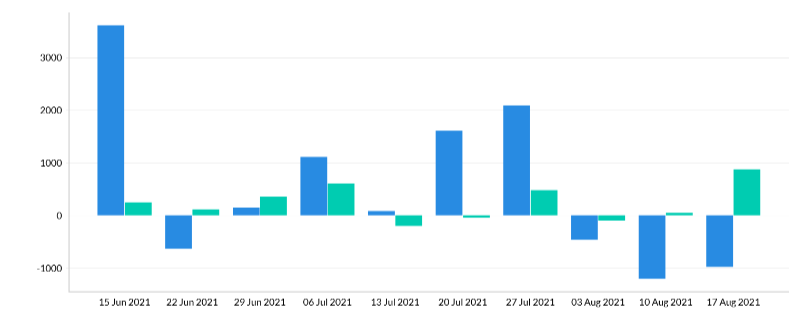

The compliance market participated in the 28th Joint Auction on 17th August 2021. We observed that financial participants held a bullish outlook in the secondary market that caused CCA prices to move up to $23 levels before the auction or at least up to 3rd August. Since then, these entities have been reducing net long positions in the market, over the last three weeks. In the graph below, we see a drop in long positions reported on 3rd August and 10th August. In the most recent data, 17th Aug or on auction day, these entities even increased their short positions by 0.87M tons. An indication that some fund managers are expecting lower settlement prices in the auction which would translate to lower front prices on the secondary market.

On the ICE market, we see an increase in OI on the CCA front on the days that the front closed in red (figure below). Both on Tuesday and Thursday, CCA prices lost between $0.20-$0.54 by the end of trade. OI position on the front however increased by over 0.5M tons on both days. OI on V21 Aug21 increased by 2.2M tons WoW*. Purchases on the Aug21 contract clearly have a close bearing with the auction settlement price that will be announced on 25th Aug, days before the expiry of the Aug21 contract.

We expect the settlement price for this auction to be in the range of $20 to $20.50. And this secondary market could be well on its way to meet that. In the coming week, the CCA front will rest on the support of previously bullish fund managers who are now clear drivers in the secondary market.

*WoW Change reported between 12th August and 19th August.

Analyst Contact:

Anant Jain (anant.jain@californiacarbon.info)

You might also likeArticle

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade