- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Price Commentary

- Weekly Commentary: WCI bid guarantees settle in, market turns short term and ICE market front sets the pace

Weekly Commentary: WCI bid guarantees settle in, market turns short term and ICE market front sets the paceWCI CaTMonday, 9th August 2021

Anant Jain

Summary:

- Total net OI increase of 3M tons WoW*, secondary market front V21 Aug21 receives a net increase of 2.4M tons.

- Total weekly volume reported at 18.1M tons, same as last week.

- Compliance entities increase net long positions by 2M tons on ACP contract.

Last week at the InterContinental Exchange (ICE) a total of 18.1M tons of California Carbon Allowances (CCAs) changed hands. This week’s volume was in line with the week before as the approaching auction re-introduced some apprehension in the secondary market. However, the secondary market front gained $0.69 WoW* as positions grew on the front. A total of 3M tons of new OI entered the secondary market. Here the front was the prime mover, providing 2.4M tons of fresh positions.

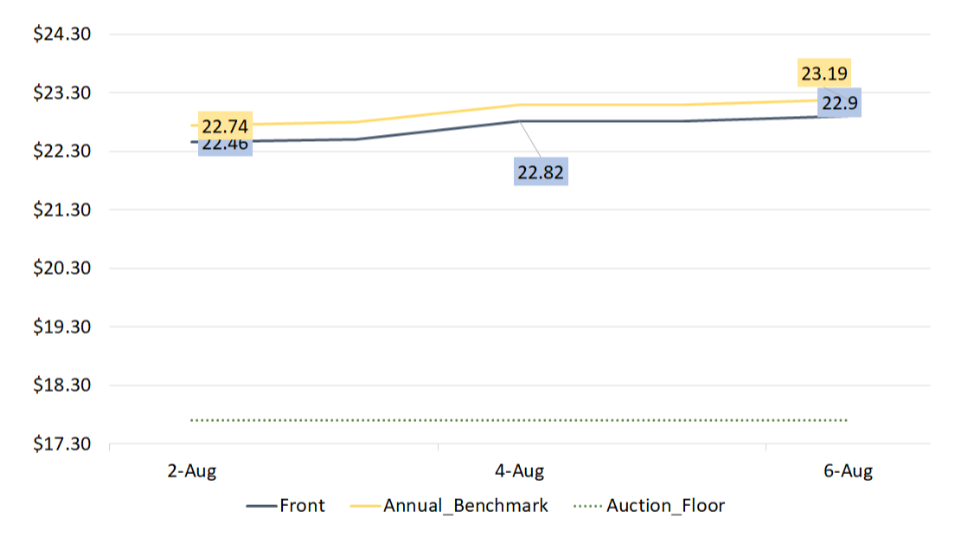

We find the front responsible for driving CCA prices last week. A large part of the OI introduced in the market was because of additions on the front. Also, Monday and Wednesday’s price jumps were the highest on the front, across the V21 term structure. At the close of trade on Monday, the front gained $0.25 whereas V21 Dec26 on the far end of the term structure gained $0.21. Even on Wednesday, the gain differential was $0.02 in the favor of the front. This is not normally the case in the ICE market.

The overall market outlook has now shifted to the near term. Auction bid guarantees were set on Friday 6th August as market participants prepare for the auction on 18th Aug. Join our Pre-Auction Outlook Webinar on Wednesday at 10 am PT. The primary objective in this auction is to capture the additional 14 million V20 allowances that will be on offer. These allowances are dearer than the V21 allowances for both compliance entities and speculators. This is as the V20s are admissible in the triennial obligation surrender on 1st November and will therefore fetch a higher price on the secondary market. Last week we saw an increase in V20 Dec21 positions, which could be to satisfy any excess emission obligations after the true-up period.

In 2020’s midyear auctions, we saw a large increase in V20 Sep21 positions. This was to arrange V20 allowances in advance of the 1st November 2021 surrender. At the beginning of May 2021, about 22.6M tons of V20 Sep21 positions floated on ICE. After the large price jumps in the following three months, about half of those positions were liquidated for short term wins. At present, around 12M tons of V20 Sep21 positions are currently open compared to 17.8M tons of V20 Dec21 positions. The importance of V20 Dec21 has increased.

From the latest reported CFTC data (3rd Aug), compliance entities reduced both long and short positions in the market. Their V21 net short positions declined by 2.53M tons with an absolute decrease in V21 positions of 18M tons. This was from the expiry of the Jul21 delivery.

However, from the latest data on current auction positions (ACP contract), these entity’s increased net long positions by 2M tons while other categories of traders remained steady. Even in the data reported a week before, compliance entities increased net long positions by 0.7M tons. We find that there is a visible bullish outlook by these entities on the auction settlement price. And that these entities will be gunning for the 14M V20 allowances on offer.

*WoW Change reported between 29th July and 5th August.

Analyst Contact:

Anant Jain (anant.jain@californiacarbon.info)

You might also likeArticle

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade