- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Price Commentary

- Liquidity bounces back as a result of fully subscribed Joint Auction 14

Liquidity bounces back as a result of fully subscribed Joint Auction 14WCI CaTMonday, 5th March 2018

Shubhangi Sharma

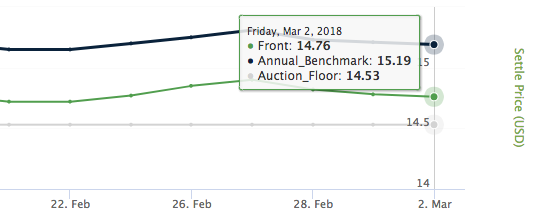

CaliforniaCarbon.info, 5th March, 2018: Post-Joint Auction 14 liquidity in the market is gaining traction with entities showcasing interest in V2019 and continuing interest in V2018 and V2017. Front (V18 Mar18) and benchmark (V18 and Dec18) gained 4-cents and 5-cents on the forward curve, respectively, at the beginning of the week. Following day front gained an additional 5-cents and benchmark gained 6-cents. After auction results were released, CCA prices decline an average of 7-cents with high intra-day volatility. Front and benchmark witnessed an 8-cent decline while Jun18, which saw trades mid-week, experienced an 11-cent decline. Future contracts declined minimally, registering 6-4 cent drop on the forward curve. On Thursday (03/01) intraday volatility was still present with front losing a further 4-cents while benchmark lost 2-cents. CCAs rounded off the week with a 2-cent drop for all deliveries. As of Friday (03/02) front (V18 Mar18) stands at $14.76 and benchmark (V18 Dec18) stands at $15.19. The graph below shows price movements for front (V18 Mar18) in the past week.

Implied Funding rates (IFR) between key deliveries

As of Friday (03/02) IFR between front (V18 Mar18) and benchmark (V18 Dec18) is 3.90% which is higher than it was before because there is only nine months left of the calendar year. While IFR between V18 Dec18 and V18 Dec19 has increased to 3.69% from 3.42% last week. IFR between V18 Dec18 to V18 Dec20 stands at increased to 3.56% from 3.36% last Friday (02/23).

Volumes traded

Liquidity is increasing as entities settle down after JA 14 as significant trades are occurring under Mar18 and Dec18 delivery while Jun18 and Sep18 register minor trades. Volumes this week have increased totaling 7,454,000 tons. In the past, volumes traded post fully subscribed auctions have also trended in the range of 7m, indicating a redundancy in auction impact. V2018 lead trades with 5,531,000 tons which makes up 74.20% of the total followed by V2019 with 950,000 tons (12.74%). V2017 is still in play with up to 713,000 tons being traded followed by V2016 with 260,000 tons which is 3.49% of the total volume traded.

Mar18, formerly the post-auction delivery and now front has the second highest trades this week with 2,340,000 tons which is 1,276,000 tons of additional volumes over a week. Dec18 trades shot up significantly and currently stands at 3,311,000 tons which is 44.42% of the total share of volumes traded. Entities are also trading around Jun18 which is the next post-auction delivery. Trades for Jun18 stand at 700,000 tons while Sep18 and Dec19 deliveries are also seeing trades at 153,000 tons and 950,000 tons respectively.

Open Interest changes

OI continues to increase for particularly for two key deliveries: front (V18 Mar18) and (V18 Dec18). A high positive OI for all vintages mean an additional 4,961,000 contracts over the week in total. OI Mar18 delivery saw an addition of 2,429,000 contracts over the week. Dec18 saw an additional 1,582,000 contracts indicating market interest around those deliveries which means entities are rolling trades. Jun18 and Dec19 also have positive OI with an added 100,000 contracts and 850,000 contracts respectively. All vintages saw a positive OI over the week with the highest additional OI under V2018 (3,825,000). V2019 also saw a positive OI change (850,000 contracts) for the first time since beginning of February.

OCA reaction

OCAs continued to see volatile price hikes and dips throughout the week. The 3,000,000 OI contracts finally closed as front changed from V18 Feb18 to V18 Mar18 on the 26th of Feb. Prices gained 8-cents on the curve on Monday, followed by a weekly high at 16-cent gain (on avg.) on Tuesday (02/27). OCAs rounded off the week with a 3-cent dip which means prices for V17 Mar18 stand at $14.72 and V17 Dec18 stand at $15.15 with a continuing trend of zero trades on all deliveries.

Analyst contact: Abhilasha Fullonton (abhilasha.fullonton@californiacarbon.info)

You might also likeArticle

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade