- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Price Commentary

- Weekly Commentary: Over 1 million open interest contracts settle under Dec18 delivery

Weekly Commentary: Over 1 million open interest contracts settle under Dec18 deliveryWCI CaTMonday, 22nd October 2018

Shubhangi Sharma

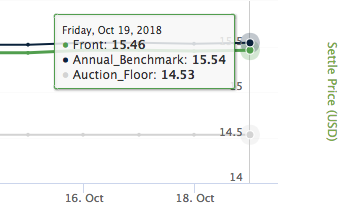

CaliforniaCarbon.Info 22nd Oct, 2018: California Carbon Allowance (CCA) prices continue to be stable with very little movement on the forward curve. Both trades and open interest relatively slowed down, registering minimal activity in the market. At the beginning of the week, prices for most deliveries remained the same with a few exceptions (mostly latter deliveries) that dropped a cent on the forward curve. The following day there was slight movement with front (V18 Dec18) and V18 Nov18 gaining 3-cents on the curve while the rest of the deliveries gained 2-cents. Mid-day prices stayed the same with no activity under Volume and OI. The last day of the week CCA market saw slight intraday volatility, with deliveries picking up anywhere from 1-cent to 6-cents on the curve. As of Friday (10/19) front is trading at USD 15.46 and benchmark (V18 Dec18) is trading at USD 15.54. See CCA tracker for daily price updates:

Volume: Volumes decreased significant in the last week as trades totaled to 4.1 million tons a drop of over 63% over a week. There have been some movement in trades, as we approach the annual and triennial surrender deadline. We see entities making strategic transactions over to the next compliance period, as expected. On Friday, 330,000 tons was transacted from V17 Dec18 to V20 Dec18 as the latter delivery was trading at a cent higher. 700,000 tons were traded from V21 Dec18 to V21 Dec19 as Dec19 was trading at 3-cents higher than Dec18. There were other minor trades that followed similar movement of aforementioned trades. Dec19 trades totaled to 1.3 million tons while Dec18 saw relatively higher trades at around 2.1 million tons. Trades under current front picked up only towards the end of the week totaling at 630,000 tons. Vintage-wise V2021 almost matched trades with V2018. Trades amounted to 1,577,000 tons for V2018 and 1,525,000 tons for V2021.

Open Interest: Market saw significant additions and closures of open interest. Around 1.1 million OI contracts settled under Dec18 while Oct18 and Dec19 saw the bulk of added OI contracts at 1.3 million. Vintage-wise around 146,000 contracts were settled under V2017 and V2018 combined while V2021 saw 575,000 new OI contracts.

Analyst contact: Abhilasha Fullonton (abhilasha.fullonton@californiacarbon.info)

You might also likeArticle

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade