- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Articles

- 2023 Demand Above Predictions, Led by Q4 Retirements

2023 Demand Above Predictions, Led by Q4 RetirementsVCMWCI CCOs & WCOsTuesday, 16th January 2024

Tanay Sawhney

Key Takeaways

- The demand for credits in 2023 exceeded 2022 levels, largely due to a spike in retirements in December 2023

- Renewables are still the highest driver of demand, but volumes declined in 2023

- Systematic year-on-year growth in retirements was observed for CAR- and ACR-verified credits

- Demand for removal-based credits higher than ever before, although significantly below avoidance-based credits

Retirements by Protocol

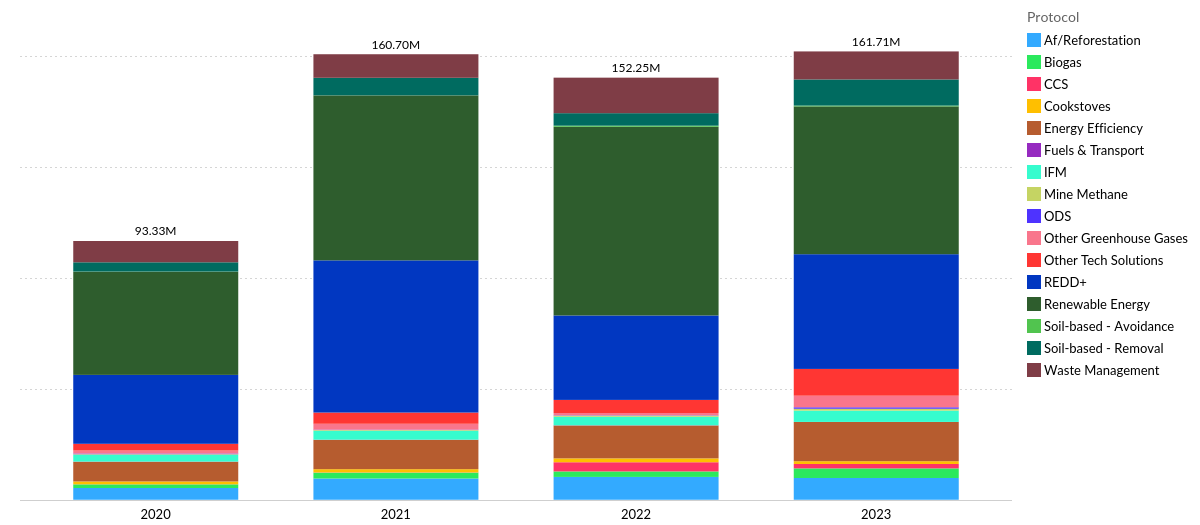

Unlike supply, demand for credits slightly exceeded 2022 volumes in 2023. Renewables and REDD+ credits continued to dominate retirements, accounting for close to 60 per cent of the total demand in 2023. As with the previous years, the share of renewables was the highest, although their demand fell both in absolute and relative terms.

Energy efficiency followed, representing over 8 per cent of the total retirements which was marginally below 2022 volumes. Other tech solutions and soil-based removal solutions both emerged with sizable shares of the retirements with their volumes witnessing a more than double increase in 2023.

Figure 1: Yearly Retirements by Protocol

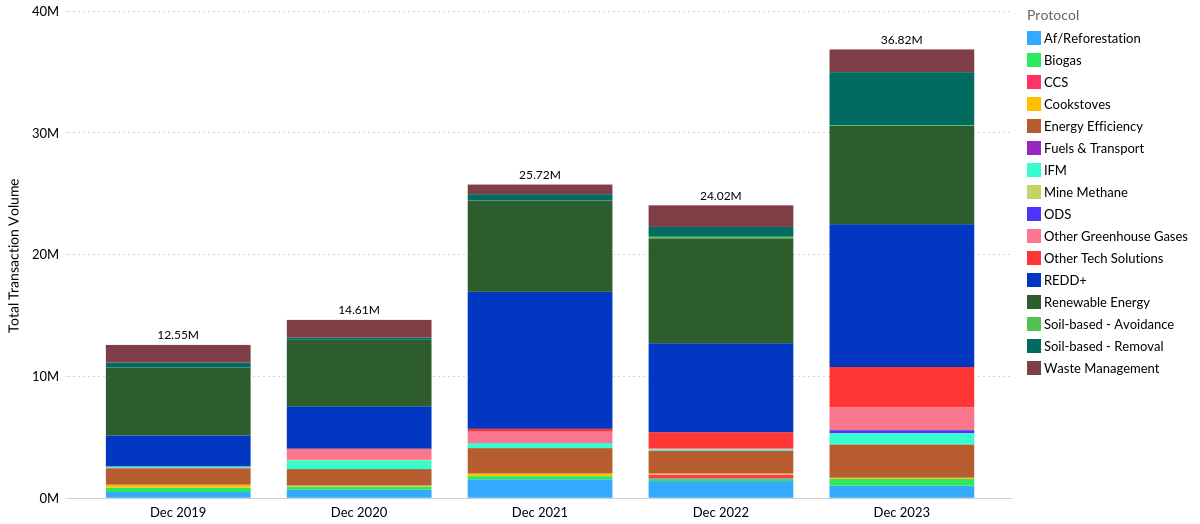

The 2023 volumes were boosted by a spike in demand in the last quarter which accounted for more than a third of all retirements that year, marking a 52% increase as compared to December 2022. End-of-year retirement spikes are normal, but last December’s retirements were unique in that they were driven more markedly than usual by a market that waited until the last minute to settle their retirement accounts in case changes came to the market before the year’s end. As long as the VCM displays its current volatility, we can expect retirement spikes in December to shape significantly the annual retirement landscapes.

Figure 2: End-of-Year Retirements 2019-2023

Retirements by Verification Standard

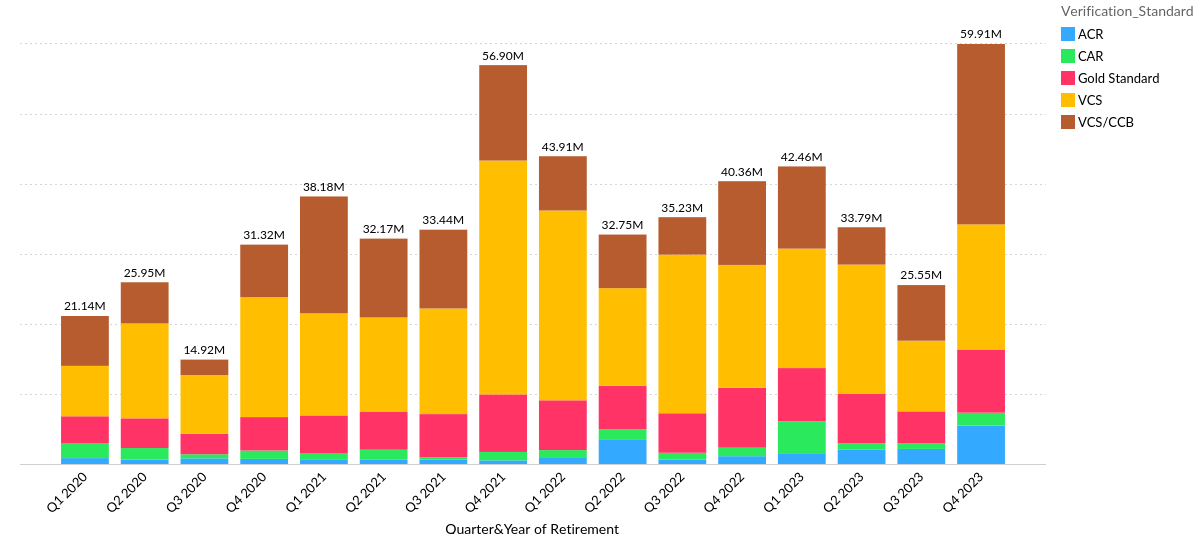

With respect to verification standards, Verra’s VCS and CCB credits continued to dominate the market with volumes over 70 per cent of total retirements in 2023. Despite their continued dominance, their share has been falling since 2021 when they accounted for over 80% of all demand. This missing Verra demand seems to be migrating predominantly to ACR and CAR, demonstrated by a slow yet systematic increase in the two registries’ retirements. Amidst the backlash faced by (REDD+) projects managed by Verra, the North American credits verified by ACR and CAR seem increasingly as safer and higher-integrity choices for corporate buyers, a hypothesis confirmed by sharply rising prices for nature-based North American projects.

Figure 3: Retirements by Verification Standard

Retirements by Avoidance/Removal

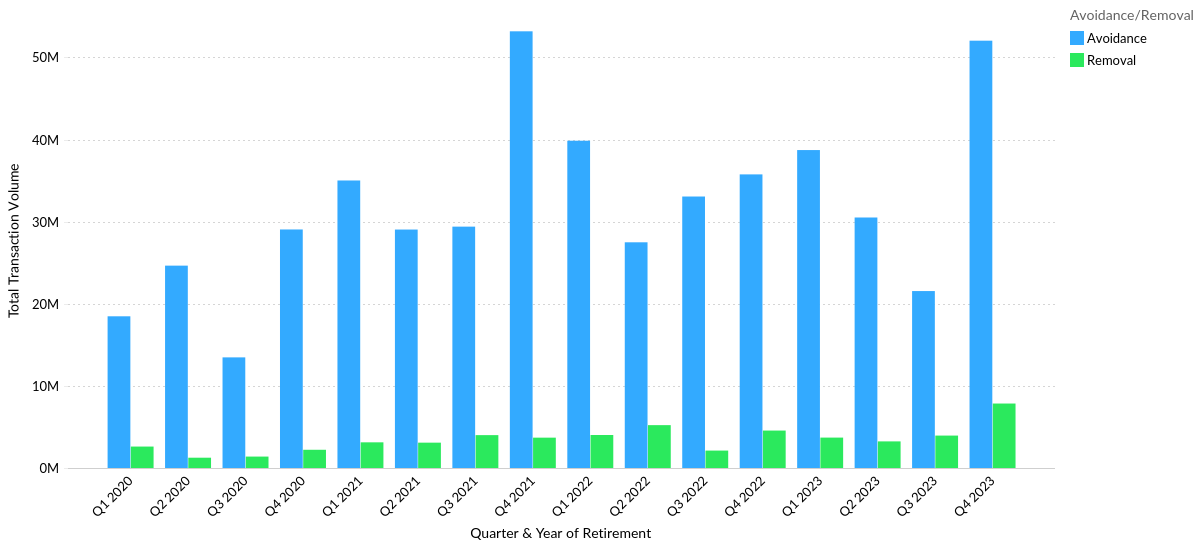

While avoidance credits have dominated both the supply and demand for offsets in the VCM, demand for removal credits continued to increase. Q4 2023 saw a jump in the retirement volumes for removal credits, higher than any previous quarter. The demand for removal credits largely comes for af/reforestation and soil-based removals but as demand continues to grow there may be greater supply and demand for such offsets from other protocols like CDR.

Figure 4: Retirements by Avoidance/Removal

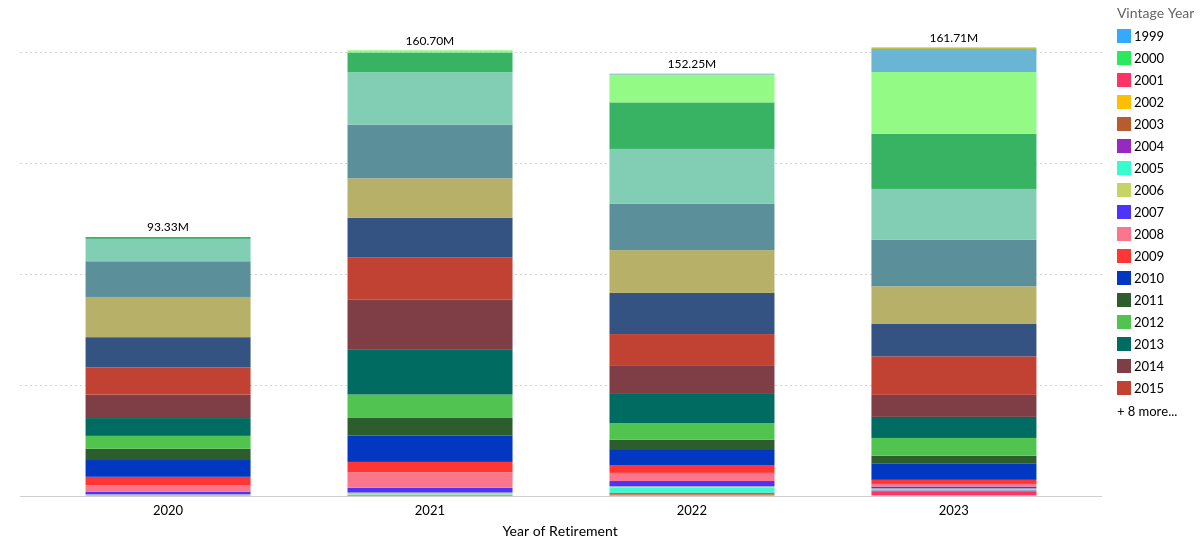

Retirements by Vintage Year

When looking at the vintage years, about half of the retirements in 2023 came from credits with the vintage not going beyond the last 6 years. While most of the demand for renewables-based credits came from newer vintages, the demand for REDD+ credits came from older vintages going back to 2009. This speaks to a growing trend where buyers go for nature-based credits of older vintages that had longer time to prove project resilience.

Figure 5: Retirements by Vintage Year

You might also likeArticles

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade