- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Articles

- Analysing the VCM Retirements boom in December 2023

Analysing the VCM Retirements boom in December 2023VCMMonday, 8th January 2024

Urvashi Thakur

Key Takeaways

- December 2023 saw record retirements, surpassing all past year retirements in December

- REDD+ offsets dominated the retirements, followed by Renewable Energy credits

- The majority of credits were retired from Verra’s CCB standard

- Oil and gas sector, led by Shell, dominated the retirements in December 2023

Retirement Volumes in December 2023

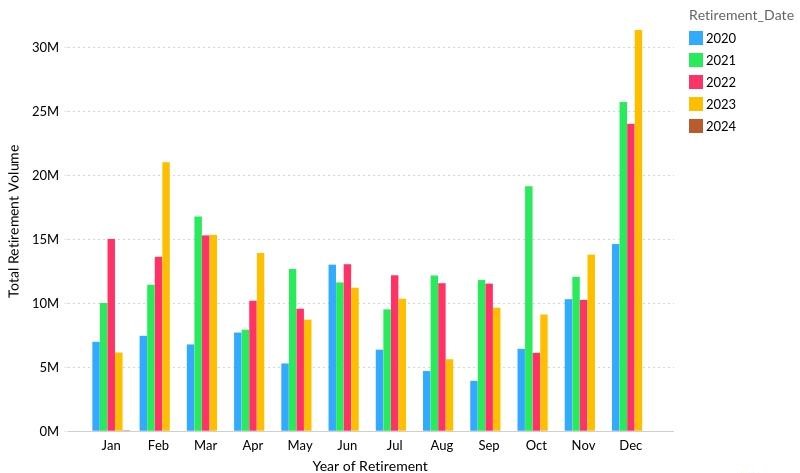

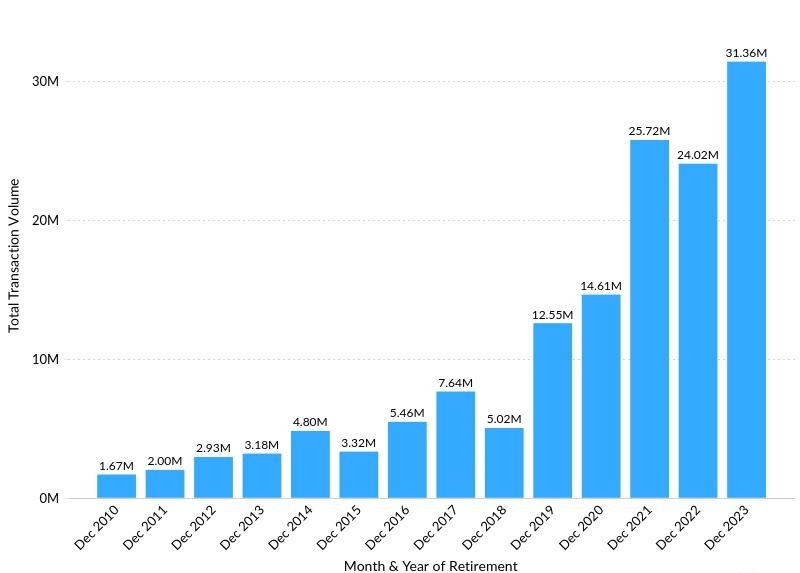

The end of 2023 saw record retirements in the VCM, with entities retiring 31.36 million offset credits in December from the four major registries, i.e., Verra, Gold Standard, American Carbon Registry (ACR), and Climate Action Reserve (CAR). The retirement volume in December was the highest in the year by a great margin. December retirements were 49% higher than February, the month with second second-highest retirements in 2023 (Figure 1). Moreover, December 2023 had the highest retirements ever on a year-on-year basis as well (Figure 2), with volumes 22% higher than December 2021, the year with second-highest end-of-year retirements. While it is expected to see high volumes of retirements in December as corporates usually retire a high number of credits to meet their annual targets, these numbers are still unprecedented. In what follows, we are diving deeper into the retirement patterns to analyse the driving force behind these high volumes.

Figure 1: VCM Monthly Retirement Patterns

Source: Verra, Gold Standard, ACR, and CAR

Figure 2: VCM Yearly Retirements in December

Source: Verra, Gold Standard, ACR, and CAR

Protocol and Registry-wise Composition of Retirements

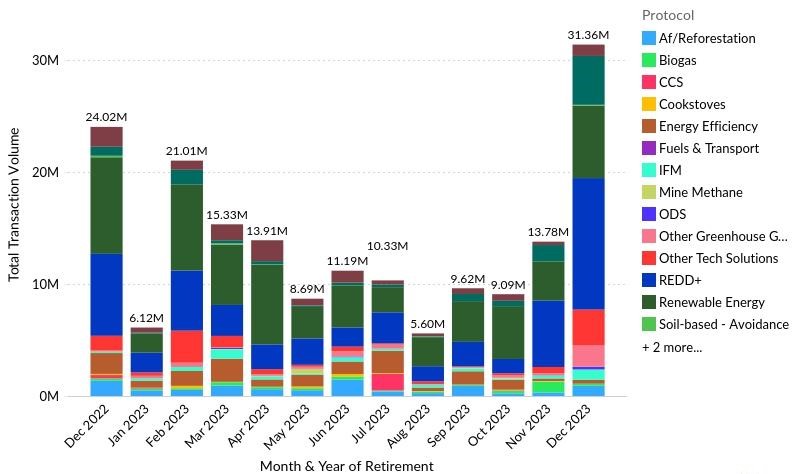

Looking at the protocol-wise break up of Retirements (Figure 3), we can see that majority of the credits retired belong to the REDD+ protocol, closely followed by Renewable Energy. REDD+ made up approximately 40% of the protocol-wise retirements in December 2023 despite the scrutiny and backlash faced by REDD+ credits throughout the year. Renewable Energy holds a share of around 20.6% of retirement volumes, followed by Soil-based removal credits with a 13.9% share.

Figure 3: Monthly Credit Retirements per Protocol

Source: Verra, Gold Standard, ACR, and CAR

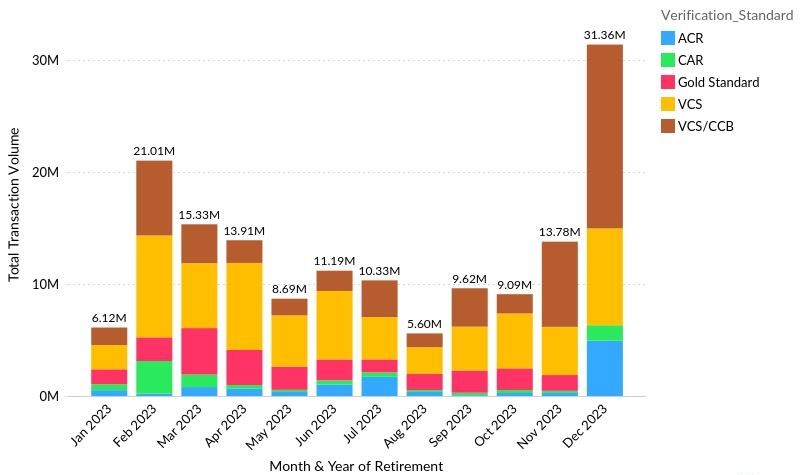

As for a registry-level break-up, Verra’s Climate, Community & Biodiversity (CCB) program credits dominating December retirements with a 52.3% share (Figure 4). Verra’s CCB Standard issues credits to those projects which not only address climate change but also provide additional benefits like supporting local communities and smallholders, and conserving biodiversity.

Figure 4: Monthly Retirements Per Registry

Source: Verra, Gold Standard, ACR, and CAR

Sectoral Retirement Trends

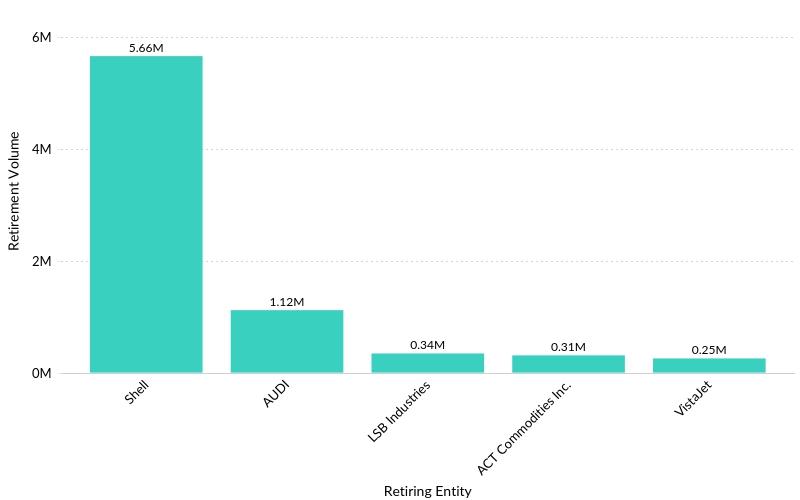

Of the 31.36 million retirements in December by the four registries, we have information about the retiring entities for 9.65 million retirees (30.8%). Of the known retirees, Shell has taken the lead in retirement volumes for the month, holding an approximate share of 58.6% of the total known retirements. AUDI has the second-highest retirement volume in December with a share of 11.6%.

Figure 5: Top Five Retiring Entities in December 2023

Source: Verra, Gold Standard, ACR, and CAR

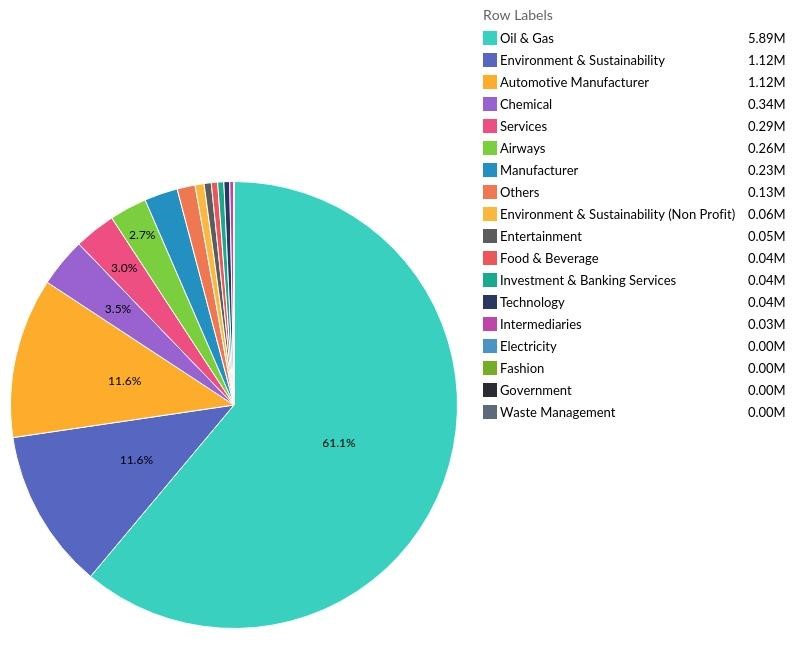

Looking at the sectoral break-up of retirements (Figure 6), we can see that Oil and Gas sector is dominating the overall retirements with an overwhelming share of 61.1%, owing to the high number of retirements from Shell. Environment and sustainability groups as well as automotive manufacturers have the second-highest share in retirements (11.6% each).

Figure 6: Sectoral Retirements in December 2023

Source: Verra, Gold Standard, ACR, and CAR

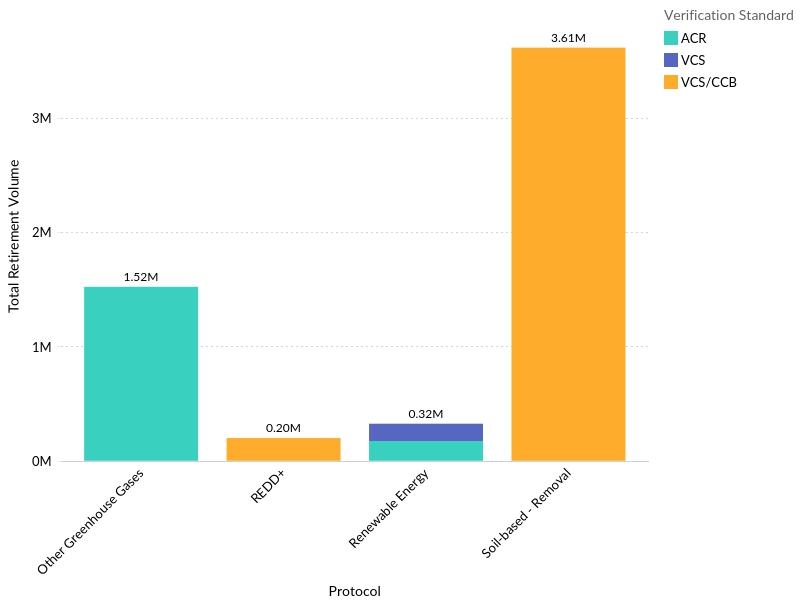

Shell had announced back in September that it would be scrapping its plan to invest $100 million per year on carbon offsetting as a part of its climate action strategy. However, this does not mean that Shell is completely forgoing offsets; rather, the company intends to be moving towards higher integrity credits. This most recent retirement will come as a relief to market players who worried about Shell’s complete pull-out. While a lot of major oil and gas companies like TotalEnergies, BP, Chevron, etc. have been relying on offsets to meet their targets, this step would likely signal a movement towards better quality offsets in the long run by all these major companies, driving away junk credits. When we look at the registry and protocol level break-up of retirements for Shell (Figure 7), we can see that the major retirements by shell are of soil-based removal credits from the Verra CCB program. While REDD+ credits have always been retired by the company, they have also been sourced from the CCB program, which provides additional benefits to the society.

Figure 7: Shell’s Retirements by Protocol and Registry

Source: Verra, Gold Standard, ACR, and CAR

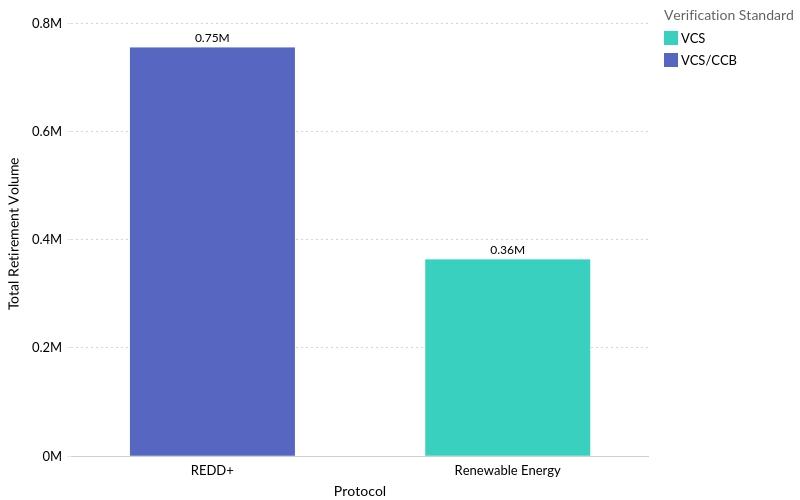

As per data available from the four major registries, AUDI has been amongst the top ten VCM retirees historically and also the second highest retiree in the automobile sector, only preceded by Volkswagen. Carbon credits have always been used by the company to compensate for their unavoidable emissions. These credits are sourced from either Verra or Gold Standard. A closer look at AUDI’s retirements in December 2023 (Figure 8) shows an inclination towards avoidance-based credits. While REDD+ credits are being used by the company, they have been certified by Verra’s CCB standard.

Figure 8: AUDI’s Retirements by Protocol and Registry

Source: Verra, Gold Standard, ACR, and CAR

cCarbon’s Analysis

Even though 2023 saw a lot of backlash in the market for credits like REDD+, this hasn’t been detrimental enough to entirely dissuade corporates from retiring avoidance credits in bulk. Although removal credits gained a lot of attention last year, both nature and technology-based avoidance credits are still dominating the market and will probably continue to do till we have an increased supply of removal credits in the market. However, the high volume of retirement of credits from Verra’s CCB program signals an increasing importance of credits which provide additional benefits and address sustainable development goals (SDGs). Oil and Gas sector and Automobile companies are dominating the sectoral retirements. Yet, Shell remains the biggest driver in terms of entity-level retirements. While the Oil and Gas sector has always been amongst the top retirees, it may be surprising to see Shell at the top of the pyramid by such a high margin despite its plans to abandon its earlier offsetting strategy. Although around 63.8% of the credits retired by the company are removals which provide additional benefits to society, it remains to be seen how much offsets would be influencing the company’s energy transition strategy in 2024.

You might also likeArticles

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade