- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Articles

- California Leads CCUS Development: Incentives and Projects Driving Progress

California Leads CCUS Development: Incentives and Projects Driving ProgressWCI CaTTuesday, 21st March 2023

Megha Jha and Craig Rocha

Key Takeaways

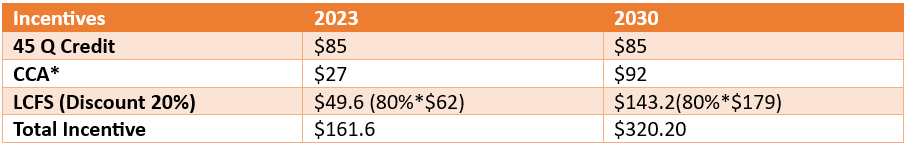

- By 2030, California is expected to see $320 in incentives stacked for CCAs, 45Q Credit, and LCFS.

- There are currently four CCUS facilities in California in operation, and several others are planned to come up in the coming years.

- California’s climate policies as well as the scoping plan integrate CCR to achieve net negative emissions and CCS as a necessary climate mitigation tool.

Global Outlook for CCUS Development

CCUS is gaining traction globally, as more countries look to reduce their carbon footprints and achieve their climate targets. According to the Global CCS Institute, there are currently 65 large-scale CCUS facilities in operation or under construction worldwide, with a total capture capacity of 126 million tonnes per annum (Mtpa) of CO2. These facilities are spread across 19 countries, with the majority located in the United States, Canada, and China. California is at the forefront of CCUS development in the United States. The state has set ambitious climate targets, including a goal to achieve carbon neutrality by 2045, and CCUS is seen as a key technology to help achieve this goal. The scoping plan highlights the necessity for carbon capture and carbon removal (CCR) to achieve net negative emissions and governments across the globe are increasingly recognizing carbon capture and sequestration (CCS) as a necessary climate mitigation tool. In order to achieve carbon removal and sequestration, the Scoping Plan concentrates on two primary methods: CCS from a specific location or point source, and CDR from the surrounding air. The plan adopts a strategic approach to include CCS in state emissions reduction tactics, concentrating on particular sectors such as electricity generation, cement production, and refineries. If CCS is not employed to diminish point source emissions, the Scoping Plan envisions using CDR technologies to directly capture CO2 from the atmosphere.Current CCUS in California

California is home to several of the most ambitious climate policies in the world, including the Global Warming Solutions Act, which aims to reduce greenhouse gas emissions to 1990 levels by 2020 and to ensure that statewide greenhouse gas emissions are reduced to at least 40% below the 1990 level by no later than December 31, 2030. There are currently four CCUS facilities in California in operation, including:- Chevron Questa Verde facility is located in Kern County, California. It captures carbon dioxide (CO2) from a natural gas processing plant and injects it into nearby oil fields for enhanced oil recovery.

- Air Products and Chemicals facility is also located in Kern County, California. It captures CO2 from an industrial gas plant and injects it into nearby oil fields for enhanced oil recovery.

- Calgren Ethanol facility is located in Pixley, California. It captures CO2 from the fermentation process in the production of ethanol and sends it to nearby oil fields for enhanced oil recovery.

- Carbon Clean Solutions facility is located in Bakersfield, California. It captures CO2 from a natural gas-fired power plant and stores it underground in a saline formation.

- Bay Area CCUS Project aims to capture carbon dioxide emissions from industrial sources in the Bay Area, such as power plants and cement plants, and then store the captured CO2 underground in geologic formations. It is expected to capture up to 4 million metric tons of CO2 per year, which would make it one of the largest CCUS projects in the world.

- SunPower Oasis Project aims to capture CO2 from a natural gas-fired power plant and use it to grow algae in large tanks.

- Northern California Energy Storage Project aims to capture CO2 from a biomass power plant and store it in an underground reservoir. The project is expected to store up to 50 million metric tons of CO2 over its lifetime, helping to reduce greenhouse gas emissions and improve air quality in the region.

- Salton Sea Geothermal Project aims to capture CO2 emissions from a geothermal power plant and store them in a geologic formation. The project could store up to 2.5 million metric tons of CO2 per year and create new job opportunities in the region.

How the Scoping Plan Covers CCUS, Safety, and Monitoring Provisions or Concerns

The California Air Resources Board’s (CARB) Scoping Plan provides a comprehensive strategy for reducing greenhouse gas emissions and achieving the state’s climate goals. The plan includes several provisions for CCUS, safety, and monitoring. For example, the plan calls for the development of a statewide geologic storage assessment to identify potential storage sites for CO2, as well as the implementation of robust monitoring and reporting requirements for CCUS projects. The plan also includes provisions for the safe and responsible management of CO2 storage sites, including regulations for well construction and testing, site closure, and financial responsibility. A Geologic Carbon Sequestration Group is yet to be established to identify and monitor hazards associated with the injection. Moreover, the US Department of Transportation’s Pipelines and Hazardous Materials Safety Administration is yet to complete its current rulemaking.The role of the 45Q Tax Credit in encouraging CCUS Technologies

The 45Q tax credit incentivizes companies to capture and store carbon dioxide (CO2) emissions rather than releasing them into the atmosphere. The funding for the 45Q tax credit comes from the federal government, and it is intended to encourage private investment in CCS and DAC technologies. It’s applicable to a wide range of carbon capture and storage (CCS) projects, including those that capture CO2 emissions from industrial processes, power plants, and direct air capture (DAC) facilities. The credit is also applicable to projects that store CO2 in geological formations, such as depleted oil and gas reservoirs or saline formations. The Inflation Reduction Act (IRA) recently passed in the US offers a large incentive for CCUS investment. Section 45Q was amended in 2022 to extend and broaden the tax credit, providing up to USD 85 per tonne of CO2 stored permanently and USD 60 per tonne of CO2 used for enhanced oil recovery or other industrial purposes, provided that emissions reductions can be shown. For DAC projects, the credit amount is considerably higher at USD 180 per tonne of CO2 stored permanently and USD 130 per tonne of used CO2.The IRA provides credits for capturing and storing CO2 in CCS projects. Prior to its introduction, the maximum credit was $50 per metric ton of CO2 for projects that capture CO2 from industrial processes, power plants, or natural gas processing. For CCUS projects capturing CO2 from other sources, CCU projects using captured CO2 to reduce greenhouse gas emissions, and DAC projects using captured CO2 to reduce greenhouse gas emissions, the credit was up to $35 per metric ton of CO2.Incentive Stacking for CCAs, 45Q Credit, and LCFS *Till the methodology is approved

California’s Direct and Indirect Support for CCUS and CCS Projects

The state extends additional indirect support through regulatory policies that encourage the deployment of CCUS and CCS technologies:- California’s Low Carbon Fuel Standard (LCFS) program provides credits to fuel producers that reduce the carbon intensity of their products, including those produced using CCUS and CCS.

- The state cap-and-trade program also allows entities to use carbon offset credits, generated through the Mine Methane Capture protocol, to comply with the state’s greenhouse gas reduction goals. It allows entities to generate offset credits by capturing and destroying methane emissions from active and abandoned coal mines.

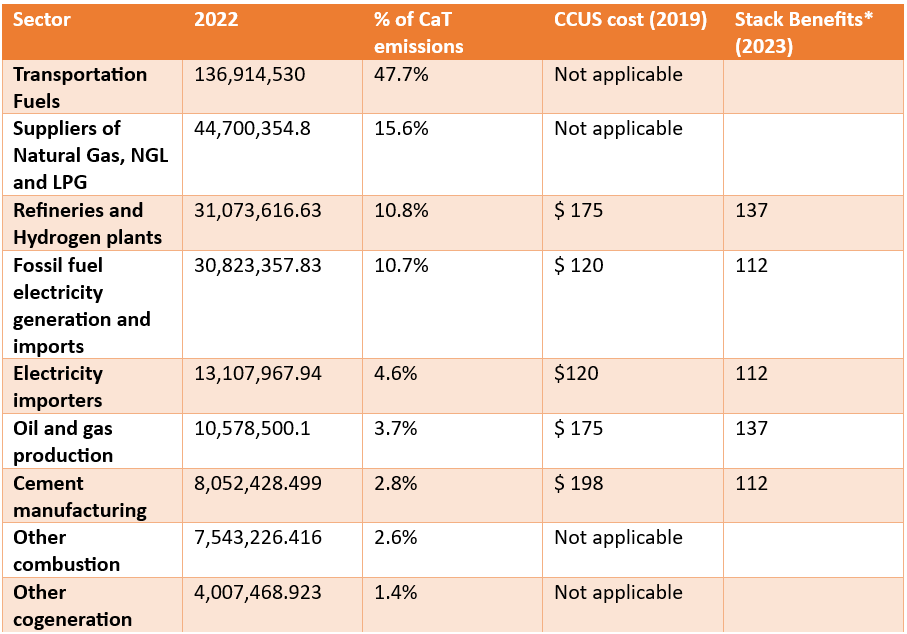

Analyst Contact:Sector-wise breakdown of the share of emission, the average CCUS cost, and the stacking benefit for CCUS projects. * Stack benefits assume that CCA benefits can be added

- Craig Rocha (cmrocha@ckinetics.com)

- Megha Jha (mjha@ckinetics.com)

Table of Content

You might also likeArticles

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade