- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Articles

- NYCI Set to Launch in 2025 as US’s Second-Largest Cap-and-Invest Initiative: A Conservative, Pragmatic Approach to Carbon Markets

NYCI Set to Launch in 2025 as US’s Second-Largest Cap-and-Invest Initiative: A Conservative, Pragmatic Approach to Carbon MarketsRGGIOther CaT NewsThursday, 21st December 2023

Craig Rocha

Key Takeaways

- The two-year initial period in 2025 and 2026 – Banking of allowances from the first compliance period will not be permitted in 2025 and 2026.

- Market caps are expected to be non-linear, start lenient, and then stringent as the 2030 and 2045 target nears.

- Lessons adopted from the EU-ETS, Washington, California, and RGGI suggest a shift towards optimizing the program to meet targets, rather than setting trends.

- Offsets will not be allowed in the New York Cap-and-Invest program (NYCI).

- The method of inclusion of electricity emissions is still under discussion – adjustments related to RGGI remain a topic of debate.

New York released the pre-proposal Outline for the state’s Cap-and-Invest program. The release was one that the carbon markets and the carbon investors were looking forward to in 2023. For carbon markets, 2023 has been pivotal across Washington, California, and RGGI. The state of New York’s cap-and-invest program takes a more pragmatic and conservative approach than the more progressive and ambitious programs on the West Coast. Nevertheless, the program remains similar to those of California and Washington in most aspects.

The pre-proposal contains details regarding anticipated program design, such as the types of greenhouse gas emission sources subject to reporting or allowance requirements, the process for demonstrating compliance, the emission cap and allowance budget trajectories, provisions for emissions-intensive and trade-exposed industries, program stability measures and cost containment, and rules for auction and allowance market participation.

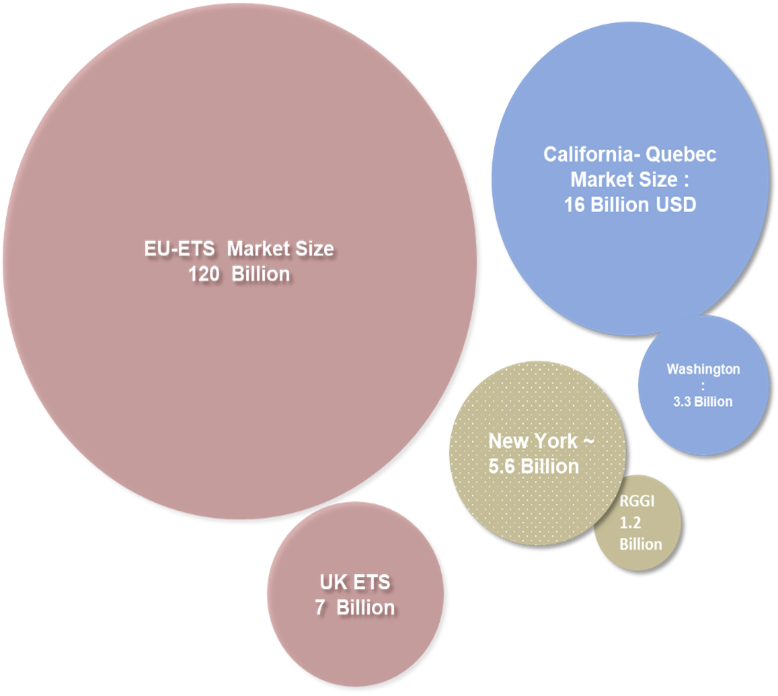

Setting the stage for the US’s third biggest cap-and-invest market – Possibly with a market size of $5.6 Billion

NYCI will set up the second biggest carbon market in North America – second only to the California cap-and-trade. At an average price of $40/ton – the NYCI is expected to create a market size of $5.6 Billion in annual issuances.

Early years (2025 & 2026) – likely to see low prices compared to the West Coast

In stark contrast to Washington’s Cap-and-Invest program, which started with a high degree of stringency, high prices, and volatility, New York’s approach begins with a two-year trial period. Two key points will significantly influence the market during the initial two years of operation:

- Non-Bankable Allowances in the First Compliance Period (2025-2026): During this period, allowances will not be bankable for future use. The absence of banking means there is no benefit in purchasing allowances for any purpose other than compliance with emissions regulations in 2025-2026. After 2026, the value of these allowances drops to zero. This approach is similar to the EU-ETS’s initial phase, which consequently saw the price of allowances plummet to the floor price.

- Non-Linear Cap: The cap will be non-linear, pushing most of the emissions reductions to years closer to the 2030 and 2050 targets. The years 2025, 2026, and 2027 will have higher caps as these represent periods of slower reduction.

The combined effect of a higher supply and the absence of banking in the first compliance period is expected to keep the price of allowances relatively low, especially when compared to their Western counterparts, which have adopted more stringent measures.

The Market pulls most of its framework from the West Coast

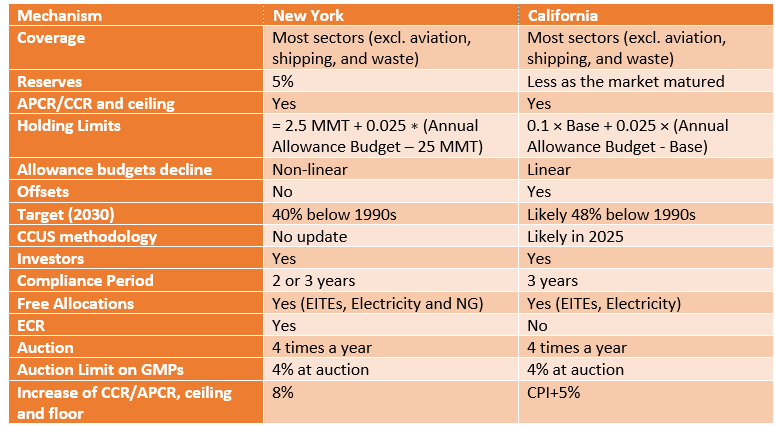

The fundamentals including the reserves, holding limits and auction timing remain like the California and Washington Market. The inclusion of offsets, Allowance budget declines and ECR – remain slightly different.

No inclusion of Offsets

All three US states with the variants of a Cap-and-trade program now have different strategies with offsets. California provides the functionality of offsets over the state’s Cap on emissions, Washington provides for offsets under the CAP and New York goes with no offsets. New York since the start of the consideration of the Cap-and-invest rulemaking had been averse to Offsets, and the proposal states that offsets would enable increased direct emissions that could negatively impact Disadvantaged Communities.

The New York Cap-and-Invest program has learnt from the experiences of Washington, California, and other states. The initial high prices in the Washington program were caused by entities accumulating a bank of allowances and increased investor speculation during the early years. New York’s program aims to incorporate all these learnings to create a Cap-and-Invest strategy that is both smooth and easy to implement. This approach is intended to achieve the state’s environmental targets while decreasing uncertainty for participants. In a manner typical of New York, the program doesn’t try to reinvent the wheel or aim to be the most ambitious in terms of climate policy. Instead, it focuses on effectiveness and feasibility.

Analyst Contact

Craig Rocha (cmrocha@ckinetics.com)

Table of Content

You might also likeArticles

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade