- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Articles

- Oregon’s biogas potential remains under-utilized

Oregon’s biogas potential remains under-utilizedOR CFPTuesday, 25th April 2023

Bikash C Maharaj

Key Takeaways

- 111 DGE of biogas potential remains unused.

- 67 more biogas plants are coming up (2021) in Oregon with a total potential of 113 new systems.

- At 957,071 DGE, biogas constitutes 95% of the RNG mix in Oregon CFP.

Oregon has a potential of 111 DGE of biogas

Senate Bill 263 has updated the statewide goals for the recovery of material from the general solid waste stream from 2020 to 2025 and further. This has been taken up positively by the waste-to-energy operators in Oregon, particularly in the biogas sector. Back in 2015 around 99% of RNG in Oregon was being imported. In 2023 most of the RNG is home produced from biogas facilities. This uptake of biogas is a result of the national trend of converting biogas-producing plants into renewable fuel production facilities which can earn credits through various federal (Renewable Identification Numbers, RINs), and state-level (Oregon CFP and California LCFS) incentives, after injecting the biogas into the natural gas pipeline. The main driver of this change is the incentives gained from the environmental attributes in addition to the commodity value of these fuels, which give a decent payback period which is less than 3 years. Moreover, pipeline injection of RNG project makes the RNG molecule fungible with fossil natural gas fuel in the pipeline and thus the environmental attribute associated with RNG can displace an equal volume of non-renewable attributes of fossil fuels. With ample biomass resources for biogas production available in Oregon (Table 1), project developers have taken up this opportunity. Currently, Oregon has around 55 operational biogas plants. As of 2021, 67 more are underway. This would generate around $ 201 million in capital investment and create 1,675 short-term jobs. If the biogas potential is fully realized, around 111 DGE (15.99 billion cubic feet) of biogas can be generated. Moreover, around 113 biogas systems (Figure 1) could be developed from the potential biogas.

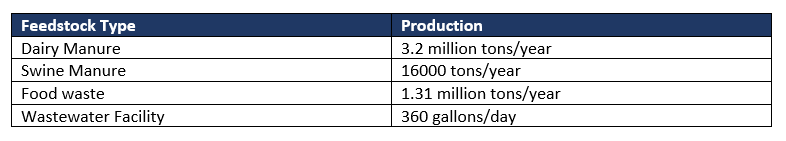

Table 1. Availability of biomass resources suitable for biogas production in Oregon

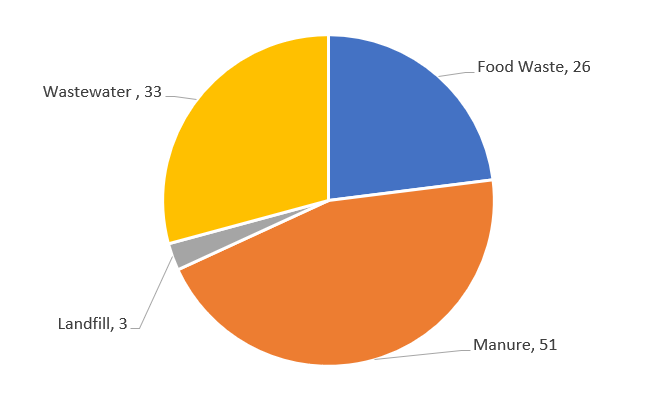

Figure 1: Number of potential biogas systems which could be developed from the potential biogas.

Majority of these potential systems would be wastewater and agricultural. Currently, the majority of biogas systems in Oregon are on wastewater (34 nos.), followed by landfill (6 nos.), manure (6 nos.) and food waste (4 nos.). In terms of feedstock, manure (8 million gallons per day), food waste (448,200 tons/yr), and wastewater (8.8 million gallons per day) leads. Campus Biogas Energy, LLC, Clean Methane Systems LLC, Energy Trust of Oregon, Essential Consulting Oregon, LLC, and Wastewater Capital Management, LLC are the major biogas companies located in Oregon.

At 957,071 DGE biogas constitutes 95% of the RNG mix in Oregon CFP

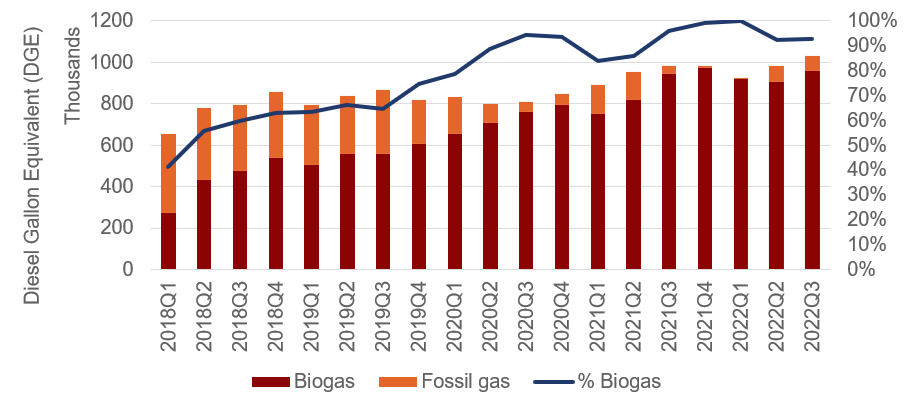

The uptake of biogas in Oregon has been increasing in recent years. The share of biogas in the NG mix for the transport sector has increased from 271,827 DGE (41%) in 2018 Q1 to 957,071 DGE (95%) in 2022 Q3 (Figure 2). Oregon currently has 55 biogas plants converting waste to energy out of which the majority are operating on dairy and food waste. In 2022 Q3 biogas has generated around 4093 credits through the Oregon CFP program. In Q1 and Q2 of 2022 there was a significant rise in credits from biogas with around 11000 credits and 8000 credits respectively. The major feedstocks for biogas in Oregon are from Livestock waste, Crop residues, Wastewater, and food waste. Biogas produced from these sources goes through conditioning and upgrading to form RNG. Typically, RNG has higher methane content as compared to raw biogas. RNG can be used for fleets operating in the waste management (garbage trucks). Oregon’s gas utilities find biogas energy as a primary route to reduce GHG emissions and are investing to meet the target set by the Oregon Department of Environmental Quality’s Climate Protection Program.

Figure 2: Percentage of biogas in the RNG mix of Oregon CFP (Quarterly Data Summary)

Although developing biogas projects and integrating them to RNG grids is feasible, however, there are some underlying challenges pertaining to project execution:

- The feasibility studies of the projects need to be in accordance with the changes in credit prices in the clean fuel markets.

- Feedstock procurement through long-term agreements is a challenge.

- Making assumptions that USEPA will approve the designed interconnection setup sometimes is not realistic. Early planning is necessary here.

- Identifying buyers of digestate from the beginning of the project is crucial for the economic viability of the plant.

- Once a project is developed, it needs to continuously send pipeline injection volumes to Oregon CFP for credit auditing and validation.

Conclusion

The surplus potential of biogas available in Oregon is around 111 DGE per year. Dairy manure, swine manure, food waste and wastewater sludge are the major sources of feedstock for biogas in Oregon. The uptake of biogas in Oregon CFP has increased in recent years and currently (2022 Q3) is at 95% of the RNG mix. Finally, it is important to note that the increase in biogas in the RNG mix has not resulted in the rapid uptake of RNG in the transportation sector. With a surplus potential of biogas in Oregon, the bottlenecks in dissemination of biogas projects in Oregon are interesting to examine in detail.

You might also likeArticles

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade