- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Articles

- RIN Price: Can it be forecasted with BOHO spread?

RIN Price: Can it be forecasted with BOHO spread?RFSTuesday, 31st May 2022

Rohit Sai Janga

Key Takeaways

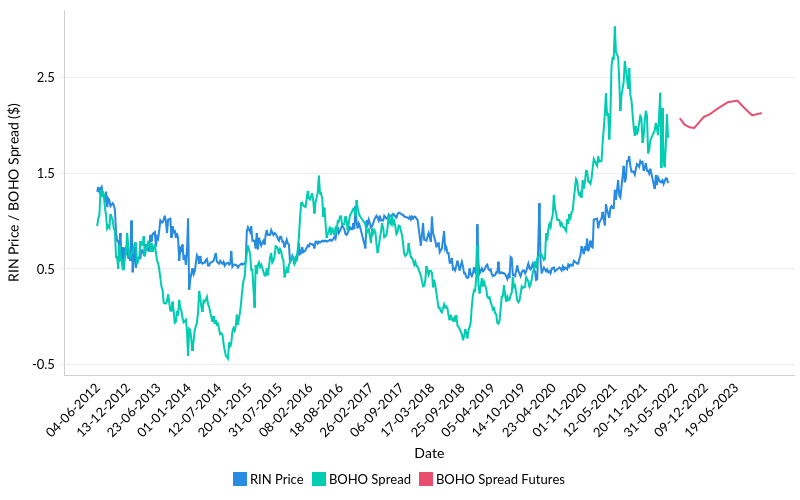

- BOHO spread is 72% positively correlated with D4 RIN price.

- A reduction in biodiesel production margin results in a higher RIN price.

- RIN price is expected to fall about 6.6% by October 2022.

Introduction

The Bean Oil Heating Oil (BO-HO) spread is an indicator describing the relationship between feedstock soybean oil and blendstock heating oil pricing used by the biodiesel industry to gauge costs and margins. This is used to gauge the feasibility of blending renewable or alternative fuels with petroleum fuels. A higher BOHO spread could be caused by a higher Soybean Oil price or a Lower Heating Oil Price. In the former, the higher Soybean Oil prices would mean higher production costs for Biodiesel producers reducing margins, and in the latter case, the Biodiesel would have to be sold in the market at a price comparative to Heating Oil, which would again result in a reduced margin. So, a higher BO-HO spread signals higher biodiesel production costs and reduced margins for producers.

The higher the spread climbs, the more expensive it becomes to produce biodiesel. So, Biodiesel sellers tend to raise the selling price to recoup the losses from poor margins.

Hence, higher BO-HO spread discourages discretionary blending or additional blending of biodiesel above what is required by federal biofuels mandates.Federal Renewable Fuel Standard

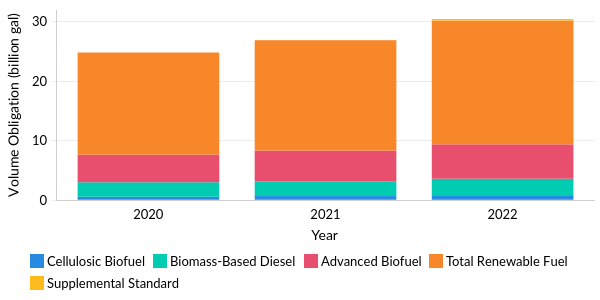

The RFS program is a national policy that requires a certain volume of renewable fuel to replace or reduce the quantity of petroleum-based transportation fuel, heating oil, or jet fuel.

US Environment Protection Agency (EPA) sets annual standards for Obligated parties. Obligated parties under the RFS program are refiners or importers of gasoline or diesel fuel. Compliance is achieved by blending renewable fuels into transportation fuel, or by obtaining credits (called “Renewable Identification Numbers”, or RINs) to meet an EPA-specified Renewable Volume Obligation (RVO). RINs are tradable credits that represent renewable fuels blended with conventional ones and are used to prove compliance with the RFS.

Figure 1: Proposed Renewable Volume Obligation

Methodology

The BO-HO factor is calculated by multiplying the cost of a pound of soybean oil by 7.37 minus the cost of a gallon of blendstock heating oil. 7.37 is the industry standard for the yield for soy methyl ester biodiesel. A comparison of the spread and D4 RIN price revealed a 72% positive correlation.

Figure 2: BOHO Spread Vs D4 RIN Price

Conclusion

Demand for soybean oil has been rising after the US EPA announced its proposed blending mandate for biodiesel would require 2.76 billion gallons of renewable fuel in 2022. This resulted in higher soybean oil prices, but the current rally in fuel prices caused by the Russia-Ukraine war decreased the BOHO spread and hence we can expect to see a slight fall in D4 RIN price.

Future contracts are traded for Soybean Oil and Heating Oil. Using the observed correlation and the available futures contracts settlement price we can arrive at an expected price signal for the RIN price. With settlement prices as of today, the BOHO spread is expected to fall about 6.6% in October 2022 and rise back up 6.63% by July 2023. It can be inferred that we could see a similar movement in the RIN trade price.

For more such insights please refer to our annual insight report

Table of Content

You might also likeArticles

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade