- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Articles

- VCM Projects Under Scrutiny

VCM Projects Under ScrutinyVCMWednesday, 22nd November 2023

Urvashi Thakur, Eszter Bencsik

Key Takeaways:

- Over the past months, no fewer than four big VCM projects were placed under investigation; issuances coming from these projects were halted

- The issues pertaining to them are indicative of systematic market failures that may be difficult to resolve on a case-by-case basis

- More immediate issues of compensatory measures might put an unsustainably large strain on the projects’ verification standards

The media scrutiny of the VCM is evolving rapidly; while the year started with more general criticism of the operations of the market and carbon accounting, this has evolved into routine investigations of some of the biggest projects on the market – although, perhaps surprisingly, this does not apply to renewable energy projects, which, after a rather bad run in 2021 seem currently to be passing under the radar.

However, nature-based projects are certainly not in such a comfortable position: over the past few months serious allegations affected four massive avoidance projects, leading to investigations by verification standards, halting of issuances and delisting of the credits by major exchanges.

The timeline of the investigation into Kariba, a Zimbabwean REDD+ project is perhaps the most infamous. After allegations by Follow the Money already in January of the project’s over-crediting of offsets, the New Yorker published another, perhaps even more damaging article on the same project in October 2023, accusing South Pole not only of false carbon accounting but also of gross financial misconduct and mistreatment of local project participants. In response, Verra launched an investigation into the project and halted credit issuances (a standard practice when an internal investigation is initiated). Carbon offset-trading exchanges, CBL and CIX removed credits from the project from their standardised nature-based spot contracts. After placing the project on a “watchlist” in March, British carbon rating agency, BeZero also now delisted the project from its project rating database. Finally, to top it all, South Pole itself cut ties with its former flagship project, claiming that the project failures were due to its project-developing partner and project owner, Carbon Green Investments, a move that has been described as “extremely rare”.

While the scandal around Kariba is certainly unique in its magnitude in the VCM, it is far from being the only one. Alongside the halt to credit issuances from Kariba, Verra also placed another project under investigation (and suspended issuances thereof); namely, the Kasigau Corridor REDD+ (Phase 1 and Phase 2) project based in Kenya, after the Kenyan Human Rights Commission alleging multiple instances sexual and physical assault taking place at the project by members of staff. The credits from these projects were likewise delisted from all major exchanges.

This is not the first allegation of human rights abuses that Verra is facing this year. Earlier in the summer, Verra launched an investigation into, and suspended credit issuances from, the Southern Cardamom REDD+ project run by the NGO Wildlife Alliance and the Environment Ministry after it received evidence from the NGO Human Rights Watch that the project led to restricted access to means of sustenance for over 4,000 local villagers.

But Verra is not the only major registry facing similar allegations on its projects. Gold Standard announced earlier this month that it would be launching an investigation into its Bachu biomass power generation project after the Guardian claimed in an article that the project was relying on the coerced labour of hundreds of Uyghur workers.

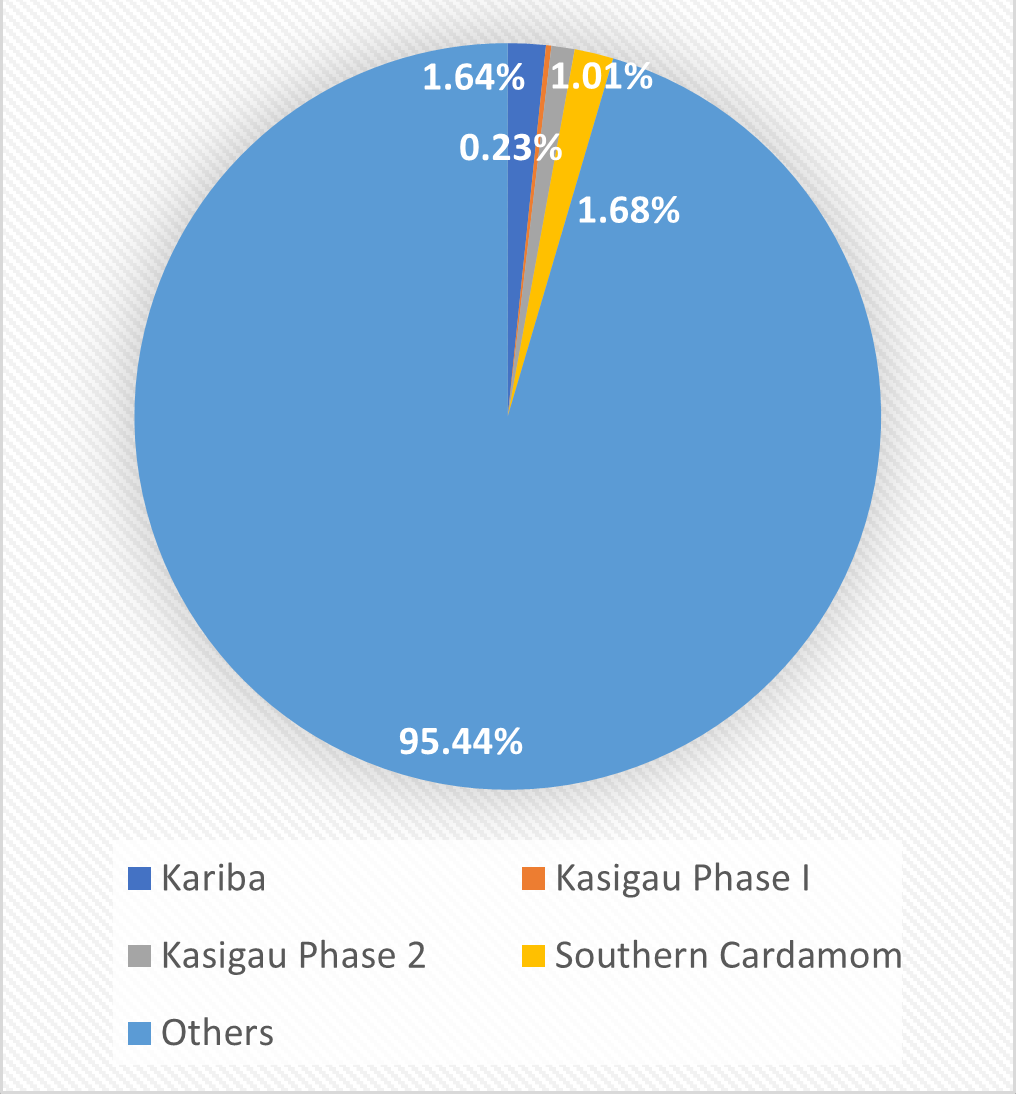

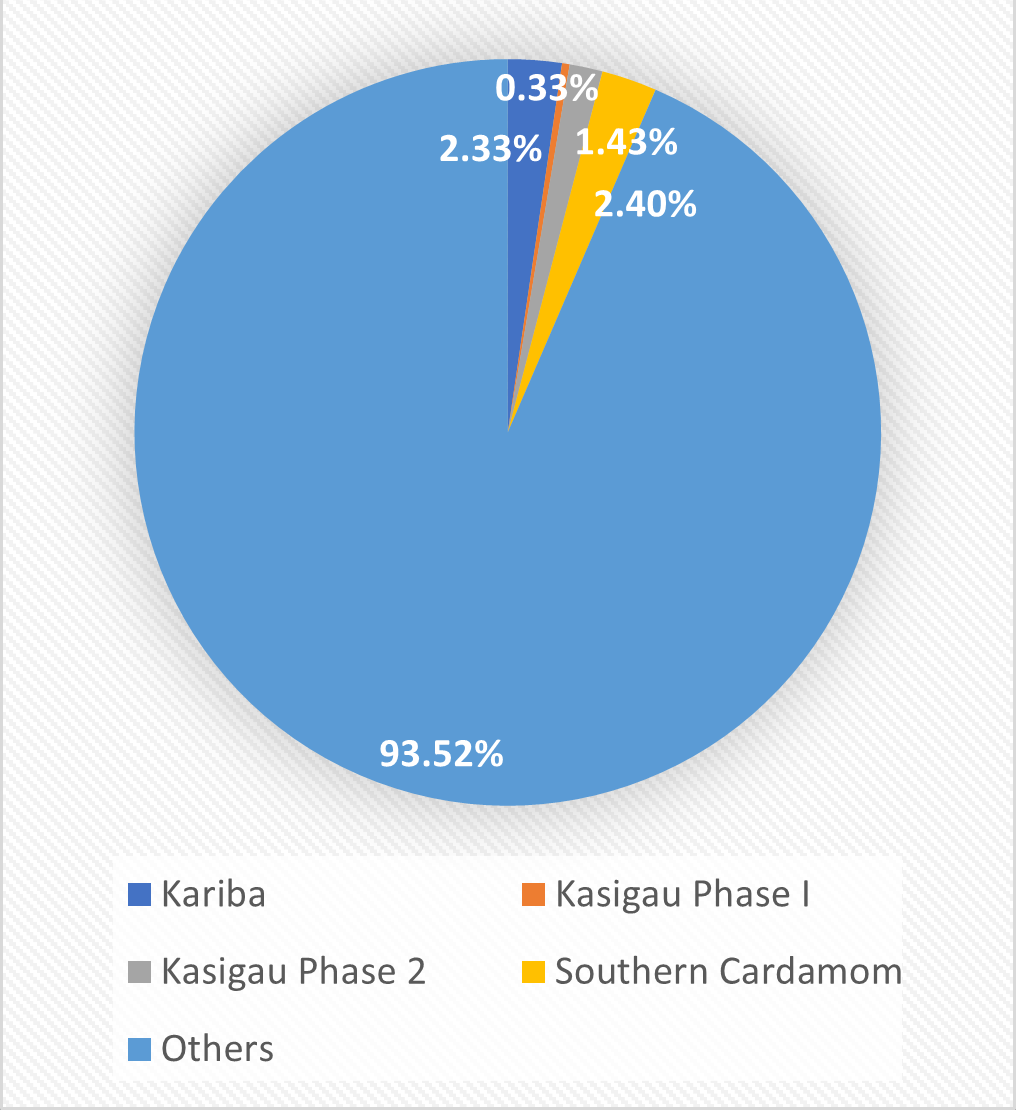

With the exception of the Bachu project which likely drew attention due to its conspicuous geography, these are massive projects with high volumes of claimed emission reduction – which is obviously partly why they have been investigated by independent researchers with such vigour. While across all registries, these projects account for about 4% of all issuances, their examples matter because they are what used to be regarded as flagship projects of both their developers and the registries. Verra and Gold `Standard are still widely regarded as some of the most reputable verification standards. In this context the fact that the four REDD+ projects make up over 18% of all Verra REDD+ issuances and over 6% of overall Verra issuances with Kariba being the second REDD+ project worldwide, is staggering.

All Registry Issuances

Source: Verra, Gold Standard, American Carbon Registry and Climate Action Reserve

Verra Issuances

Source: Verra

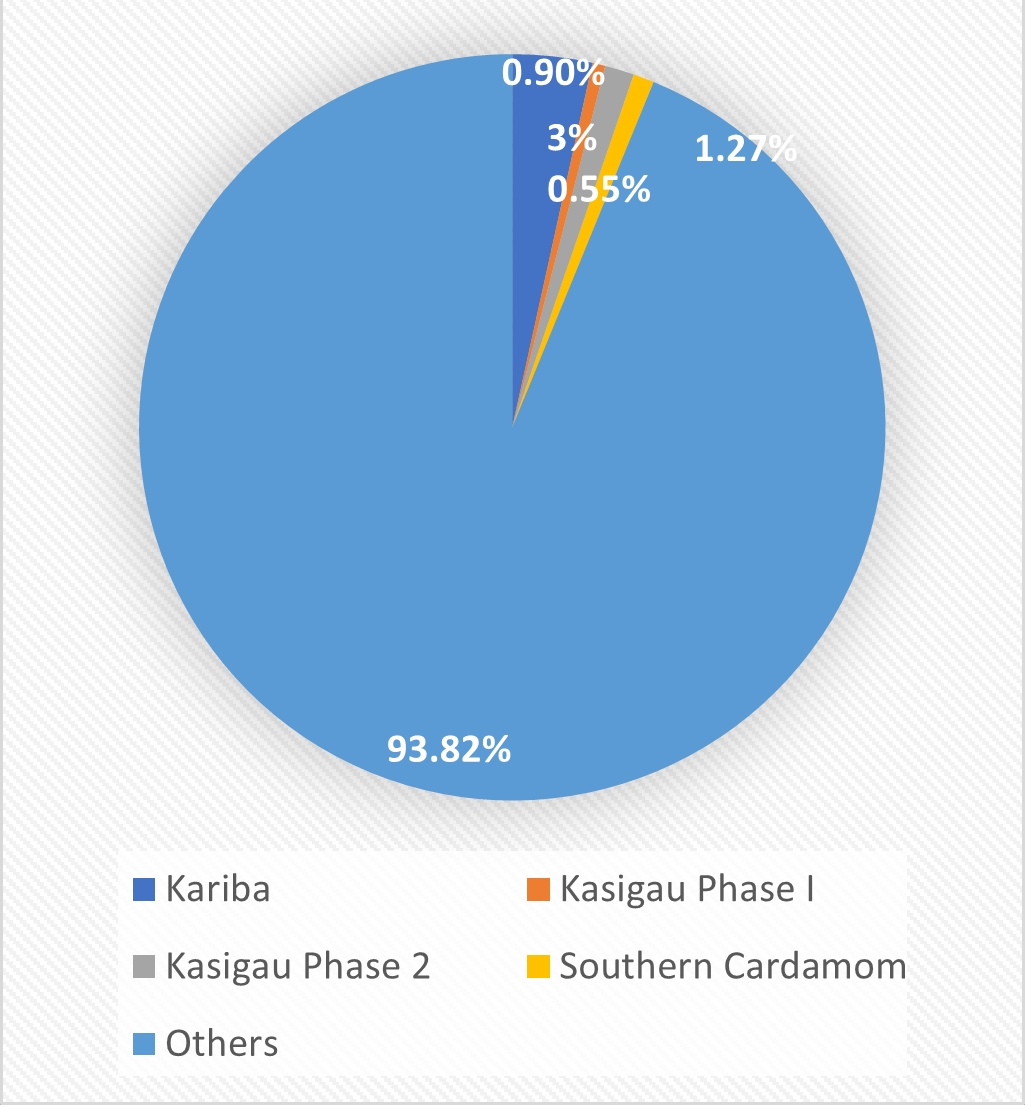

Furthermore, their exposure has discouraged dozens of corporate buyers from investing in carbon offsets. Notably, some of the biggest buyers of Kariba credits, including Gucci, Nestle and Delta Air Lines have all announced this year that they are withdrawing from offset retirements. While the scandal around Kariba is just one of many reasons for them doing so, it might well act to discourage further (potential) buyers.

Verra Retirements

Source: Verra

A more immediate problem is posed by another buyer, Dutch energy company Greenchoice’s emphasis that it was counting on Verra’s safety mechanism to compensate for the fictious credits they paid for. However, it is not at all evident that Verra does have such a mechanism in place. Certainly, the registry has a buffer pool for unintentional reversal; namely, a collection of unretired credits that they may use in case of project failures such as natural disasters, unforeseen leakage, etc. But the rules do not state explicitly that the project failures associated with the above projects qualify as triggering the buffer pool mechanism. In any case, even if – and this is a big if, since Verra’s internal investigation is very much ongoing – the verification standard decides to try and compensate buyers for credits that do not represent genuine emission reductions, it is difficult to speculate how exactly this would happen. Would it compensate all buyers, even though not all credits were fictious? If they did decide to do so – which is probably unlikely – they would probably do it through a mechanism (such as litigation) other than the buffer pool, since even compensating only for Kariba woulddeplete Verra’s entire forest pool account by over 61%. While the verification standard claims it is a sign of the buffer pool’s functionality that it can compensate for the whole project if it so chooses, that course of action would evidently be critically unsustainable.

Furthermore, it is even less clear that compensation would be the appropriate response to the exposed failure of the other projects given that in those cases the legitimacy of the emission reduction, as such, is not called into question. In short, Verra (and South Pole) is facing an extremely difficult situation, and no potential solution seems acceptable.

The fact that such gross violations of human rights and proper financial conduct can occur at all even in projects which have been approved by some of the most reputable standards suggest that the issue at hand is less of a series of one-off problems and much more indicative of systemic market failure to do with the core infrastructure of the market, such as the operation of validation and verification bodies and their dynamics with project developers as well as verification standards. Because of this, it does certainly feel like the market is running out of band-aids to treat the injuries and the only solution left is a complete uprooting of the VCM. It is highly dubious, however, that there is enough momentum left in the market to carry out that task.

Table of Content

You might also likeArticles

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade