- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Price Commentary

- CCA Weekly Commentary: CCA future’s prices decline as JA33 auctions settles lower at $26.8

CCA Weekly Commentary: CCA future’s prices decline as JA33 auctions settles lower at $26.8WCI CaTMonday, 28th November 2022

Megha Jha

Summary:

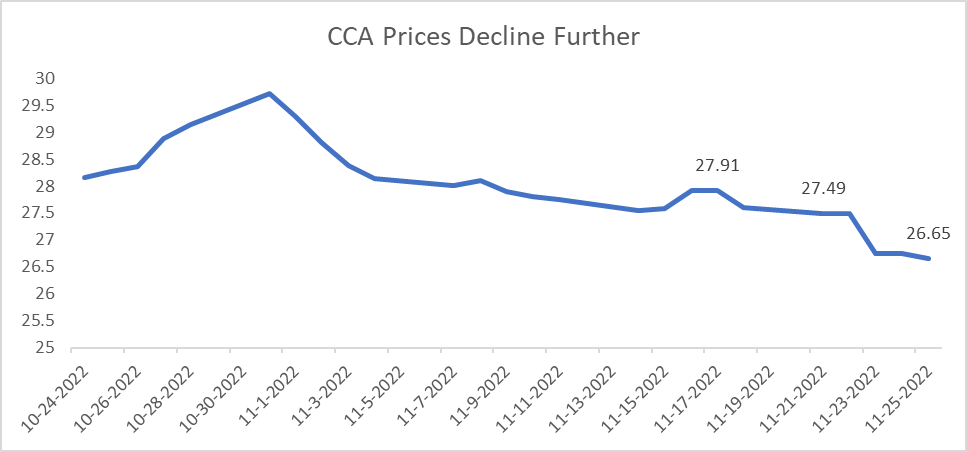

- CCA front on Friday closed at 26.65, losing $0.84 over the week.

- ICE weekly volume was reported as 38.2 M tons (+11.34% WoW), 4-week moving avg. 37.42 M tons.

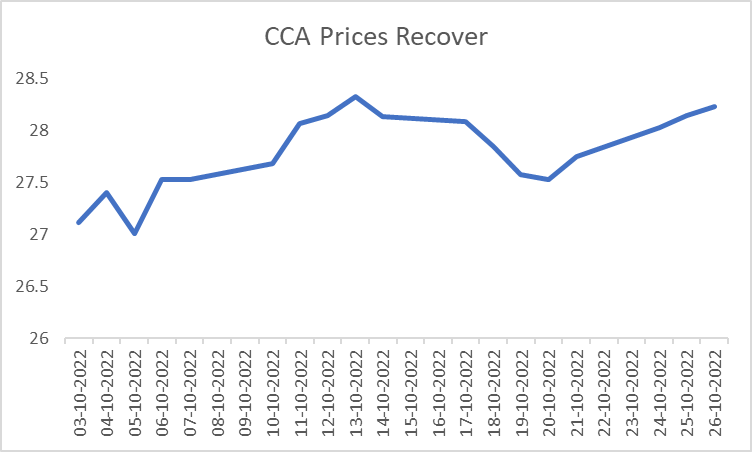

The CCA market further declined after the week JA33 auction. On Friday, allowances traded at $26.65, declining by 3.05%, over the week.

CCA Joint Auction Results #33 Released

The WCI JA33 auction settled on the lower side of cCarbon expectations. As per our assessment, the fundamentals did not call for a low closing price. The auction had a good bid ratio and good investor participation. The market fundamentals at present also indicate higher WCI emissions than expected (as compared to where we should have been in 2022) and there is the possibility of the cap declining in California after the scoping plan gets adopted.

The justification for the low closing price in the auctions can be:

- Investors seeking a higher risk-adjusted return, causing them to bid lower

- Covered entities tightening budgets and unwilling to spend more on allowances due to macroeconomic conditions

- Uncertainty on the WCI extension beyond 2030 beginning to weigh on the market as that makes the existing bank far more important in their calculation

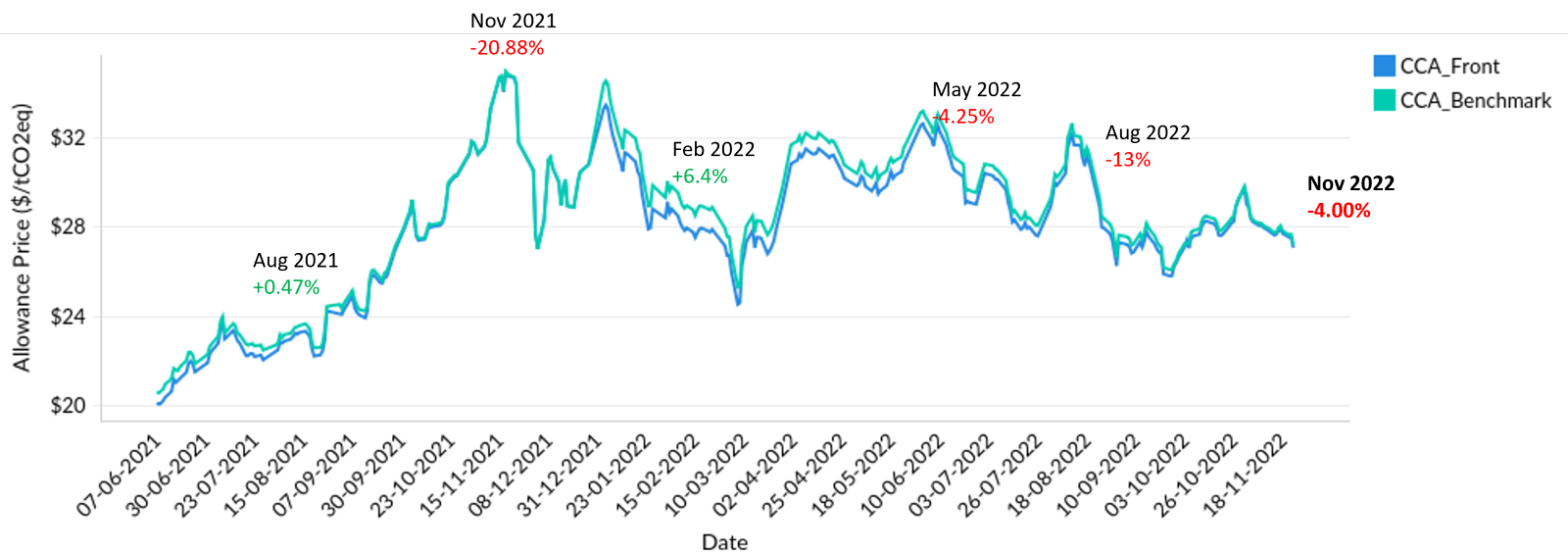

The auction settled 4% below the front on the day of the auction. After the auction, the front closed at $27. Although, the auction settled on the lower side of expectations, it was not a major surprise like the last auction, where the auction settled 13% below the secondary market.

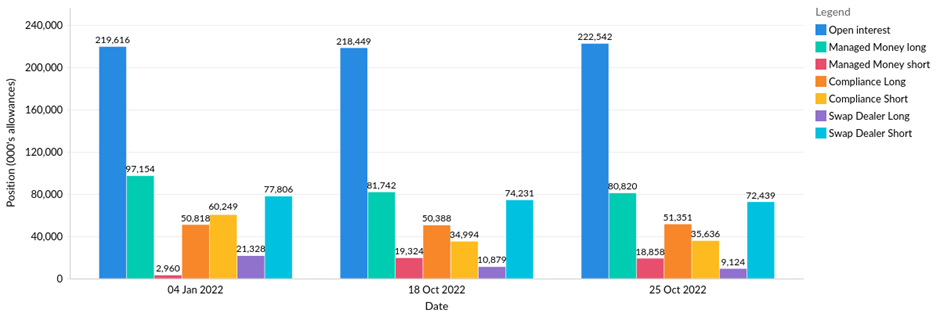

The settlement price for the current auction was $ 26.80 MtCO2 with a bid-to-cover ratio of 1.8. The advance auction settled at a price of $26.00 with a bid-to-cover ratio of 2.35. This auction recorded 113 qualified bidders with 83 from California and 30 from Quebec. Financial participation rose in the current auction from 12.80% to 20% — a strong expression of interest from investors. The market engagement was high: the current auction bid ratio too rose to 1.8 from 1.29, in the last auction. The Advance Auction bid ratio stayed high at 2.35. Read our initial analysis here.

US Inflation: Indicating a change of scenery?

The US FED’s Chair Jerome Powell is expected to deliver a speech indicating the slowdown of FED’s pace of interest-rate increases next month. Powell is also set to remind Americans that FED’s fight against inflation will continue in 2023. While the speech will be nominally focussed on the labor market, it is expected that Powell may use this stage to join his fellow FED officials in signaling a rise in the benchmark rate by 50 basis points at their final meeting this year.

This comes despite two weeks of improvement in key market indicators, suggesting that this year’s incessantly increasing inflation has peaked and relief can be anticipated in the coming months as the pace of headline price growth is set to slow down. Over the course of last month, the Dow Jones Industrial Average has witnessed an increase of 5.23% to 34,347 and the S&P 500 has observed an increase of 4.35% to 4,026.

(Source: Yahoo Finance) On the other hand, the KCCA ETF, a California Allowances ETF by Kraneshares, declined by 10.3% to 22.20 over the month.

(Source: Yahoo Finance) Ahead of this week, the United States’ economic position will be impacted by the US government’s monthly employment report, data on the housing market, a second look at GDP growth, and PCE inflation. The Labor Department’s latest employment report, set for release at 8:30 a.m. ET Friday morning.

*Note: Due to the Thanksgiving holiday, CFTC data has not been released for the previous week.

Market Fundamentals:

- Read our latest Analyst Note and forecast on Emissions, Supply, Demand, and Price.

- Over the last week, key financial indicators like shipping rates, commodity prices, and inflation expectations have started to slow down from their record-high levels since the summer of 2022, indicating that global inflation has peaked, and it can be anticipated that it will slow down in the coming months.

- The US Natural gas futures fell by 4% on Friday as higher temperatures indicate that there will be lower heating demand in November and early December.

- US FED Chair Jerome Powell is expected to deliver a speech this week and indicate FED’s stance on the anticipated slowdown of the pace of interest-rate increases next month while reminding Americans that its fight against inflation will run into 2023.

Analyst:

- Craig Rocha (cmrocha@ckinetics.com)

- Megha Jha (mjha@ckinetics.com)

You might also likeArticle

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade