- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Price Commentary

- CCA Weekly Commentary: CCA prices fall amongst weak global market sentiments

CCA Weekly Commentary: CCA prices fall amongst weak global market sentimentsWCI CaTMonday, 20th June 2022

Megha Jha

Summary:

- CCA front falls to $30.29 on Friday, retreating 4% over the week

- ICE weekly volume reported as 26 .94 M tons (+42% WoW), 4-week moving avg. 23.70M tons

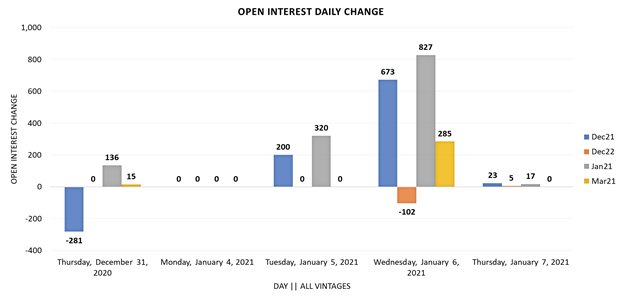

- CFTC: Total OI increased by 0.232 M tons

Technicals:

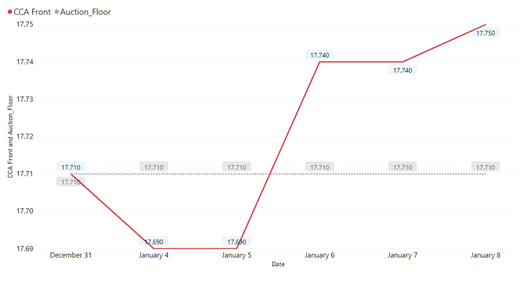

Trading activity increased 42% last week to 26.94M tons. Volumes have risen to 26.94 M tons from 18.98 M tons the previous week. The secondary market gained fresh OI of 0.232 M tons WoW. The FED interest rate hike has caused a retreat in CCA prices, with a 4% drop last week.

Trader Positions:

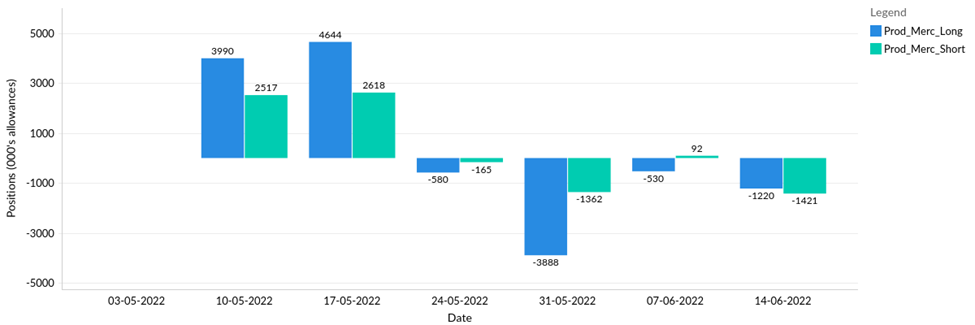

CFTC V22: Positions across all traders (14th June)

Total OI has increased by 0.232 M tons. Both Compliance entities and fund managers have reduced their long and short positions. Compliance entities reduced their long positions by 1.22 M tons and short positions by 1.42 M tons. Managed money has reduced long positions by 1.33 M tons and short positions by 0.003 M tons. Compliance and fund managers have reduced positions as the market sentiments stay low on high recession risk.

CFTC V22: Fund Manager change in positions (14th June)

Fund managers decreased long positions by 1.329 M tons and short positions by 0.03 M tons.

CFTC V22: Covered entity change in positions (14th June)

Compliance entities reduced both long and short positions. The move shows that compliance entities are reducing exposure to CCAs.

Market Fundamentals:

- Read our latest Analyst Note and forecast on Emissions, Supply, Demand, and Price.

- California average gasoline prices have reached $6.44 per gallon (AAA data). The overall effect is a conscious reduction in VMTs, which could reduce transportation emissions.

- Natural gas futures fell 27% WoW. The Free point plant in Texas, which had a fire last week, will not be back up and running until late 2022. The plant closure will reduce natural gas exports, increasing domestic supply and hence plummeting domestic natural gas prices.

- The FED hiked interest rates by 75 basis points, the highest rate hike in 28 years.

Analyst: Craig Rocha (cmrocha@californiacarbon.info)

Table of Content

You might also likeArticle

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade