- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Price Commentary

- CCA Weekly Commentary: CCA prices flatline as market entities anticipate interest hikes, recession, and a drop in oil prices

CCA Weekly Commentary: CCA prices flatline as market entities anticipate interest hikes, recession, and a drop in oil pricesWCI CaTMonday, 12th September 2022

Megha Jha

Summary:

- CCA front on Friday closed at 26.84, losing $0.81 over the week.

- ICE weekly volume was reported as 7.38 (-73% WoW), 4-week moving avg. 25.73 M tons.

- CFTC: Total OI decreased by 1.19 M tons (-114.7% WoW).

CCA prices stabilized last week, after the JA 32 auction and California’s legislative session come to an end. Compliance entities increased long positions by 1.56 M tons while Managed money decreased long positions by 0.72 M tons. Overall, OI declined by 1.19 M tons over the last week.

The Legislature session saw two major updates that are quickening the reduction of emissions, but the impact on the Cap-and-trade remains mixed.

- Perhaps the most significant bill that passed, the CA Climate Crisis Act changes the definition of carbon neutrality going forward. While previously CARB had calculated their emissions targets to 2050 and used a balancing mechanism where remaining emissions after that date were to be offset by direct air capture, new legislation sets a concrete 85% emissions reduction target. This means a fundamental shift in the way that CA and the Air Resources Board will calculate their emissions reduction calendar. Not only does the timeline speed up, but they are now required to reduce a larger portion of emissions than previously planned. As a result, the reduction slope is going to be steeper. The question is when will CARB make these changes, and how will they adjust the program to achieve the new target.

- In addition to the legislation referenced above, several electricity-related bills figure into the equation of CA’s climate goals. California Governor Newsom successfully pushed for a stay on de-activating the Diablo Canyon Nuclear plant, a step some have seen as a win for renewable power in the state. However, the $1.4 billion deal constitutes a more complex decision about renewable power, and although it is not clear how things will fall, the deal may reallocate money away from other renewable electricity projects.

The market sentiment is clouded with uncertainty about the future as the risk of inflation, further interest hikes, and oil prices continue to loom. US FED Chair Jerome Powell’s speech at the Jackson Hole conference two weeks ago indicated towards another interest hike to achieve FED’s 2% inflation goal. Yesterday, US Treasury Secretary Janet Yellen also said that the United States faces a risk of recession as it continues to battle against inflation and anticipates its role in slowing down the economy. Oil prices also witnessed a fall today as market entities expect an interest hike by FED in the coming days. The front is now trading at a 36% premium to 2022’s floor price, and 27% above next year’s expected floor price (CPI at 7%). The low trading price makes the CCA allowances a lucrative investment.

Technicals:

Trading activity on the ICE exchange decreased 49% WoW to 27.26 M tons.

Trader Positions:

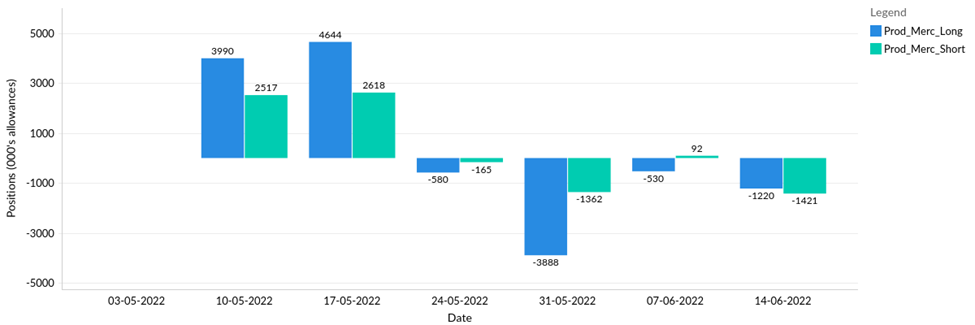

CFTC V22: Positions across all traders (6th September)

In the CFTC data last reported on 6th September 2022, total OI decreased by 1.19 M tons. The compliance entities increased long positions by 1.56 M tons while Managed money decreased long positions by 0.72 M tons.

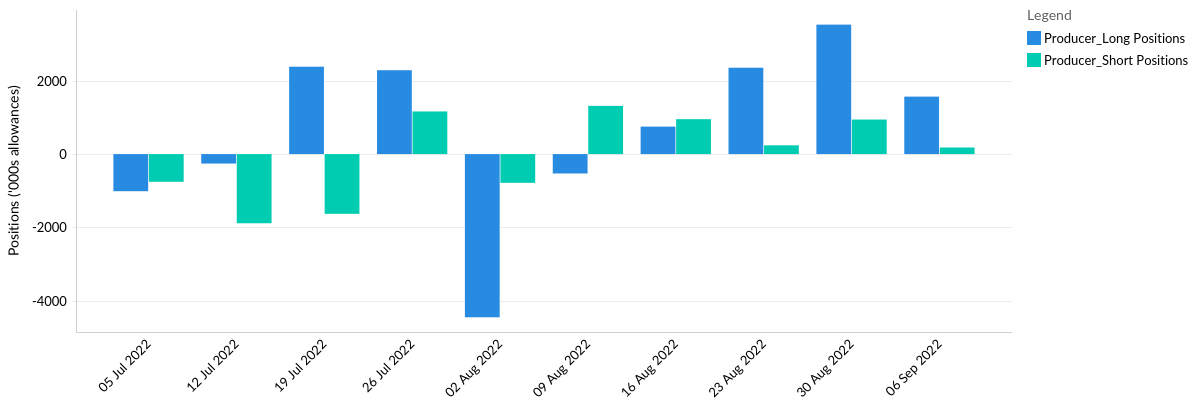

CFTC V22: Fund Manager change in positions (6th September)

Managed money decreased long positions by 0.72 M tons, along with a decrease in short positions by 0.29 M tons.

CFTC V22: Covered entity change in positions (6th September)

Compliance entities increased long positions by 1.56 M tons and increased short positions by 0.17 M tons.

Market Fundamentals:

- Read our latest Analyst Note and forecast on Emissions, Supply, Demand, and Price.

- On 11th September 2022, US Treasury Secretary Janet Yellen said that the nation faces a risk of recession as its battle against inflation could slow the nation’s economy.

- Global crude oil prices fell on Monday in anticipation of interest rate hikes by the US FED. Brent Crude prices have declined to $90 per barrel over the last two months and further declined to $88 over the last ten days.

- Russian forces faced a string of defeats on Ukraine soil and were forced to flee the strategic city of Izium – their main bastion in north-eastern Ukraine on Saturday.

Analyst:

- Craig Rocha (cmrocha@ckinetics.com)

- Megha Jha (mjha@ckinetics.com)

You might also likeArticle

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade