- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Price Commentary

- CCO Scorecard: DEBs Prices Keep Rising in the Wake of Record-High Allowance Prices

CCO Scorecard: DEBs Prices Keep Rising in the Wake of Record-High Allowance PricesWCI CCOs & WCOsThursday, 29th February 2024

Eszter Bencsik

This Week’s Highlights

- DEB offsets continue to dominate new CCO issuances

- CCO-0 DEBs are trading at a record high of $34.33, driven by similarly record-high CCA settlement prices seen in the wake of the first quarterly California – Quebec auction results last week

- Meanwhile, the remaining high stock of non-DEBs credits keeps non-DEB prices low

cCarbon’s Market View This Week

No surprise issuances were made in the most recent cycle of issuances by CARB, although a new West Virginia-based MMC project did come online. Record-high CCA prices keep driving DEB prices up, with compliance entities looking to frontload compliance instruments. However, this should not distract from the fact that the open volume of CCOs in the market is still very high.

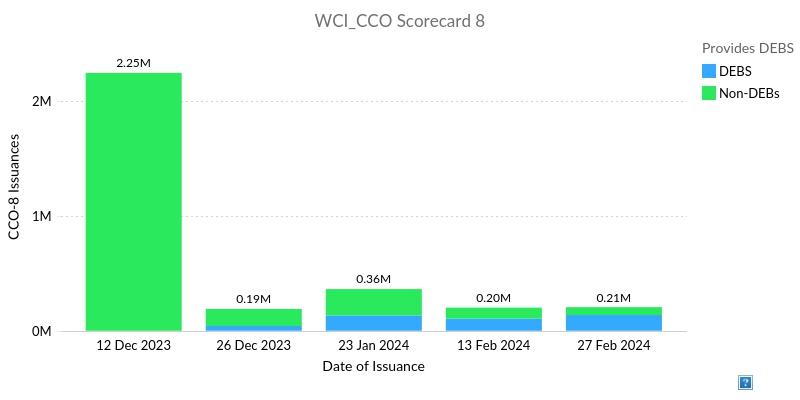

CCO-8 Issuances

Source: California Air Resources Board (CARB)

The latest batch of California Carbon Offset (CCO) issuances by the California Air Resources Board (CARB) was similar in volume to the previous one, earlier in February. This time, 205,489 offset credits were issued, of which 137,096 provided direct environmental benefits (DEBs) to California. These figures are in line with the average over the past half a year when excluding the highly unrepresentative early December issuance. The latest DEBs issuance came from the Garcia River Forest project operated by The Conservation Fund. This issuance represents the 8th one of the project that has issued 1,187,031 offsets to date since it started reporting emission mitigation activities in 2016. The Non-DEB credits were issued by a new Mine Methane Capture project located in West Virginia operated by McElroy Green Marketing.

CCO-3 Conversions

No credits saw their invalidation periods reduced this time round.

CCO-0 Conversions

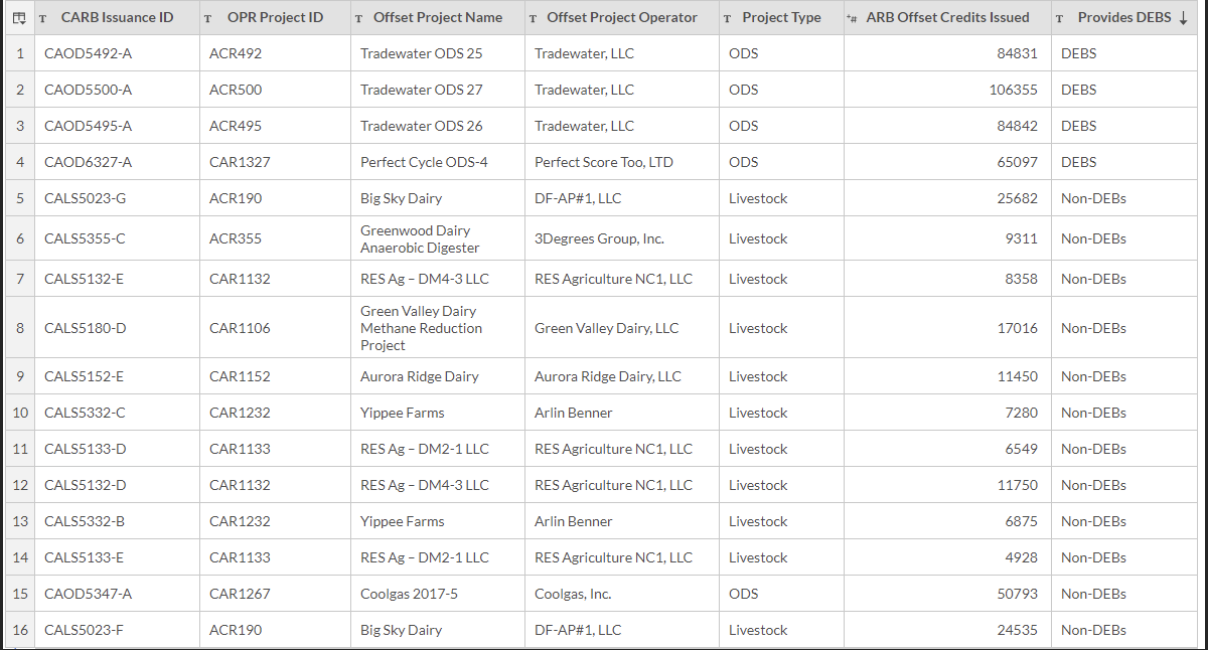

Source: California Air Resources Board (CARB)

Sixteen project issuances reached the end of their invalidation periods in February, adding 525,652 offset credits to the CCO Golden/Zero Pool, a decline of 16.9% from January. Of the conversions, 64.9% were for DEBs, consisting of four ODS projects, while the remaining twelve non-DEBs conversions included one ODS project, with the rest being livestock projects. The biggest conversion was for the first batch of issuance of an ODS DEBs project registered with ACR and operated by Tradewater, LLC.

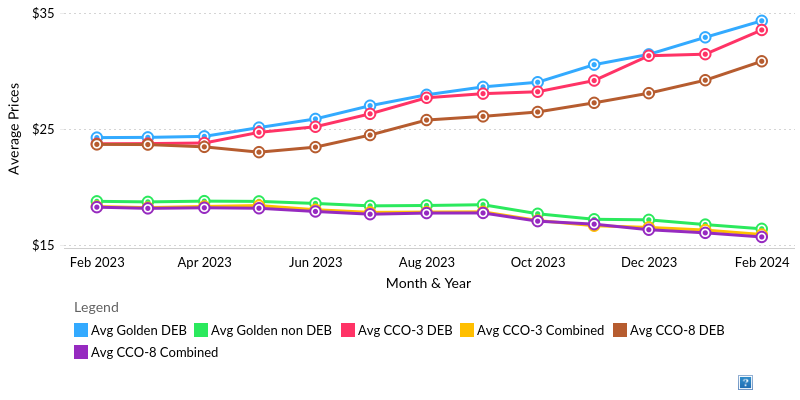

Average CCO Prices (DEBs vs non-DEBs)

Source: Numbers are average of broker prices reported to CC.info

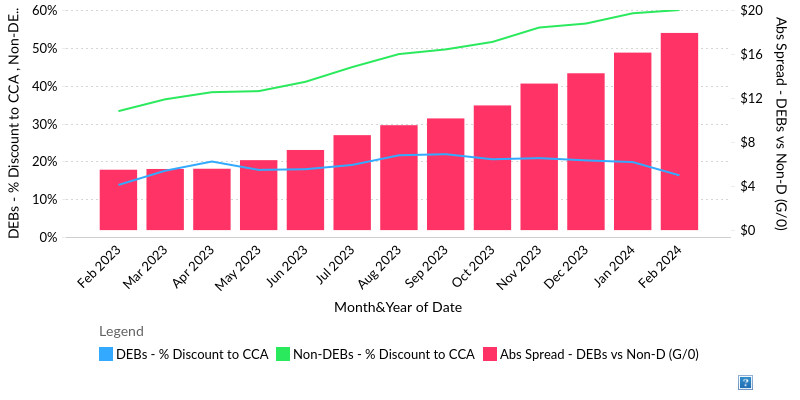

CCO DEBs have continued their upward trajectory in February owing to record California Carbon Allowance (CCA) prices seen in the wake of the first quarterly California – Quebec auction. An interesting trend to consider is the way DEBs prices are increasing slightly faster than CCA prices, most likely driven by compliance entities trying to frontload compliance instruments at as low a price as possible, leading to a narrowing CCA vs. DEBs discount gap (see figure below). In the meantime, non-DEB prices continue their downward trend due to a persistent oversupply in the market. Among DEBs, CCO-0s are trading $34.33, CCO-3s at $33.53, and CCO-8s at $30.84. Non-DEB prices by invalidation periods are as follows: CCO-0s are trading at $16.41, CCO-3s at $15.92, and CCO-8s at $15.71. The difference between CCO-0 DEBs and Non-DEBs has increased by 22% since December.

Our WCI CCO forecast provides an outlook for the market till 2030.

CCA vs CCO Discount Trend

Source: Numbers are an average of broker prices reported to CC.info

WCI CCO Dashboards

CC.info Readers Digest

- WCI 2030 Offset Price Forecast – Demand-Supply scenarios and offset price forecast till 2030 (November 2023 Update) | Analyst Note | December 2023

- Offset Use Guidelines I Analyst Note I November 2023

Analyst Contact

- Urvashi Thakur (uthakur@ckinetics.com)

- Eszter Bencsik (ebencsik@ccarbon.info)

You might also likeArticle

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade