- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Price Commentary

- Market experiences lull in trades between auctions

Market experiences lull in trades between auctionsWCI CaTMonday, 9th July 2018

Shubhangi Sharma

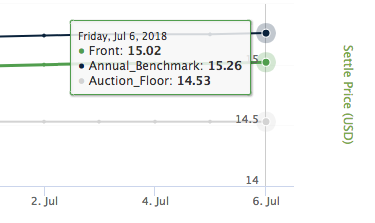

CaliforniaCarbon.Info 9 Jul, 2018: California Carbon Allowances (CCAs) prices experienced a steady gain this week. Market also slowed down with noticeable trades exclusively under V18 Dec 18, V17 Sep 18. This might be because market is reverting to inactive sessions between auctions which is characteristic. The other possibility for lack of trades might be that entities have procured enough allowances to meet compliance obligations end of this year, with high trades in Jun18. As well as with Ontario’s exit, entities might be a little more cautious as regulations and impending de-linkage is in a state of limbo. At the beginning of the week prices increased by 1-cent. They experienced a similar price increase the day after following which prices remained unchanged until the end of the week. As of Friday (07/09) front price (V18 Jul18) is trading at US$ 15.02 and benchmark (V18 Dec18) is trading at US$ 15.26. Daily prices can be tracked using CCA price tracker below.

Volumes traded this week have further decreased from slightly over 5.6 million tons last week to 200,000 tons this week. As mentioned earlier, entities traded only under V17 Sep18 and V18 Dec18. Around 120,000 tons were traded under the former while 80,000 tons were traded under the latter. Trades under V2017 made up 60% of the total volumes and the remaining 40% were made up by trades under V2018. This is evident of a period of lull in trades between auctions. It could also be indicative of entities’ response to the market as it is the beginning of the third compliance period.

After a week of absence in significant trades, open interest was negative last week. Around 575,000 contracts closed which is a complete reversal to market behavior last week when 1.3 million contracts were opened. Around 100,000 contracts closed for Jul18, 50,000 contracts closed for Sep18 and 600,000 contracts closed for Dec19. The only delivery that experienced a positive OI was V18 Dec18 with an added 175,000 contracts.

Analyst contact: Abhilasha Fullonton (abhilasha.fullonton@californiacarbon.info)

You might also likeArticle

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade