- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Price Commentary

- RGGI Weekly Commentary: RGAs rise to high of $18.73; Vermont pushes for 100% renewable electricity generation by 2035

RGGI Weekly Commentary: RGAs rise to high of $18.73; Vermont pushes for 100% renewable electricity generation by 2035RGGIFriday, 22nd March 2024

Rajas Raje and Craig Rocha

This Week’s Highlights

- RGA prices reached a high $18.73 after Auction #63.

- RGA Trade volumes rise as market anticipates tighter cap for RGGI program soon.

- Vermont House passes bill to mandate 100% electricity generation from renewable sources by 2035.

- British national Grid to invest $1B in New York grid infrastructure.

cCarbon’s Market View This Week

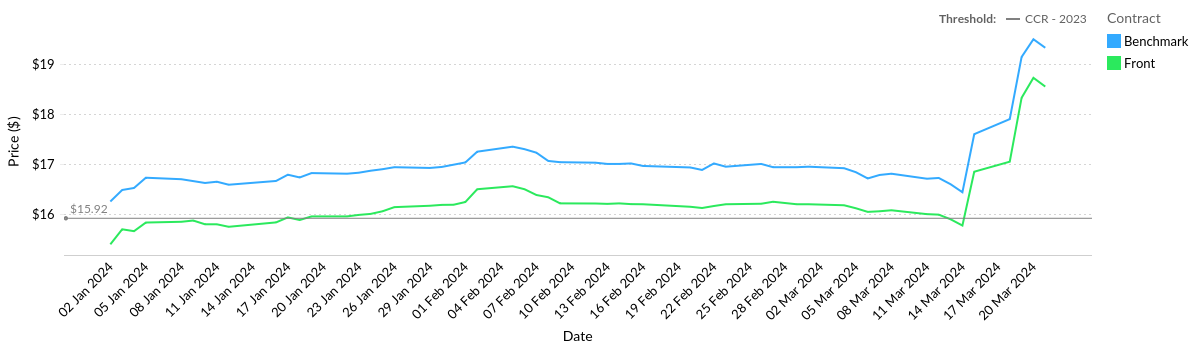

As cCarbon had pointed to earlier this week, RGA prices began a steep upward journey, in the aftermath of the 63rd RGGI auction and the subsequent exhaustion of the CCR for 2024. With no other mechanisms to slow RGA prices, front prices rose 10.75% over the last week. This indicates a potential move to a much tighter market in the future, as market await the release of the Third Program Review.

In a step towards decarbonization, the Vermont House of Representatives passed a bill mandating 100% of the state’s electricity to come from renewable sources by 2035, making it only the second state after California to officially set the goal. The bill will now go to the Senate for approval. The Mid-Atlantic’s renewable energy infrastructure received another boost on Wednesday as the U.S. unit of the private firm British National Grid approved an investment of $4B to ease the integration of renewable energy generated into New York’s electricity grid.

The Grid Deployment Office of the U.S. Government on Thursday published the Action Plan for Offshore Wind Transmission Development in the U.S. Atlantic Region, which will help New York and Vermont achieve their objectives.

cCarbon is also keeping a close eye on the status of the PACER Act in Pennsylvania, which will create a state-wide cap and invest program.

Price and Volume Trends

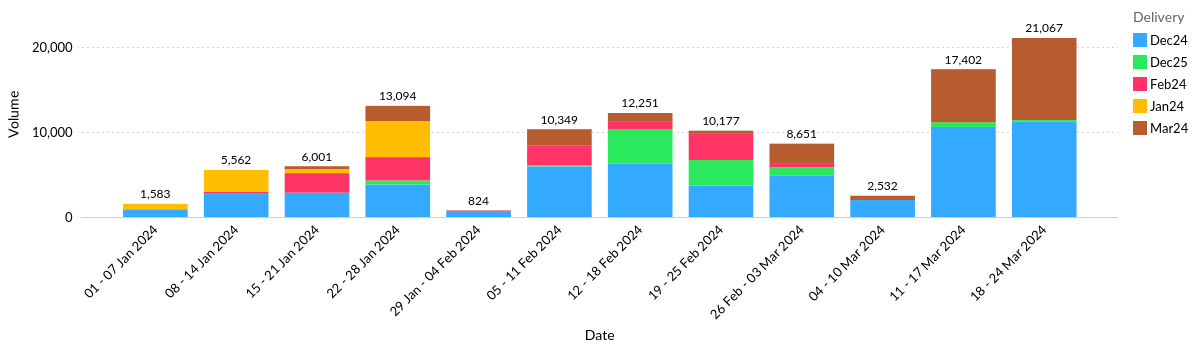

There was a steep rise in both V24 front and benchmark RGA prices by 10.75% and 10.46% to $18.55 and $19.33, respectively. Traded volumes also experienced a significant increase by 21.06% to 21.07 M sh. tons (short tons) over the last week and was higher than the 4-week average volume trade by 69.72%.

Figure 1. RGGI ICE Daily Price Change, Data Source: Intercontinental Exchange

Table 1. RGGI Future Price Change (Weekly), Data Source: Intercontinental Exchange

Figure 2. RGGI ICE Weekly Volume Change, Data Source: Intercontinental Exchange

Trader Positions

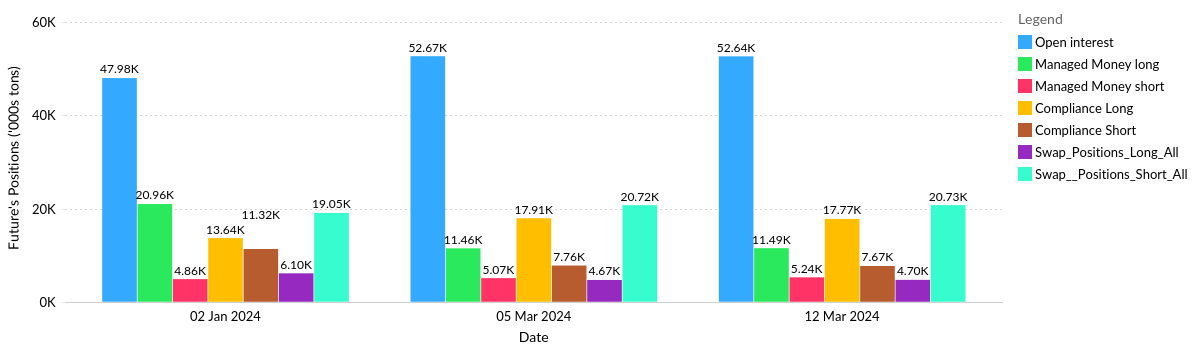

An analysis of traders’ positions from the CFTC data gives us an indication of the market sentiment. The OI decreased by 0.03 M sh. tons over the previous week. Compliance entities decreased net long positions by 0.05 M sh. tons.

In the latest CFTC data reported on March 12th2024, Open Interest (OI) decreased by 0.03 M sh. Tons over the previous week. Compliance entities decreased their net long positions by 0.03 M sh. tons, while managed money decreased net long positions by 0.14 M sh. tons.

Total Positions (Positions on March 12, 2024)

Figure 3. CFTC Positions Across Traders (WoW), Data Source: CFTC

Other Market Fundamentals

- The U.S. Bureau of Labor Statistics data shows that the consumer price index (CPI) increased 0.4% in February with gasoline and shelter price indices contributing to over 60% of the monthly increase.

- Natural gas futures climbed up marginally by 2.18% to $1.69 over the past week, as on March 21st, Thursday.

- The Nasdaq Composite Index rose by 2.48% over the past week to 16369.41, as on March 20th, Wednesday.

CC.Info Readers Digest

- Outlook for Voluntary Renewable Energy and Unbundled Voluntary Certificates in the USA | Insight Report | February 2024

- NYCI Set to Launch in 2025 as US’s Second-Largest Cap-and-Invest Initiative: A Conservative, Pragmatic Approach to Carbon Markets

Analyst Contact

- Rajas Raje (rpraje@ckinetics.com)

- Craig Rocha (cmrocha@ckinetics.com)

You might also likeArticle

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade