- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Price Commentary

- Weekly Commentary: Dec19 registers significant trades and OI, overtaking benchmark

Weekly Commentary: Dec19 registers significant trades and OI, overtaking benchmarkWCI CaTMonday, 13th August 2018

Shubhangi Sharma

CaliforniaCarbon.Info 13th Aug, 2018:

A brief overview of market activity: California Carbon Allowances (CCAs) prices continue to show stability with minor movements along the curve. Trades and OI are defying normal downward trend during pre-auction session, having significantly increased over the last week. There is noticeably a significant hike in both trades and open interest under Sep18 which is the next post-auction delivery.

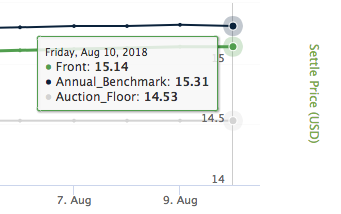

CCA Prices: Prices have not seen any drastic hikes or dips recently with narrow margin of movement for the last month. CCAs are keeping to trend this week with certain deliveries dropping a cent at most. Intraday volatility was high on the last day week with certain deliveries dropping a cent (V18 Nov18, V18 Dec18, V18 Jan19) while certain future deliveries gaining anywhere from 2-cents to 6-cents. As of Friday (08/10) front (V18 Aug18) was trading at US$ 15.14 and benchmark (V18 Dec18) was trading US$ 15.31, marking a 4-cent and 2-cent gain respectively. See CCA tracker below to follow daily price movements:

Volume: Volumes totaled up to 9,834,000 tons which almost a 3.2 million ton increase in volume over a week. While the general trend is for trades to go down over pre-auction session, the significant increase, noticeably under the Dec19 delivery indicates that there have been significant movement of trades from short-term to the long-term. Trades under Dec19 roundup to be 4.4 million tons while Sep18 registered around 2.7 million and Dec18 trades totaled up to 2,558,000 tons. Aug18 delivery saw minor trades at 26,000 tons. Vintage-wise trades were concentrated under V2018 with 7.7 million tons making up 77.87% of the total while V2019 had the second highest trades this week with 1.05 million tons.

Open Interest: There has been a huge uptick in OI contracts when compared to last week. Around 4.5 million OI contracts were added to the market with Dec19 and Sep18 making up significant number of those additions. V18 Sep18 saw an added 2,525,000 tons of OI contracts and Dec19 saw 2.9 million OI contracts added. V18 Dec18 was the sole delivery that saw closure of about 979,000 OI contracts.

Analyst contact: Abhilasha Fullonton (abhilasha.fullonton@californiacarbon.info)

You might also likeArticle

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade