- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Price Commentary

- RGGI price tumble as Pennsylvania and Virginia continuation remains in question

RGGI price tumble as Pennsylvania and Virginia continuation remains in questionRGGIThursday, 21st July 2022

Megha Jha

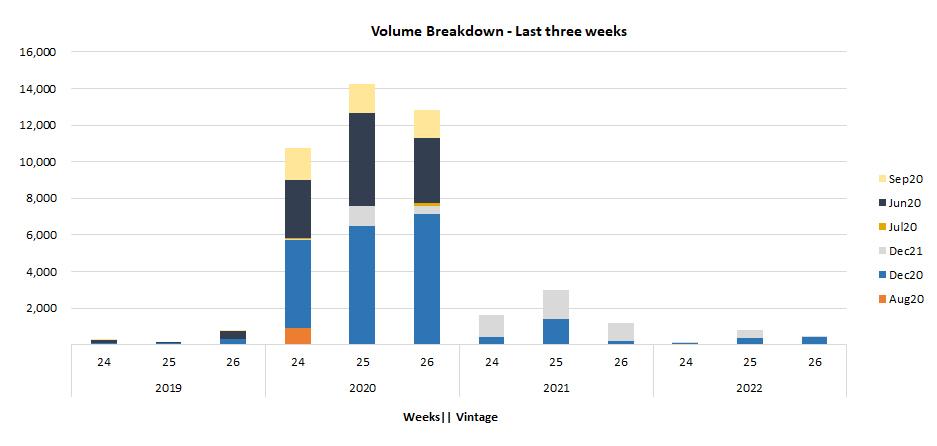

- Total Weekly Volume of 6.88 M tons -26% WoW change

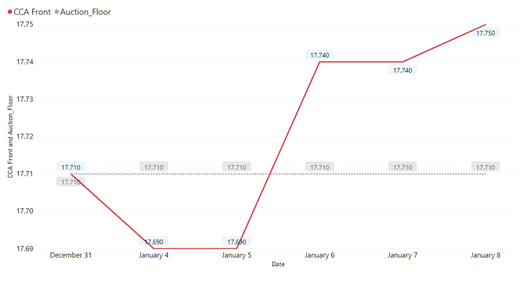

- RGGI ICE weekly average settlement price: $13.47 -1.5% WoW.

- Managed Money increased short positions by 1.0 M tons, and compliance entities increased long positions by 1.0 M tons. OI increased by 3 million positions as spread positions by swap dealers increased by 2.3 million.

Summary:

Future’s prices fell 1.7% WoW, and have fallen 4.2% since the beginning of this month. The prices have witnessed a downward spiral ever since the Supreme court move against the EPA, early this month. Pennsylvania’s Commonwealth court issued an injunction order shortly afterward, on the 8th of July, temporarily prohibiting the state from “implementing, administering, or enforcing” the new RGGI regulation till the court considers the merits of the cases. Neither the SC’s ruling against EPA’s right to control emissions nor the Pennsylvania Commonwealth court’s ruling had any impact on RGGI. PA commonwealth court’s injunction was bypassed as the state’s EPA moved to PA’s supreme court. Nevertheless, two RGGI states are ensued in judicial cases against joining the RGGI, and the recent judgment doesn’t seem great for the coalition.

US inflation in June rose to a new 40-year high at 9.1%. The high inflation rate will force the FED to turn hawkish, as the market rises expectations of a 100 basis point rise in interest rates. The rising inflation also means rising recession risks, as the FED desperately attempts to cool a blistering hot economy.

RGGI Future Price Weekly RGGI Volumes Decline (-26% WoW)

Market Fundamentals

(Green indicates upward influence on price, red indicates downward influence)Trader Positions:

Managed Money increase short positions

An analysis of traders’ positions from CFTC data gives us an indication of market sentiments. The data after the Pennsylvania Court injunction order, shows managed money increasing short positions by 1 M tons, while compliance entities increased long positions. OI increased by 3 million. Majority of the new open interest positions were spread positions by swap dealers, with 2.247 million new positions, as rolling over to future contracts begins.

Total Positions (Positions on 12th July)

Compliance Entities (Net Long: 0.9 M tons ): Increased long positions by 1.0 M tons

Decreased short positions by 0.1 M tons.

Managed Money (Net Short: 0.8 M tons ): Increased long positions by 0.2 M tons

Increased short positions by 1.0 M tons.

Analyst: Craig Rocha (cmrocha@californiacarbon.info)

You might also likeArticle

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade