- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Articles

- Washington’s First-Ever Auction: Investor and Compliance participant deep-dive

Washington’s First-Ever Auction: Investor and Compliance participant deep-diveWashington CaIWednesday, 15th March 2023

Megha Jha and Craig Rocha

Key Takeaways

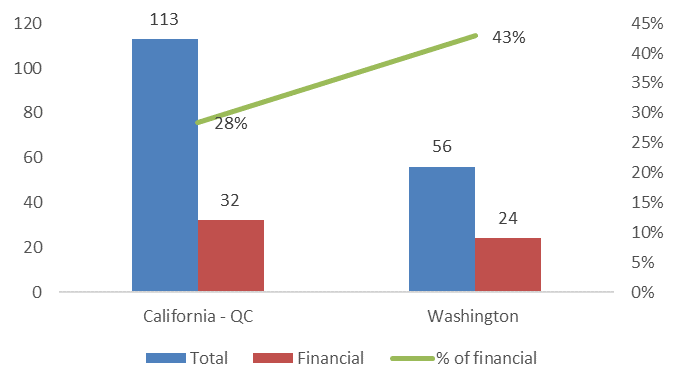

- The auction witnessed the participation of 56 qualified bidders, including 23 financial entities.

- Most financial entities in Washington, already have an interest in the CA-QC market.

- Bigger Compliance entities participate while smaller ones stay away.

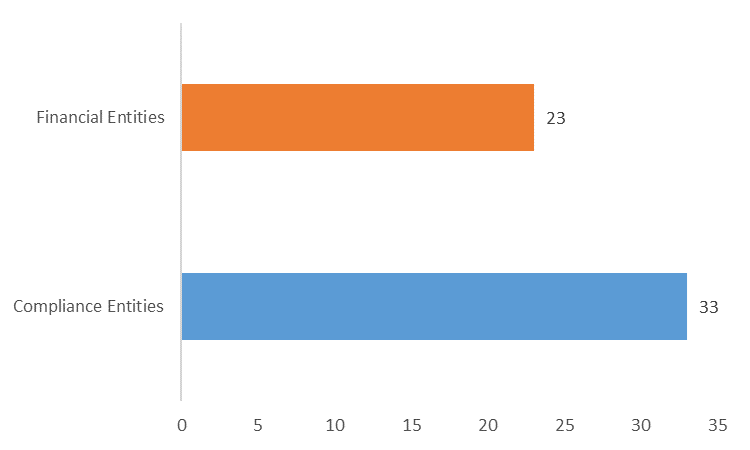

23 of the 56 qualified bidders who participated in the auction were financial Entities.

The participating entities were a mix of financial entities and compliance entities. We have attempted to take a deeper look at both the financial and compliance entity trends. Financial participation stood at 41% against 28% in the California-Quebec market.Participation of entities segregated by compliance and financial entities Participation of entities segregated by compliance and financial entities

Participation of entities segregated by compliance and financial entities

Further Breakdown of Investor participation

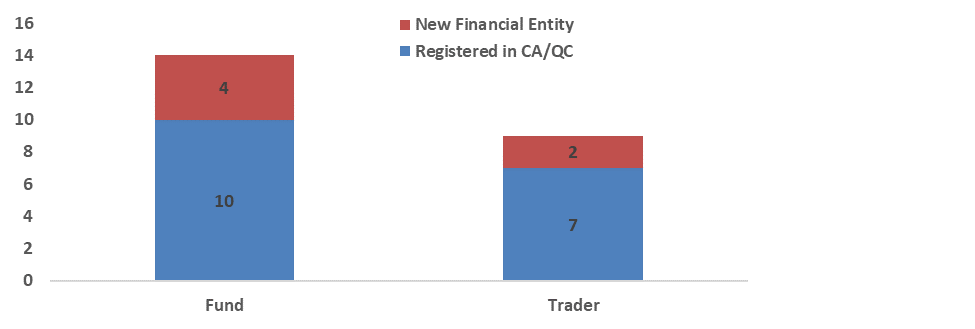

The financial entities have been broken into investment funds and traders. The investment funds included a mix of large asset managers, hedge funds, and other investing interests. Traders are generally, commodity traders and risk management forms on behalf of clients. Out of the 23 financial entities, 14 were funds, with the remaining seven being mainly commodity traders. Some of the major investment firms that participated in the auction include Bellus Ventures, Carbon Point Partners, Morgan Stanley Capital Group, Klima Holdings, Norther Trace Capital, and Environmental Commodity Partners. The commodity traders, saw Trafigura, Mercuria Energy, Macquarie Energy, and Trailstone Commodity trading.Large overlap between California-Quebec financial entities

The auction participants were also mainly funds and traders that already have interests in California. Only four new funds participated and two near-trading entities joined in.

Compliance Entities Break-down of participation.

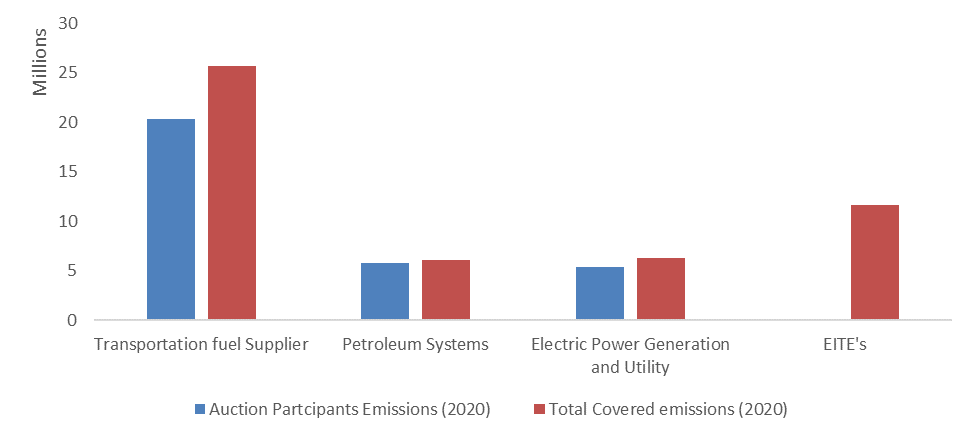

The EITEs remained away from participating in the auction, as they are due to receive free allocations for all their emissions in the first compliance period. We expect to see EITEs start participating at auction only in the second compliance period.Emissions from participating entities to the total sectoral emissions

The transportation fuel suppliers show a major emitter of the sectors had participated. BP, Shell, Chevron, Phillips 66, and Marathon, were all present. The petroleum and electricity generation too saw most of the heavy emitters participating.Natural gas suppliers and electricity importers have not been shown, as the state’s emissions emission data does not show the entity-wise emissions data for these sectors

Smaller entities stay away from the auction

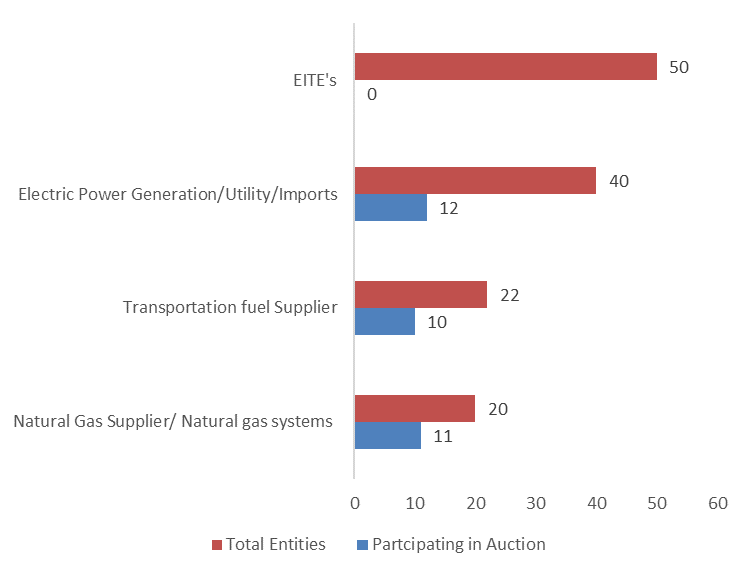

Though emissions are largely covered by the few compliance entities participating, most of the emissions are concentrated from a few companies. At large, the smaller entities have stayed away from the market. In the transportation sector, which has an emission coverage of 80%, less than 50% of the historically covered entities participated. While in the electricity sector that falls to 25%.Analyst Contact:Number of compliance entities participating vs the total covered entities

- Craig Rocha (cmrocha@ckinetics.com)

- Megha Jha (mjha@ckinetics.com)

Table of Content

- Key Takeaways

- 23 of the 56 qualified bidders who participated in the auction were financial Entities.

- Further Breakdown of Investor participation

- Large overlap between California-Quebec financial entities

- Compliance Entities Break-down of participation.

- Emissions from participating entities to the total sectoral emissions

- Smaller entities stay away from the auction

You might also likeArticles

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade