- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Price Commentary

- Weekly Commentary: ICE CCA prices gain $2.33, feed off global optimism for carbon markets and climate ambition

Weekly Commentary: ICE CCA prices gain $2.33, feed off global optimism for carbon markets and climate ambitionWCI CaTMonday, 15th November 2021

Anant Jain

Summary:

- ICE CCA front gained $2.33 after 63.5M tons of Volume and 19.6M tons of Fresh OI

- CFTC data update pending; old data suggests an increased in short positions by fund managers

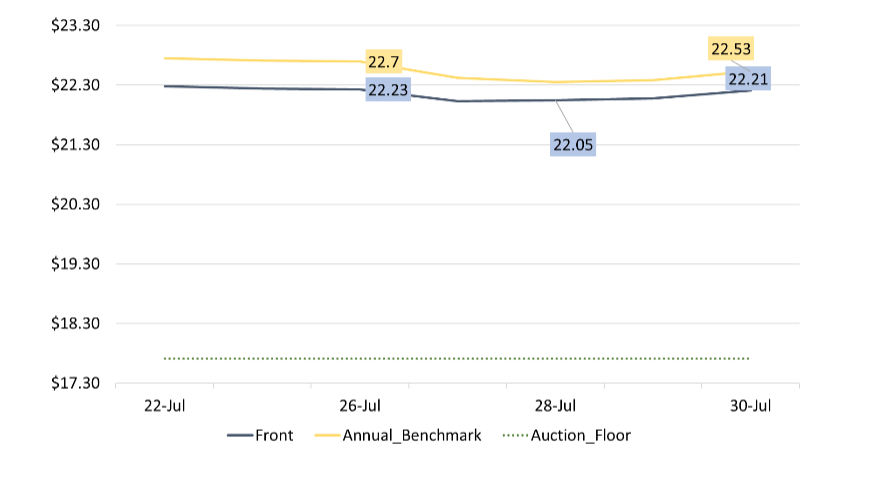

- ICE CCA prices seemingly overinflated before Nov auction; Auction could settle below secondary market

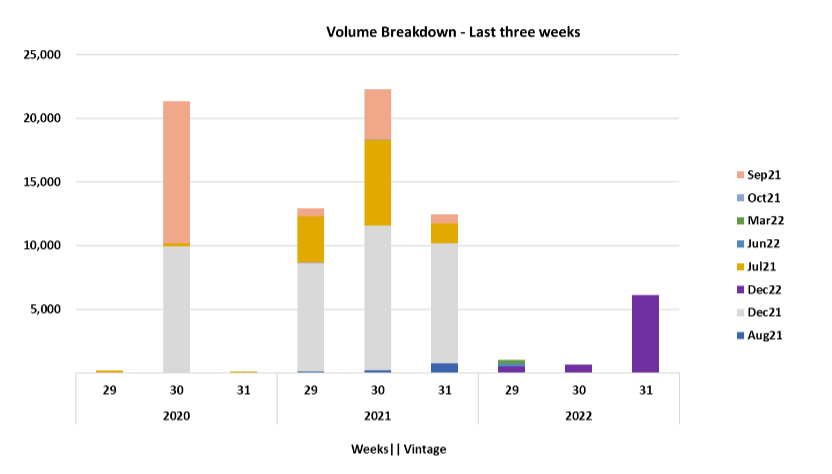

The ICE CCA market felt strong global optimism for carbon markets over the last week. A great surge in participation was observed around COP26 announcements on greater climate ambition: 62.5M tons of CCAs changed hands last week. The Biden administration announced several policies ranging from slashing methane emissions, reducing subsidies for Oil & Gas, promoting Electric Vehicles and the 1.2 trillion dollar infrastructure transformation bill that passed the legislature. Globally, countries agreed on coordinating adjustments for offsets, improving the integrity of the accounting systems. Additionally, a share of proceeds for the adaptation fund was fixed at 5% taken from new issuances, from the Article 6.4 pathway. Overall, the positivity of the talks at Glasgow waded into the California Compliance market. The ICE CCA front gained $2.33 on the shoulder of the announcements, just days ahead of the November Auction.

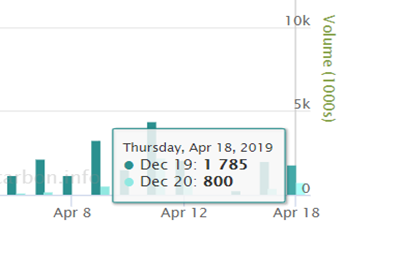

A whopping 19.6M tons of fresh Open Interest entered the secondary market. The V22 Dec22 contract gained 8.9M tons. Interestingly, the Nov21 and Dec21 contracts also received high OI creation. Something which was missing in the weeks before as more participants rolled up to Dec22. A substantial 5.3M tons was opened on the Nov21 contract while the Dec21 contract received 2.5M tons of fresh OI. Only CFTC data would reveal how much of those Nov21 contracts are short positions. But, that data has not been updated by the regulator yet.

However, in the last reported CFTC data, on 2nd November, we see a disconcerting increase in short positions held by Fund Managers. From 2.2M tons a few weeks ago, their positions (red) have increased to 7.8M tons, indicating that few of these traders are going short.

There is a noticeable decrease in the number of traders (Managed Money/Fund Managers) that are long, now down to 24 from 28. And an increase of traders reporting short positions: from 4 to 6. While this positioning may have changed in the last week, it is something that must be carefully monitored over the coming week. These traders have been holding a strong bullish outlook for quite some time and a temporary reversal in outlook could waver CCA prices in the short term.

The strong participation at the upcoming auction however remains unquestionable. CCA prices at their current secondary-market level will pose greater cost pressures for compliance entities participating, who are clearly aware that CCA prices would only move up in the long-term. On the other hand, financial participants have enjoyed a 60% increase in CCA price since July 2021 and will return to the auction with deeper pockets. ICE CCA prices however remain over-inflated after last week’s announcements and could mean that auction bidders bid lower than current secondary-market levels. This could lead to our expectation of an auction settlement price below that of the ICE secondary market.

Hear our revised forecast for Allowance Supply-Demand in tomorrow’s webinar: WCI 2021-22 Outlook: The Beginning of Allowance Deficits? Click Here to register if you’re a subscriber of CaliforniaCarbon.info.

*WoW OI Change reported between 4th November & 11th November.

Analyst Contact:

Anant Jain (anant.jain@californiacarbon.info)

You might also likeArticle

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade