- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Articles

- Conventional Hopes being realised? SBTi’s step on Scope 3 is the first move towards possible CCP tie-up

Conventional Hopes being realised? SBTi’s step on Scope 3 is the first move towards possible CCP tie-upVCMWednesday, 10th April 2024

Harry Horner

Key Takeaways

- SBTi’s decision to extend carbon credit use for Scope 3 emissions marks a significant shift in direction for the world’s largest coporate environment target organisation.

- If fully realised, SBTi-led Scope 3 demand can completely alter offset market dynamics for the next 25 years, opening up the possibility of a tight market from the current trajectory of massive surplus.

- SBTi’s wording necessitates a 3rd party to define credit quality, IC-VCM’s CCP seems to be the front-runner and a natural fit for this role.

- If carried through, much of this seems to have been orchestrated and well pre-determined.

Introduction

SBTi’s yesterday announced a decision “to extend …[carbon credit’s] use for the purpose of abatement of Scope 3 related emissions beyond the current limits.” This represents a monumental, and yet sensible, step forward by the world’s predominant corporate environmental targets initiative.

Monumental – as this may have wide-reaching implications for offsets demand over the next 25 years – as forecasted by cCarbon last year, and again at NACW three weeks ago (free webinar upcoming tomorrow). The announcement provides an opening for a mechanism of structural, formalised, (self-)mandated demand to emerge for the use of “voluntary” carbon credits.

Sensible – as there has been no effective direct way for corporates of any sector to tackle their “Beyond Value Chain” Scope 3 emissions, by definition, they are out of their (direct) control. For 18 months now, Scope 3 been somewhere between a looming elephant in the boardroom, and a running joke at the helplessness of corporates to address.

For all this time, effective contribution through offsets has been held up by some (incl. the cCarbon team), as the clear and obvious way to act on Scope 3. It’s the only lever left to pull for corporate actors on emissions they can’t directly mitigate.Potential for CCP tie-up

The SBTi announcement explicitly lays out an open road for formal engagement of the Integrity Council’s (IC-VCM) Core Carbon Principles (CCP) framework:

“SBTi will not embark in validating carbon credits quality. Other entities are better positioned to deal with this activity.”

In no uncertain terms, this states that an external framework will be used. Such a framework would undoubtedly have to be a cross-industry (check), multi-stakeholder (check), independent (somewhat), long-running (!check!) process, examining the full range of registries and protocols (check), explicitly focused on establishing a modern threshold for offset quality (check). All signals point towards use of the CCP assessments happening this year. CORSIA eligibility would be a distant possibility – but it wouldn’t meet several of the criteria above and is specifically defined by ICAO’s approach to the airline industry, rather than a cross-economy approach.

cCarbon’s Forecast

So, whatever does a future look like where SBTi demand is moderated through the use of CCP credits? That would surely be a difficult future to construct…

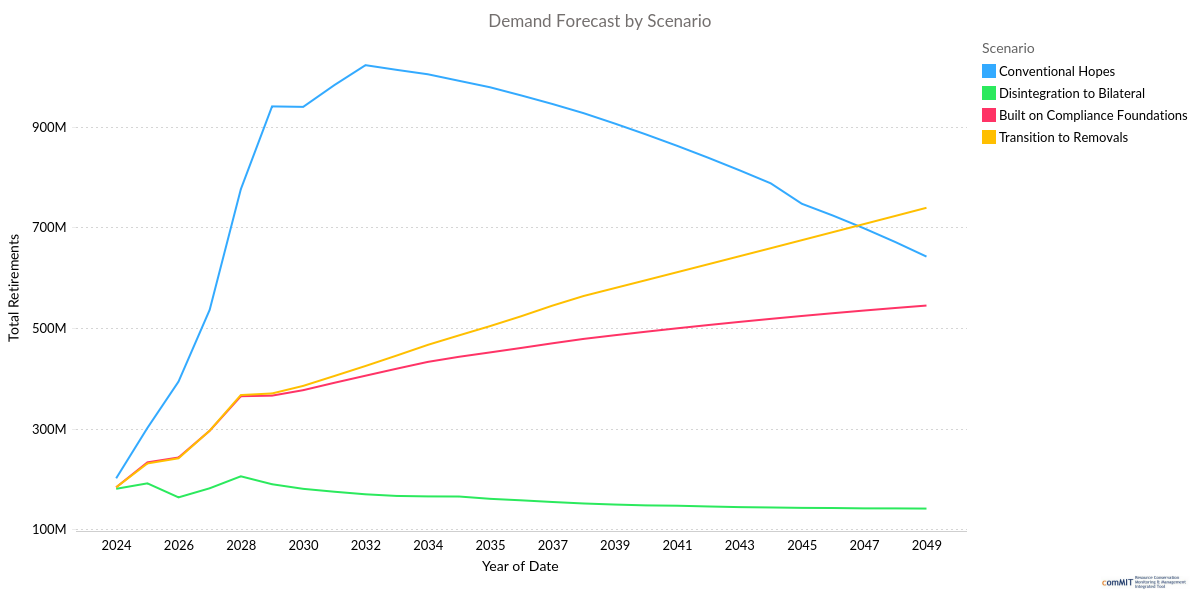

Thankfully the team at cCarbon had this ready-made last month in our “Conventional Hopes” Scenario, as presented at the NACW conference in San Francisco, we will be presenting this again in a webinar (tomorrow) on the 11th April. The Conventional Hopes scenario is the most significantly different of our four presented scenarios, precisely because of the huge demand driver that an SBTi-CCP link up would provide:

Figure 1: Annual Retirements across Scenarios

The full realisation of SBTi-tied demand results in a market apart from the other VCM visions. Only in Conventional Hopes is there a tight market for SDG offsets (CCP-eligible REDD+, Cookstoves, and the co-benefit style offsets), and developers must react to this carrot of (self-)mandated demand with further investment in building credit supply capacity. In all other scenarios, a yawning surplus of decades worth of annual retirement volumes emerges in surplus stock, providing a strong “stay away” signal for investment in further project developments.

Hitherto, we’ve seen the Conventional Hopes scenario as possibly the least-likely of the group, as there had, until this point, been no intimation from SBTi towards formalising offsets inclusion. This announcement radically changes that probability, and so will better enable variants of this future to emerge. Yet it’s by no means a foregone conclusion, the CCP-link up is on the horizon – but has only been suggested at. Conventional Hopes is more likely now than before, but still far off from being fully realised.

Role of Claims Code of Practice (the second CCP)

The final questions for us revolve around CCP… but, the other CCP: the Integrity Initiative’s (VCM-II) Claims Code of Practice (CCP-2). The marriage between the IC-VCM and the VCM-II was announced Summer of last year, a tie-up between the two integrity initiatives made sense and was seen as pre-destined by some, or even pre-determined by others – especially given the convenient pre-alignment of acronyms…

If SBTi follows through as explained above, and uses the IC-VCM’s CCP-grade as the gatekeeper for SBTi Scope 3 contributions, what is left for the VCM-II’s CCP-2?

The foundational criteria (page 7) of the Claims Code were likely pre-designed to coalesce well with SBTi’s policies of transparency in disclosure, science-based target setting, on track for real reductions, and advocacy toward Paris targets. What is more, beyond-value-chain mitigation is a pre-condition of the claims code that chimes perfectly with SBTi’s recent announcement. So, there is a lot in common here for this potential Ménage à trois, the clearest area for tension is in VCM-II’s platinum-gold-silver % framework for defining quality of claim. But really this looks like how you cut the cake, rather than how to bake it. A well-done branding exercise or two ought to be able to flatten this molehill. if we do see an independent framework from SBTi, it will inevitably, by design or not, echo much of what is in the existing claims code – whether it references explicitly or not.

Conclusion

An SBTi-shaped lighthouse has appeared amongst the fog that made the future of the carbon offsets market so very hard to discern. The viability and likelihoods of the courses ahead have been adjusted. This change will soon be accounted for across investment and corporate offset purchase decisions. However, land has not yet been sighted, so there remains massive uncertainty as to which continent this market will end up on.

We will know, with a high enough degree of certainty, in 12 – 24 months from now – when the majority of the IC-VCM’s CCP assessments have occurred and after SBTi has formalised its own rules for offset use. Even then, as ever, tracking the corporate response and uptake will be the ultimate proof in the pudding.

You might also likeArticles

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade