- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Articles

- ICE vs Nodal – The Race for Traded Volume in Washington’s Carbon Market

ICE vs Nodal – The Race for Traded Volume in Washington’s Carbon MarketWashington CaIThursday, 25th January 2024

Megha Jha and Craig Rocha

Key Takeaways

- Established exchanges hold a strong competitive advantage over ‘challenger’ platforms in the still emerging environmental commodity space – well borne out by the launch of the Washington market.

- As of January 2024, ICE accounts for 96.2% of the trade activity for WCAs, up from 16.62% in June 2023 when the contract started trading on the platform, bestowing liquidity to WCA contracts.

- Nodal Exchange (a subsidiary of European Energy Exchange (EEX)), started as the sole platform for WCA futures trading but market share was quickly lost to ICE upon their respective launch.

- cCarbon’s latest analyst note delves into liquidity and market signals for the Global Cap-and-trade markets by leveraging various proprietary matrices and how carbon is emerging as an attractive asset class for diversification.

Catch our latest analyst note on Global Cap-and-Trade Liquidity and Market Signals with insights on broader metrics across environmental commodities markets, tailored for traders and investors engaged in carbon assets here.

Context

Washington’s cap-and-invest program started on January 1, 2023, and the first emissions allowance auction was held on February 28, 2023. Before this, IncubEx and Nodal collaborated to introduce the first Washington Carbon Allowance (WCA) futures and options contracts, these were successfully launched on December 5, 2022, on the Nodal Exchange. After the program’s launch, ICE introduced the Washington futures contract on June 5, 2023.

ICE emerged as the leading exchange for WCA trades

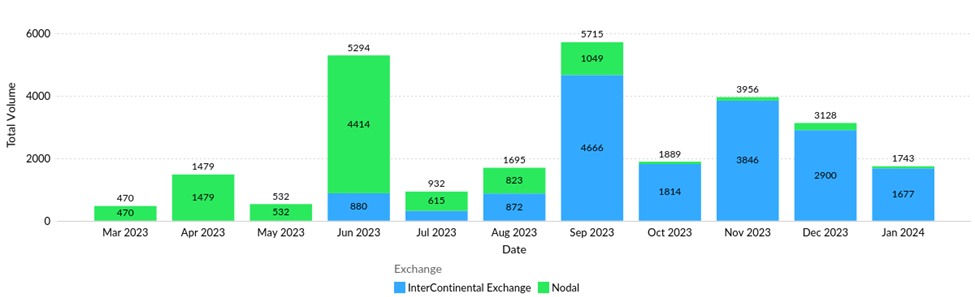

Before ICE initiated WCAs’ trade on its exchange, the only platform for trading was the Nodal Exchange, where significant volumes were transacted. However, following ICE’s entry into WCA trading on June 5, a notable shift occurred, quickly leading to an unequal split in the trading of allowances between the two exchanges. As shown in Fig 1, a substantial contraction in trading volumes on the Nodal Exchange became evident as ICE took steps to facilitate the trading of WCAs. Along with the volume shift away from Nodal, ICE Exchange entry has brought improved liquidity to the WCA contracts.

Fig 1. WCA trades on ICE and Nodal exchanges, Data Source: cCarbon.info

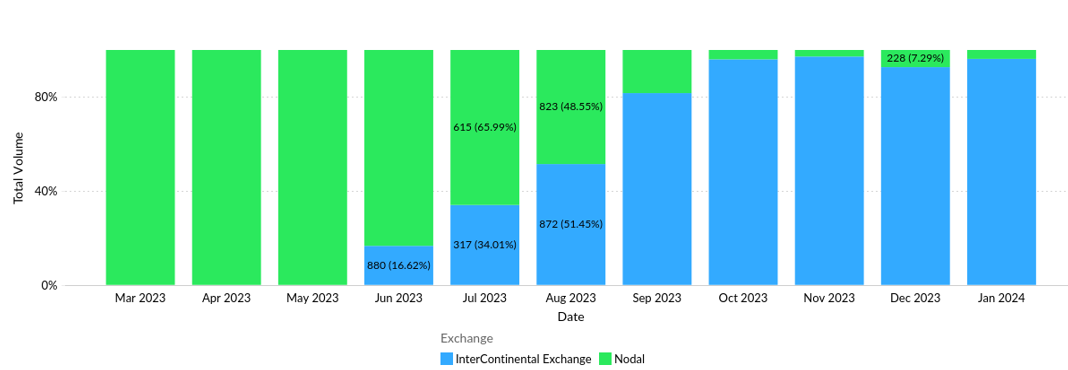

In January 2024, ICE accounts for 96.2% of trade for WCA Futures contract

Over time on Nodal, the traded volume for WCAs gradually diminished week-over-week, reaching negligible volumes in subsequent weeks. In contrast, trading volumes on ICE expanded, demonstrating substantial week-over-week growth. As of January 2024, ICE now accounts for 96.2% of WCA volumes traded, leaving Nodal with a mere 3.8% share (refer to Fig. 2). This substantial shift in market share underscores the overwhelming preference for ICE as the primary platform for all North-American Carbon Market allowance trading (and has a strong global presence).

Fig 2. Percentage share of volume trade on ICE vs Nodal, Data Source: cCarbon.info

ICE’s success in the WCA market can be attributed to over two decades of experience that the exchange has accumulated in the environmental commodities market. We also reached out to Gordon Bennett, Managing Director of Utility Markets at ICE. According to Gordon, ICE has been operating in the energy and environmental commodities markets since 2000 and has built a loyal clientele trading in California Carbon Allowance futures (CCA Futures) since 2011, translating to their Washington Cap and Invest Futures (WCA Futures) upon its launch. He also believes that the exchange has created a data and digital network built over two decades which is integral for stakeholders to both measure and manage risk.

Traders have to pay non-trivial membership fees for access to each exchange, there is a strong network externality benefit of all traders being on the same platform for both trading and messaging, and ICE is also dominant in related markets where the same desks would also trade WCAs. For all these reasons, one can see why ICE has emerged as dominant in this space, challenging this market share will be tricky for any exchange, whilst having an ICE account will remain critical for market players.

For further insights on the liquidity of similar Cap-and-Trade markets, read our Analyst Note on Global Cap-and-Trade – Liquidity and Market Signals

This analyst note focuses on global cap and trade markets’ liquidity and financial market signals. It delves into the nuances of liquidity, leveraging vital metrics such as the Bank, cCarbon.info Bank Coverage Index, cCarbon.info Cap Adjusted OI, and the cCarbon.info Bank Adjusted OI index. These tools are pivotal in evaluating surplus allowances and overall market robustness. An interest read for traders and funds – engaged in carbon assets.

Analyst Contact

- Megha Jha (mjha@ckinetics.com)

- Craig Rocha (cmrocha@ckinetics.com)

Table of Content

- Key Takeaways

- Context

- ICE emerged as the leading exchange for WCA trades

- In January 2024, ICE accounts for 96.2% of trade for WCA Futures contract

- For further insights on the liquidity of similar Cap-and-Trade markets, read our Analyst Note on Global Cap-and-Trade – Liquidity and Market Signals

- Analyst Contact

You might also likeArticles

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade