- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Scenario Simulators

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Articles

- WCI Q2 auction (JA35): Muted auction clears at $30.33 as the market waits to see how the regulatory landscape unfolds

WCI Q2 auction (JA35): Muted auction clears at $30.33 as the market waits to see how the regulatory landscape unfoldsWCI CaTFriday, 26th May 2023

Megha Jha and Craig Rocha

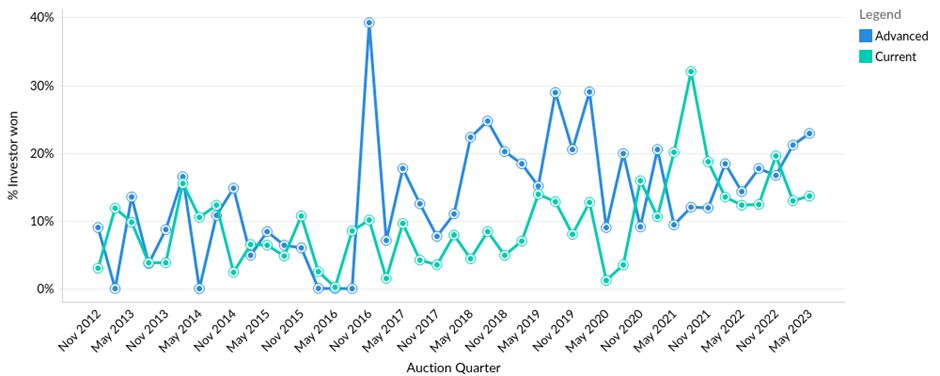

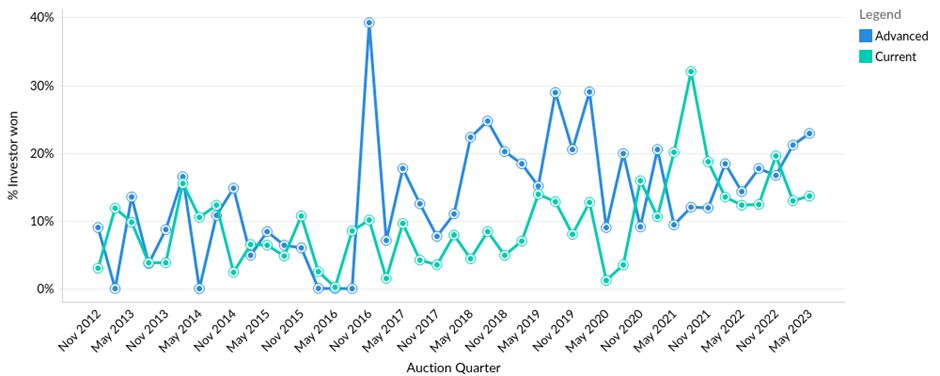

The auction saw the participation of 120 qualified bidders, with 93 from California and 27 from Quebec. Financial participation increased slightly from 13% in the previous auction to 13.6% in the current auction. Notably, Greenlight Energy Group, LLC, a power marketing firm, participated in its first CCA auction. Overall, 20 funds/investors took part in the JA35 auction, one more than the previous year.

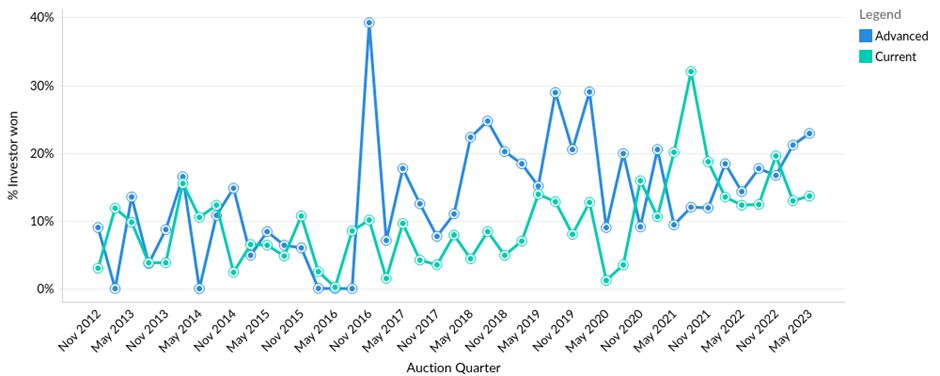

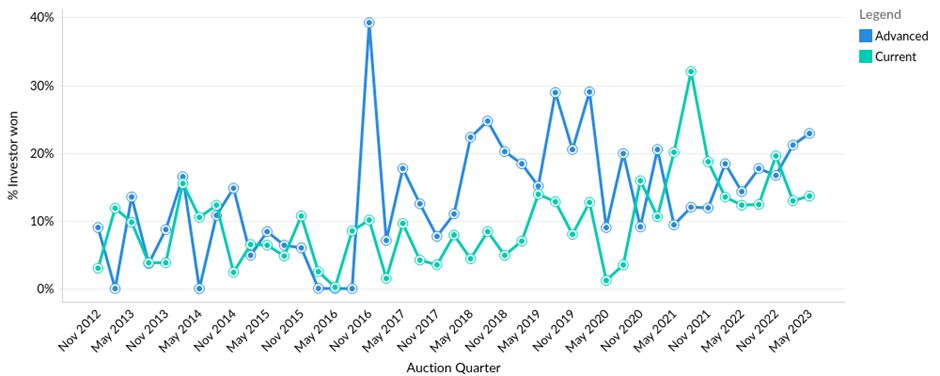

Figure 3. Investor Participation at current and advanced auction (Data Source: CARB)

Anticipated Drivers of Price and Regulatory Developments

CARB’s evaluation of potential changes to the cap-and-trade program design in 2023, aligned with the Scoping Plan, will play a significant role in determining future prices. The Scoping Plan aims to reduce carbon emissions by 48% below 1990 levels by 2030, an 8% increase from the previous target. CARB will hold a workshop on June 14th to discuss potential regulatory amendments and align them with the 2022 Scoping Plan Update. Modeling suggests that program reform to meet the accelerated targets could drive prices up to $58 per allowance by the end of 2023. Key drivers of the price movement:

- CARB will evaluate and propose potential changes to the design of the cap-and-trade program in 2023, taking into account the modeling results from this Scoping Plan and an additional focus on annual caps. The scoping plan has set a more aggressive goal to reduce carbon emissions by 48% below 1990 levels in 2030 – an 8% increase from the previous target. CARB will be holding a workshop on June 14, 2023. CARB’s staff will present the status of the Cap-and-Trade Regulation, the scope of potential updates, and evaluations to inform potential regulatory amendments to align with the 2022 Scoping Plan Update.

- Our modeling shows that program reform to reach the accelerated targets of the Scoping plan could raise prices up to $58 per allowance by the end of 2023.

- California emissions for 2022 are slightly lower than previously forecasted – indicating slightly quicker transitions, with both fuels and natural gas consumption lower in 2022 than in 2021.

- Hydro-power output is expected to rise significantly in 2023, on record rain and snowfall.

- Additionally, California’s emissions for 2022 were slightly lower than anticipated, indicating a quicker transition with reduced fuel and natural gas consumption compared to 2021. Moreover, an expected increase in hydro-power output in 2023 due to record rain and snowfall will impact the market dynamics.

Impending Regulatory Changes and Market Outlook

CARB announced a scheduled workshop to discuss potential updates to the California and Quebec Cap-and-Trade programs. This program review is expected to result in tighter market regulations, with completion anticipated by the end of the year. Consequently, market participants widely believe that these changes will lead to a rapid increase in prices. The registration link for the same is available here.

Conclusion

The 35th Joint Auction conducted by CARB yielded results that fell below expectations, with investors displaying minimal enthusiasm. However, the imminent program review and potential regulatory changes are anticipated to tighten market regulations and drive up prices significantly. The market remains positive, with our expectations of prices reaching $58 per allowance by the end of the year. It is crucial for market participants to closely monitor the developments in the regulatory landscape to navigate the evolving carbon market effectively. Analyst Contact:

- Craig Rocha (cmrocha@ckinetics.com)

- Megha Jha (mjha@ckinetics.com)

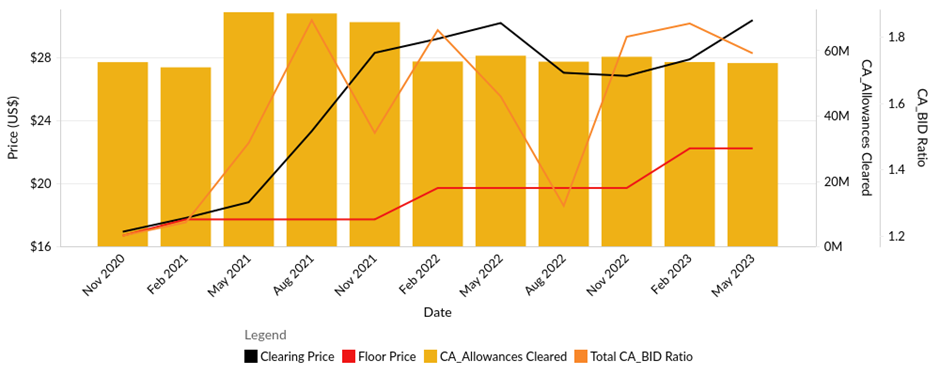

Figure 1. Current Auction Clearing Price, Allowances Cleared and Bid Ratio (Data Source: CARB)

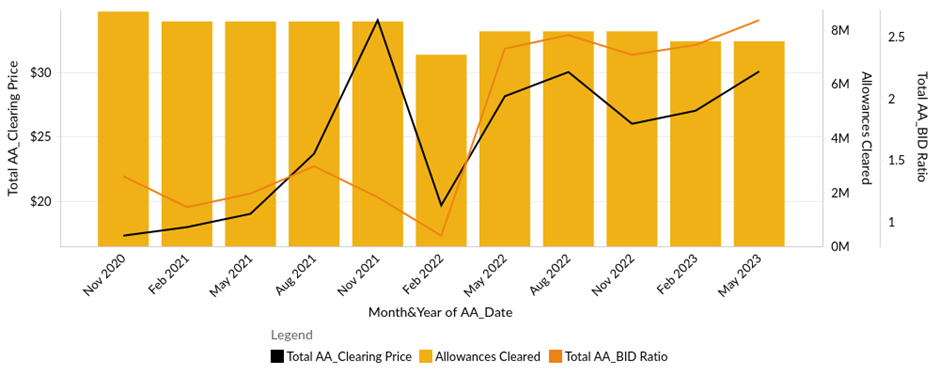

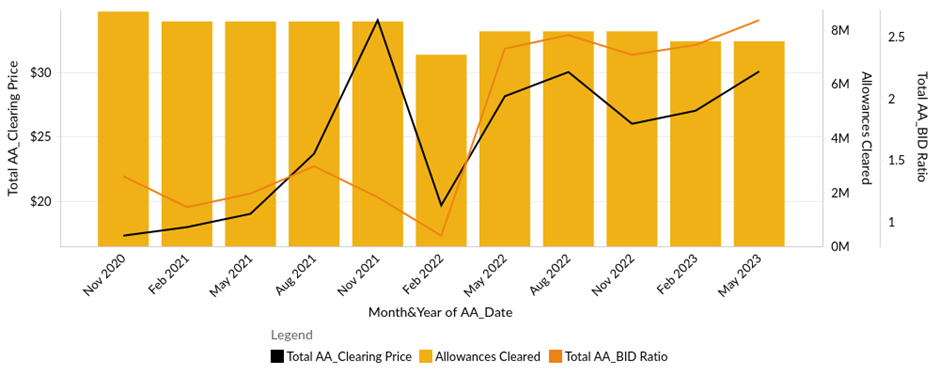

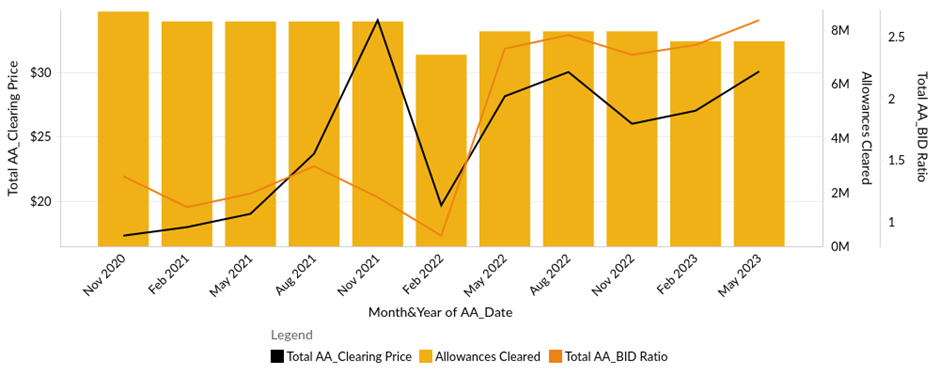

On the other hand, the advanced auction witnessed an increase in both the bid ratio and investor participation. The bid ratio increased significantly along with the increased participation of investors in the advanced auction.

Figure 2. Advanced Auction Clearing Price, Allowances Cleared and Bid Ratio (Data Source: CARB)

Despite CCAs rising by 9% over the previous auction, the market expected higher gains considering the improving US growth outlook. However, the market remains positive, with expectations that progress on the program review of the Cap-and-Trade program will drive prices to reach $58 by the year’s end. The auction concluded with a relatively lackluster performance. Investors exhibited minimal enthusiasm, submitting low bids and seeking value buys throughout the auction. Compliance entities appeared content with the current price levels, maintaining their bidding activities.

Investor Participation and Market Player Analysis

Funds/Investors Participating:

- 20 funds/investors participated in JA35, one higher than last year.

- Greenlight Energy Group, LLC (https://www.gltenergy.com) – A power marketing firm participated in its first CCA auction

- No new fund/investor participated in the JA35 auction

Table 2. Fund and Investor Participation in JA 35 (Data Source: cCarbon.info)

The auction saw the participation of 120 qualified bidders, with 93 from California and 27 from Quebec. Financial participation increased slightly from 13% in the previous auction to 13.6% in the current auction. Notably, Greenlight Energy Group, LLC, a power marketing firm, participated in its first CCA auction. Overall, 20 funds/investors took part in the JA35 auction, one more than the previous year.

Figure 3. Investor Participation at current and advanced auction (Data Source: CARB)

Anticipated Drivers of Price and Regulatory Developments

CARB’s evaluation of potential changes to the cap-and-trade program design in 2023, aligned with the Scoping Plan, will play a significant role in determining future prices. The Scoping Plan aims to reduce carbon emissions by 48% below 1990 levels by 2030, an 8% increase from the previous target. CARB will hold a workshop on June 14th to discuss potential regulatory amendments and align them with the 2022 Scoping Plan Update. Modeling suggests that program reform to meet the accelerated targets could drive prices up to $58 per allowance by the end of 2023. Key drivers of the price movement:

- CARB will evaluate and propose potential changes to the design of the cap-and-trade program in 2023, taking into account the modeling results from this Scoping Plan and an additional focus on annual caps. The scoping plan has set a more aggressive goal to reduce carbon emissions by 48% below 1990 levels in 2030 – an 8% increase from the previous target. CARB will be holding a workshop on June 14, 2023. CARB’s staff will present the status of the Cap-and-Trade Regulation, the scope of potential updates, and evaluations to inform potential regulatory amendments to align with the 2022 Scoping Plan Update.

- Our modeling shows that program reform to reach the accelerated targets of the Scoping plan could raise prices up to $58 per allowance by the end of 2023.

- California emissions for 2022 are slightly lower than previously forecasted – indicating slightly quicker transitions, with both fuels and natural gas consumption lower in 2022 than in 2021.

- Hydro-power output is expected to rise significantly in 2023, on record rain and snowfall.

- Additionally, California’s emissions for 2022 were slightly lower than anticipated, indicating a quicker transition with reduced fuel and natural gas consumption compared to 2021. Moreover, an expected increase in hydro-power output in 2023 due to record rain and snowfall will impact the market dynamics.

Impending Regulatory Changes and Market Outlook

CARB announced a scheduled workshop to discuss potential updates to the California and Quebec Cap-and-Trade programs. This program review is expected to result in tighter market regulations, with completion anticipated by the end of the year. Consequently, market participants widely believe that these changes will lead to a rapid increase in prices. The registration link for the same is available here.

Conclusion

The 35th Joint Auction conducted by CARB yielded results that fell below expectations, with investors displaying minimal enthusiasm. However, the imminent program review and potential regulatory changes are anticipated to tighten market regulations and drive up prices significantly. The market remains positive, with our expectations of prices reaching $58 per allowance by the end of the year. It is crucial for market participants to closely monitor the developments in the regulatory landscape to navigate the evolving carbon market effectively. Analyst Contact:

- Craig Rocha (cmrocha@ckinetics.com)

- Megha Jha (mjha@ckinetics.com)

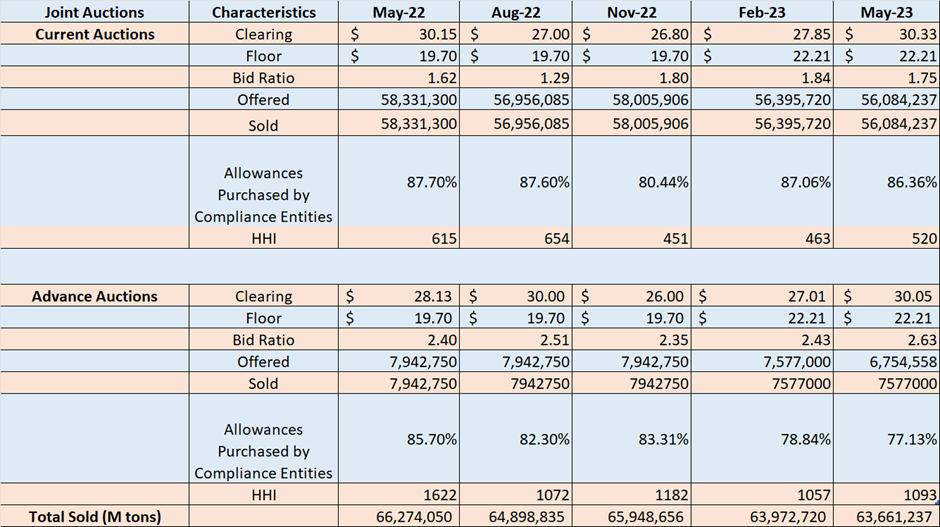

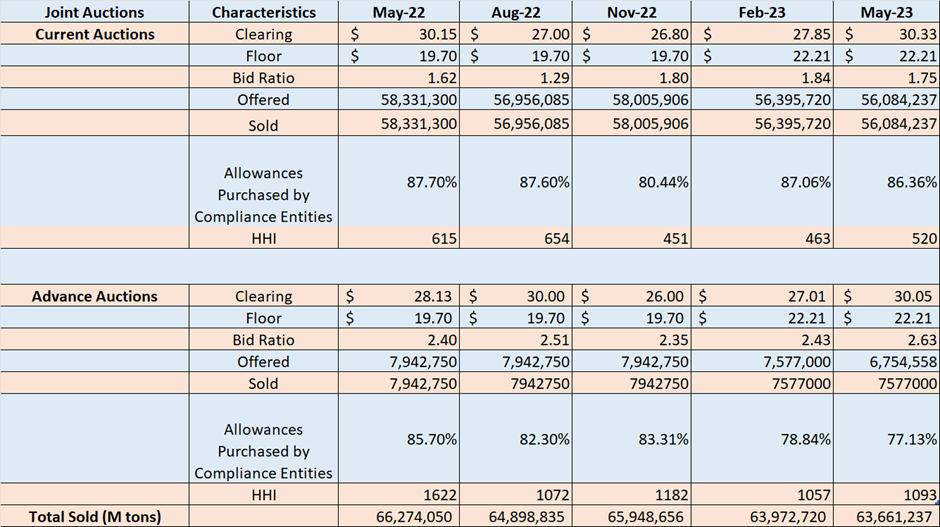

Table 1. Key statistics from past WCI Auctions (Data Source: CARB)

The California Air Resources Board (CARB) unveiled the outcomes of the Q2 auction JA#35 on May 25, 2023, revealing some interesting trends and developments in the market. The current auction cleared at $30.33 MtCO2 $2.48/mt stronger than the first quarter, and the advanced auction cleared at $30.05. The settlement price was below cCarbon’s pre-auction expectation of the auction clearing between $31.00-$33.00. The auction sold out of 56 million current vintage CCAs on offer and the bid-to-cover ratio was 1.75. The secondary market sprung to action post-auction as the Intercontinental Exchange (ICE) CCA V23 December 2023 futures contract increased 65cts/mt to $32.25/mt by 2 p.m. CT Thursday as per OPIS reports.

Auction Results and Market Trends

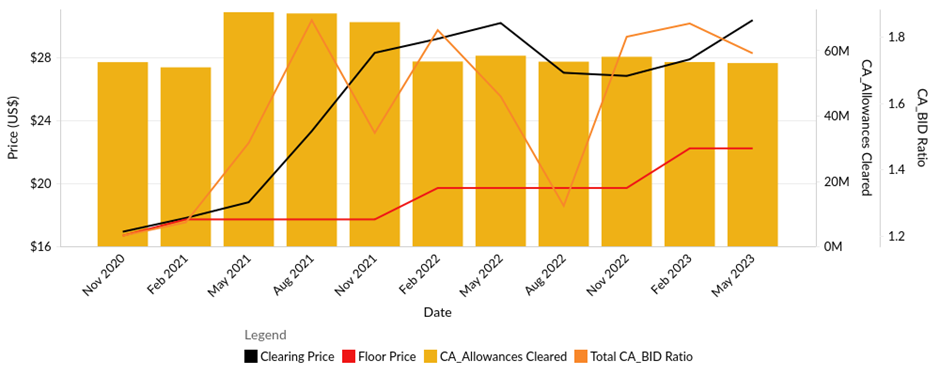

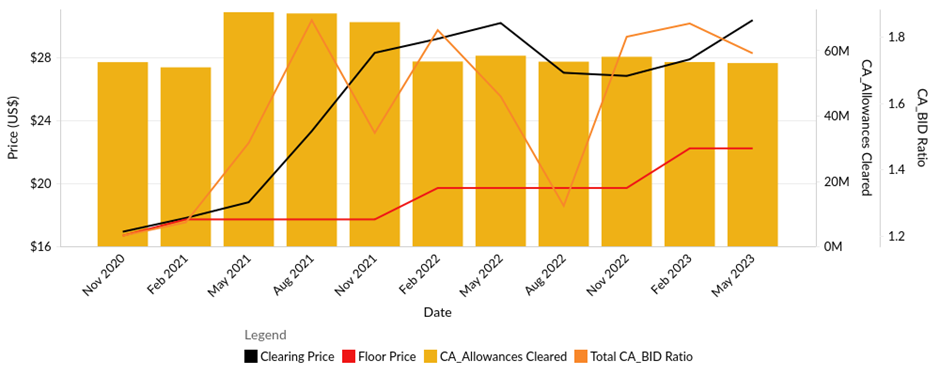

The bid ratio declined in the current auction, accompanied by an increase in the clearing price. The current auction saw less bidding than the two previous auctions.

Figure 1. Current Auction Clearing Price, Allowances Cleared and Bid Ratio (Data Source: CARB)

On the other hand, the advanced auction witnessed an increase in both the bid ratio and investor participation. The bid ratio increased significantly along with the increased participation of investors in the advanced auction.

Figure 2. Advanced Auction Clearing Price, Allowances Cleared and Bid Ratio (Data Source: CARB)

Despite CCAs rising by 9% over the previous auction, the market expected higher gains considering the improving US growth outlook. However, the market remains positive, with expectations that progress on the program review of the Cap-and-Trade program will drive prices to reach $58 by the year’s end. The auction concluded with a relatively lackluster performance. Investors exhibited minimal enthusiasm, submitting low bids and seeking value buys throughout the auction. Compliance entities appeared content with the current price levels, maintaining their bidding activities.

Investor Participation and Market Player Analysis

Funds/Investors Participating:

- 20 funds/investors participated in JA35, one higher than last year.

- Greenlight Energy Group, LLC (https://www.gltenergy.com) – A power marketing firm participated in its first CCA auction

- No new fund/investor participated in the JA35 auction

Table 2. Fund and Investor Participation in JA 35 (Data Source: cCarbon.info)

The auction saw the participation of 120 qualified bidders, with 93 from California and 27 from Quebec. Financial participation increased slightly from 13% in the previous auction to 13.6% in the current auction. Notably, Greenlight Energy Group, LLC, a power marketing firm, participated in its first CCA auction. Overall, 20 funds/investors took part in the JA35 auction, one more than the previous year.

Figure 3. Investor Participation at current and advanced auction (Data Source: CARB)

Anticipated Drivers of Price and Regulatory Developments

CARB’s evaluation of potential changes to the cap-and-trade program design in 2023, aligned with the Scoping Plan, will play a significant role in determining future prices. The Scoping Plan aims to reduce carbon emissions by 48% below 1990 levels by 2030, an 8% increase from the previous target. CARB will hold a workshop on June 14th to discuss potential regulatory amendments and align them with the 2022 Scoping Plan Update. Modeling suggests that program reform to meet the accelerated targets could drive prices up to $58 per allowance by the end of 2023. Key drivers of the price movement:

- CARB will evaluate and propose potential changes to the design of the cap-and-trade program in 2023, taking into account the modeling results from this Scoping Plan and an additional focus on annual caps. The scoping plan has set a more aggressive goal to reduce carbon emissions by 48% below 1990 levels in 2030 – an 8% increase from the previous target. CARB will be holding a workshop on June 14, 2023. CARB’s staff will present the status of the Cap-and-Trade Regulation, the scope of potential updates, and evaluations to inform potential regulatory amendments to align with the 2022 Scoping Plan Update.

- Our modeling shows that program reform to reach the accelerated targets of the Scoping plan could raise prices up to $58 per allowance by the end of 2023.

- California emissions for 2022 are slightly lower than previously forecasted – indicating slightly quicker transitions, with both fuels and natural gas consumption lower in 2022 than in 2021.

- Hydro-power output is expected to rise significantly in 2023, on record rain and snowfall.

- Additionally, California’s emissions for 2022 were slightly lower than anticipated, indicating a quicker transition with reduced fuel and natural gas consumption compared to 2021. Moreover, an expected increase in hydro-power output in 2023 due to record rain and snowfall will impact the market dynamics.

Impending Regulatory Changes and Market Outlook

CARB announced a scheduled workshop to discuss potential updates to the California and Quebec Cap-and-Trade programs. This program review is expected to result in tighter market regulations, with completion anticipated by the end of the year. Consequently, market participants widely believe that these changes will lead to a rapid increase in prices. The registration link for the same is available here.

Conclusion

The 35th Joint Auction conducted by CARB yielded results that fell below expectations, with investors displaying minimal enthusiasm. However, the imminent program review and potential regulatory changes are anticipated to tighten market regulations and drive up prices significantly. The market remains positive, with our expectations of prices reaching $58 per allowance by the end of the year. It is crucial for market participants to closely monitor the developments in the regulatory landscape to navigate the evolving carbon market effectively. Analyst Contact:

- Craig Rocha (cmrocha@ckinetics.com)

- Megha Jha (mjha@ckinetics.com)

Key Takeaways

- The settlement price for the current auction was $30.33 MtCO2 with a bid-to-cover ratio of 1.75. The advance auction settled at a price of $30.05 with a bid-to-cover ratio of 2.63

- This auction recorded 120 qualified bidders with 93 from California and 27 from Quebec

- Financial participation increased slightly from 13% in the last auction to 13.6% (current auction)

- The secondary market sprung to action post-auction as the Intercontinental Exchange (ICE) CCA V23 December 2023 futures contract increased 65cts/mt to $32.25/mt by 2 p.m. CT Thursday

- One new firm, Greenlight Energy Group participated in the auction

Key Statistics

Table 1. Key statistics from past WCI Auctions (Data Source: CARB)

The California Air Resources Board (CARB) unveiled the outcomes of the Q2 auction JA#35 on May 25, 2023, revealing some interesting trends and developments in the market. The current auction cleared at $30.33 MtCO2 $2.48/mt stronger than the first quarter, and the advanced auction cleared at $30.05. The settlement price was below cCarbon’s pre-auction expectation of the auction clearing between $31.00-$33.00. The auction sold out of 56 million current vintage CCAs on offer and the bid-to-cover ratio was 1.75. The secondary market sprung to action post-auction as the Intercontinental Exchange (ICE) CCA V23 December 2023 futures contract increased 65cts/mt to $32.25/mt by 2 p.m. CT Thursday as per OPIS reports.

Auction Results and Market Trends

The bid ratio declined in the current auction, accompanied by an increase in the clearing price. The current auction saw less bidding than the two previous auctions.

Figure 1. Current Auction Clearing Price, Allowances Cleared and Bid Ratio (Data Source: CARB)

On the other hand, the advanced auction witnessed an increase in both the bid ratio and investor participation. The bid ratio increased significantly along with the increased participation of investors in the advanced auction.

Figure 2. Advanced Auction Clearing Price, Allowances Cleared and Bid Ratio (Data Source: CARB)

Despite CCAs rising by 9% over the previous auction, the market expected higher gains considering the improving US growth outlook. However, the market remains positive, with expectations that progress on the program review of the Cap-and-Trade program will drive prices to reach $58 by the year’s end. The auction concluded with a relatively lackluster performance. Investors exhibited minimal enthusiasm, submitting low bids and seeking value buys throughout the auction. Compliance entities appeared content with the current price levels, maintaining their bidding activities.

Investor Participation and Market Player Analysis

Funds/Investors Participating:

- 20 funds/investors participated in JA35, one higher than last year.

- Greenlight Energy Group, LLC (https://www.gltenergy.com) – A power marketing firm participated in its first CCA auction

- No new fund/investor participated in the JA35 auction

Table 2. Fund and Investor Participation in JA 35 (Data Source: cCarbon.info)

The auction saw the participation of 120 qualified bidders, with 93 from California and 27 from Quebec. Financial participation increased slightly from 13% in the previous auction to 13.6% in the current auction. Notably, Greenlight Energy Group, LLC, a power marketing firm, participated in its first CCA auction. Overall, 20 funds/investors took part in the JA35 auction, one more than the previous year.

Figure 3. Investor Participation at current and advanced auction (Data Source: CARB)

Anticipated Drivers of Price and Regulatory Developments

CARB’s evaluation of potential changes to the cap-and-trade program design in 2023, aligned with the Scoping Plan, will play a significant role in determining future prices. The Scoping Plan aims to reduce carbon emissions by 48% below 1990 levels by 2030, an 8% increase from the previous target. CARB will hold a workshop on June 14th to discuss potential regulatory amendments and align them with the 2022 Scoping Plan Update. Modeling suggests that program reform to meet the accelerated targets could drive prices up to $58 per allowance by the end of 2023. Key drivers of the price movement:

- CARB will evaluate and propose potential changes to the design of the cap-and-trade program in 2023, taking into account the modeling results from this Scoping Plan and an additional focus on annual caps. The scoping plan has set a more aggressive goal to reduce carbon emissions by 48% below 1990 levels in 2030 – an 8% increase from the previous target. CARB will be holding a workshop on June 14, 2023. CARB’s staff will present the status of the Cap-and-Trade Regulation, the scope of potential updates, and evaluations to inform potential regulatory amendments to align with the 2022 Scoping Plan Update.

- Our modeling shows that program reform to reach the accelerated targets of the Scoping plan could raise prices up to $58 per allowance by the end of 2023.

- California emissions for 2022 are slightly lower than previously forecasted – indicating slightly quicker transitions, with both fuels and natural gas consumption lower in 2022 than in 2021.

- Hydro-power output is expected to rise significantly in 2023, on record rain and snowfall.

- Additionally, California’s emissions for 2022 were slightly lower than anticipated, indicating a quicker transition with reduced fuel and natural gas consumption compared to 2021. Moreover, an expected increase in hydro-power output in 2023 due to record rain and snowfall will impact the market dynamics.

Impending Regulatory Changes and Market Outlook

CARB announced a scheduled workshop to discuss potential updates to the California and Quebec Cap-and-Trade programs. This program review is expected to result in tighter market regulations, with completion anticipated by the end of the year. Consequently, market participants widely believe that these changes will lead to a rapid increase in prices. The registration link for the same is available here.

Conclusion

The 35th Joint Auction conducted by CARB yielded results that fell below expectations, with investors displaying minimal enthusiasm. However, the imminent program review and potential regulatory changes are anticipated to tighten market regulations and drive up prices significantly. The market remains positive, with our expectations of prices reaching $58 per allowance by the end of the year. It is crucial for market participants to closely monitor the developments in the regulatory landscape to navigate the evolving carbon market effectively. Analyst Contact:

- Craig Rocha (cmrocha@ckinetics.com)

- Megha Jha (mjha@ckinetics.com)

You might also likeArticles

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade