- Home

- Markets

- Cap & Trade

- Clean Fuels Standard

- Sustainable Fuels

- Carbon Offsets

- Carbon Linked Mechanisms

- Get to Know

- Market Coverage

- Cap & Trade

- Clean Fuels Standard

- Sustainable Fuels

- Carbon Offsets

- Carbon Linked Mechanisms

- Use Cases

- About us

- Membership Plans

- InSights

- Webinars

- Analytics Toolkit

- CAFÉ

- CAFÉ – Carbon Analysis Forecasting Engine Enter my CAFÉ

- Cap-and-Trade

- Clean Fuel Standards

- Carbon Offsets

- Articles

- The new player of Internationally traded RECs: Tradable Instruments for Global Renewables (TIGRs)

The new player of Internationally traded RECs: Tradable Instruments for Global Renewables (TIGRs)I-RECsTuesday, 2nd May 2023

Nishant Kumar Upadhyay

Key Highlights

- TIGR registry covers 1.8% of globally traded RECs

- Over the last five years TIGR issuance recorded a 111% CAGR

- Indonesia leads in the issuance of TIGR certificates, accounting for 40%, followed by Singapore, Vietnam, and China

- China leads the registered capacity for TIGRs, followed by Singapore, Vietnam, and Indonesia

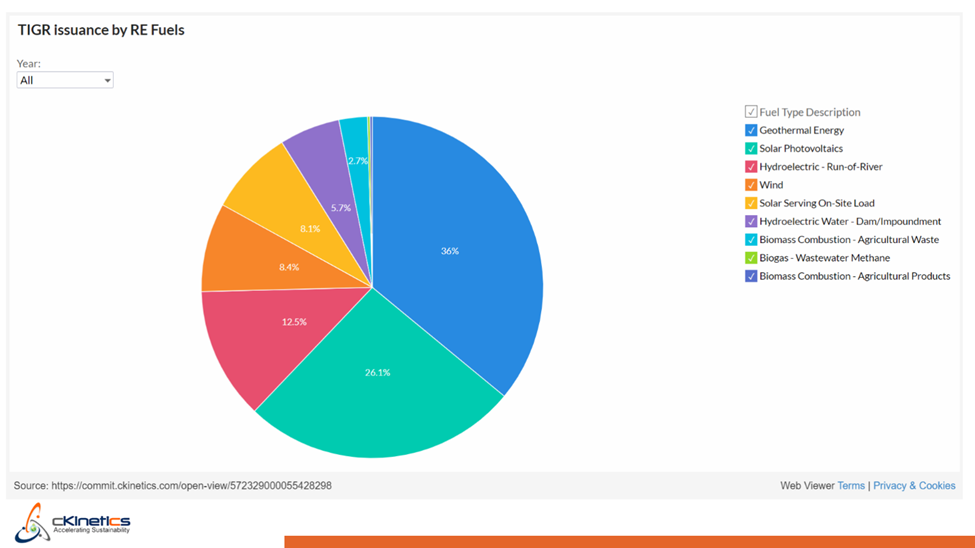

- Geothermal energy accounts for 36% of the total TIGR issuances

The TIGR Registry, created by An Xpansiv company (APX) in 2016, is an online platform that facilitates the tracking and trading of Renewable Energy Certificates (RECs) globally. With over 9.87 million certificates issued to date, TIGR is the second largest internationally traded REC after I-REC. This registry enables developers to generate, verify, and sell RECs worldwide, and allows buyers to source RECs from anywhere in the world through a single online portal. TIGR’s validity period is one year, and it is currently issued by 12 countries: Bangladesh, China, Guatemala, India, Indonesia, Korea, Malaysia, the Philippines, Singapore, Taiwan, Thailand, and Vietnam.

Figure.1: Map of countries registered in TIGR (Source: TIGR Registry)

TIGR registry covers 1.8% of globally traded RECs

In 2022, TIGR issued 3.78 million certificates, while I-RECs issued a total of 199 million certificates. Notably, 114 million I-REC certificates were issued from the same region where TIGRs and I-RECs both operate.

Over the last five years, TIGR grew at CAGR of 111%, trading 3.78 million certificates in 2022

Figure.2: TIGRs issuance year-wise growth

Indonesia leads in the issuance of TIGR certificates, accounting for 40%, followed by Singapore, Vietnam, and China

As of 31st March 2023, Indonesia has issued a total of 4 million (40%) TIGR certificates, including 1.6 million certificates issued in 2022 alone. Compared to the issuance of I-RECs in Indonesia, which is 3.1 million as of 31st March 2023, TIGR is more popular in Indonesia. Likewise, Singapore holds the second position, having issued 1.43 million certificates, and exhibits a comparable scenario where only 0.18 million I-REC issuances are observed. This suggests a preference for TIGR in these countries. Despite having restricted renewable energy resources, Singapore continues to play a significant role in the TIGR market.

Figure.3: TIGR certificate issuance – Country wise (as of 31st March 2023)

Over the past two years, there has been a decreasing trend in the issuance of TIGRs in China, Malaysia, and the Philippines. There are several factors contributing to the decreasing trend of TIGRs in these countries, including better pricing in other domestic or I-REC markets that incentivizes generators to shift towards them, and TIGRs specific domestic regulations in these nations which limit the adoption of TIGRs. All the nations within TIGR are also present in the I-REC market, making the competition more intense for TIGR.

Geothermal energy accounts for more than one-third of total TIGR issuance

There are 9 different fuel type descriptions which can be broadly categorized into geothermal, hydro, wind, solar, and biomass. Of the total 9.87 million TIGR certificates, geothermal energy sources account for the largest share (36%) of TIGRs issuance. Indonesia being the major contributor, more than 70% of TIGRs in Indonesia comes from geothermal. Solar PV and onsite solar together accounts for 35% of total TIGRs issuance.

Figure.4: TIGR certificates issuance by different RE Technology

Conclusion

To conclude, TIGRs have shown impressive growth over the past five years, with 3.78 million certificates traded in 2022, representing a remarkable 111% CAGR. In comparison, I-REC’s growth rate has been 88% CAGR over the same period. Despite being a relatively new player in the global renewable energy market, TIGR has demonstrated significant growth, particularly in the southeast Asia region, including Indonesia, Singapore, and Vietnam. TIGRs have the potential to support the growth of renewable energy production in various countries and play a crucial role in achieving net-zero emissions targets.

References

Table of Content

- Key Highlights

- TIGR registry covers 1.8% of globally traded RECs

- Over the last five years, TIGR grew at CAGR of 111%, trading 3.78 million certificates in 2022

- Indonesia leads in the issuance of TIGR certificates, accounting for 40%, followed by Singapore, Vietnam, and China

- Geothermal energy accounts for more than one-third of total TIGR issuance

- Conclusion

- References

You might also likeArticles

Interviews

News

- No data Found!

Free Trial or Login to access

Our market portals and InSights are only for logged-in users with the relevant access. This can be you too…

Your Current Membership Does not Include this Content

This content is outside of your current package. If you need this too, let’s talk…

Solve Your Problems

Send this problem to our Clients team, and we will get back to you shortly with a plan of attack.

orSpeak and exchange notes with our specific-market expert, use your complimentary hours.

Arrange with Client TeamLet's Connect

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Request Access to Data Tool

Tell us who you are, and what you're after. We'll find you the right person with the answer - before you wake up twice.

Newsletter Sign Up

Your name and email in exchange for staying up to date across the world's environmental markets... what a deal?!

MEMBERSHIPS

Sign Up for Free Trial or Login to Access Market Dashboard

Your Current Membership Does not Include this Content

This content is outside of your current package.

If you need this too, let's talk…My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

ID # Custom Name Created On Insert From My Saved Selections

Phasellus tempor tincidunt sem, sed dictum ipsum mollis vitae. Maecenas eu diam convallis, pellentesque lacus et, mollis enim.

# ID Custom Name Created On My pinned contentThere is no pinned content to display - Clean Fuel Standards

- Clean Fuels Standard

- Cap & Trade

- Clean Fuels Standard

- Cap & Trade